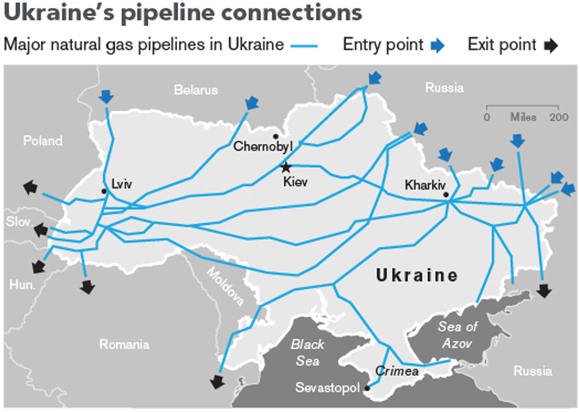

Understanding the importance of Ukraine to the global energy market begins with an overview of Ukraine’s role as the major conduit for the shipment of natural gas from Russia to Western Europe. Ukraine is not a major energy producer, but it is one of the world’s most important energy transhipment locations.

This graphic below shows the major natural gas pipelines running from Russia in the east and Belarus in the north toward Poland, Slovakia, Hungary, and Romania. From there, those pipelines connect to hubs that distribute the natural gas further to Italy, Germany, Austria, and other major economies in Western Europe:

|

|

| Source: Bloomberg |

The dependence of Western Europe on Russian natural gas is critical. The 27 member nations of the EU currently receive 40% of their imported natural gas from Russia. Most, but not all, of this natural gas passes through Ukraine. Some natural gas enters Germany through the Nord Stream 1 pipeline and other conduits under the Baltic Sea. The Nord Stream 2 pipeline (also under the Baltic Sea), which would supply natural gas to Germany, is currently suspended due to sanctions on Russia. Still, the Ukraine pipelines are the most important link.

The immediate damage to European natural gas supplies transiting through Ukraine went beyond financial sanctions and potential embargos. Russia blew up certain gas pipelines in Ukraine to deny natural gas to Ukrainians and to deny Ukraine their share of the gas revenues paid to Ukraine as transit fees. This damage will not be repaired quickly, even if the war ends.

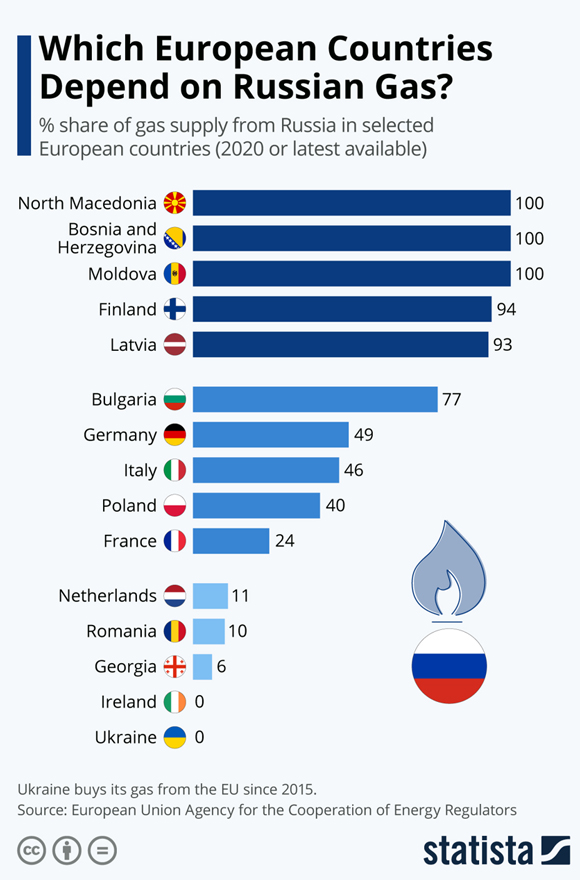

This dependence on Russian natural gas isn’t distributed evenly throughout the EU. Finland and Latvia receive more than 90% of their natural gas from Russia. Germany receives almost 50% of its natural gas from Russia, while the figure for Italy is only slightly less at 46%. Poland is dependent on Russia for 40%. France is somewhat less dependent, getting 24% of its natural gas from Russia. (France gets a large percentage of its total energy from nuclear power, making it less dependent on oil and natural gas.) These figures are presented in more detail in the chart below:

|

|

| Source: Statista |

Of course, these nations have other energy sources — including oil, coal, wind, and solar — but none come close to providing the energy needed to run modern industrial economies while providing heat and light to civilian populations. In particular, solar and wind provide intermittent output, which is not capable of providing the baseload needed to keep a modern power grid in operation. Germany foolishly shut down almost all of its coal- and nuclear-generating capacity over the past 10 years at the urging of climate alarmists, leaving it almost completely dependent on Russia.

