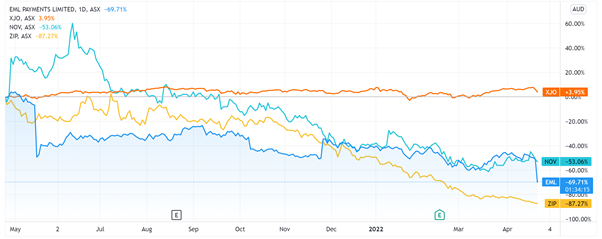

EML Payments [ASX:EML] shares crashed 35% on Tuesday after cutting their FY22 EBITDA guidance by 8%.

EML shares briefly spiked a fortnight ago when the fintech acknowledged it discussed takeover talks with Bain Capital.

The talks ceased, but investors were buoyed by the possibility EML could become an acquisition target.

Investors were not buoyed by EML’s update today, however, sending the stock down 35% in a day.

Source: Tradingview.com

EML’s third quarter guidance update

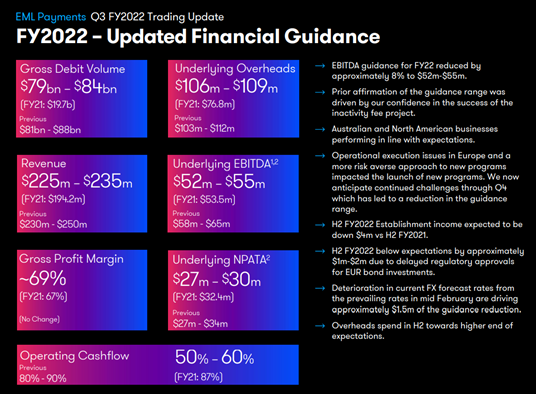

EML presented its guidance update today, and the results might not have been what shareholders were hoping for.

EML reported gross profit margins had suffered due to higher COGS, interest, and low European establishment fees.

Underlying NPATA totalled $8.1 million, 22% less than the prior corresponding quarter, with EBITDA also down 14% to $13.6 million.

Underlying overheads were up 31% for the year due to European headcount investments and increased IT expenses.

That said, EML’s gross debit volume (GDV) — the debit volume processed by the firm through its platforms — did rise 408% and revenue rose 21% on the prior corresponding period.

However, GDV was up only 17% if you exclude Sentenial — EML’s recent acquisition.

In the end, EML cut its FY22 EBITDA guidance by 8% to $52–55 million.

EML foreshadowed ‘continued challenges’ through Q4, which impacted the guidance reduction.

The fintech admitted:

‘Operational execution issues in Europe and a more risk averse approach to new programs impacted the launch of new programs.’

EML also acknowledged that its overhead spend in H2 was in the higher end of expectations, as margins are likely to be hit in the coming quarter