Russia seemed to have timed its invasion of Ukraine perfectly if one aim was to have the maximum effect on energy prices. Those prices were already rising steeply due to basic supply and demand factors well before the invasion. In military planning, this is called a ‘force multiplier’.

The idea is to take military forces and make them more powerful by combining with some exogenous variable that has already put the wind at your back. If you were going to conduct a cyber-attack on a stock exchange, the best time would be when the market was already crashing, say 3% or so, and then launch the attack to use the momentum to push it down 20% or more. Putin used the force multiplier tactic by disrupting energy supply chains when prices were already going up.

This tactic is explained by Daniel Yergin, one of the world’s leading authorities on energy and oil markets. He is the Pulitzer Prize-winning author of The Prize: The Epic Quest for Oil, Money and Power. Yergin had the following comments on the timing of Putin’s invasion of Ukraine and the state of global energy markets in an interview with The New York Times published on 26 February 2022:

‘This was a very advantageous time for Putin to move. The oil market always goes through cycles, but it’s just gone through the most violent cycle that I’ve ever studied — from negative prices less than two years ago to an incredibly tight market. Whether Putin calculated that or not, he chose a time when oil markets are really tight, gas markets are really tight, coal markets are really tight, and he’s a big exporter of all three. So he’s a beneficiary of it. That gives him leverage. So whatever this terrible invasion is costing Russia, he’s making a lot of money from a higher oil price. It’s noticeable that oil and gas were not directly sanctioned [by European countries]. And that’s because, you know, if they were to do that, you would really be hitting Europe. I mean, it would partly immobilize Europe. That’s why this is such a difficult situation.’

The impact of the war in Ukraine on world energy prices was felt immediately. Gasoline prices at the pump increased in a matter of days. Because of sanctions, ExxonMobil has announced that it was pulling out of its Sakhalin-1 oil and gas project in the Russian Far East. Energy majors BP, Shell, and Total announced similar pull-outs from Russian energy joint ventures.

The Biden Administration’s dirty little secret

These shutdowns come on top of what was already a global energy shortage. Numerous suggestions are being offered for how Europe can deal with an energy shortage if they cannot buy Russian oil and gas or if Russia imposes an embargo on energy exports.

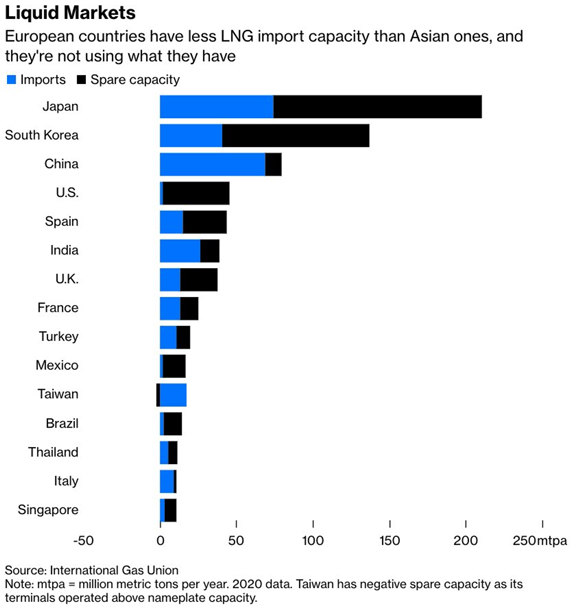

None of these solutions are practical in less than three or four years. Biden suggested that Europe could obtain natural gas from the Middle East, particularly Qatar. This ignores the fact that China has been buying all of the natural gas available under long-term contracts, so spare capacity is minimal.

Moreover, the chart below shows that spare import capacity for liquid natural gas (LNG) in major countries — including Spain, France, Italy, and the UK — is quite low compared to the amount needed to replace Russian exports:

|

|

| Source: International Gas Union |

The dirty little secret among White House policymakers is that they like high energy prices because it helps to promote the Green New Deal (really the Green New Scam) goals of wind and solar power to replace oil and gas. The more expensive gas is the more feasible alternatives become. That represents the triumph of ideology over common sense. There’s a role for wind and solar, but even if you favour it, one has to recognise that it’s non-scalable, intermittent, and cannot come online fast enough to close the gap between existing energy supplies and growing demand for energy.

Another drag on global energy output is the fact that major energy companies are reducing their investments in new exploration and development. Given the opposition to oil and gas from climate alarmists and do-gooder ideologue investors like BlackRock’s Larry Fink, major oil companies are reluctant to invest large amounts in projects that may be deemed unwanted or even banned in years to come. This can be reversed in future years but not in time to alleviate the current shortages.

Investors should expect persistent energy shortages and much higher prices. These trends were underway before the war in Ukraine, but they were greatly exacerbated by the war.

Regards,

|

Jim Rickards,

Strategist, The Daily Reckoning Australia

This content was originally published by Jim Rickards’ Strategic Intelligence Australia, a financial advisory newsletter designed to help you protect your wealth and potentially profit from unseen world events. Learn more here.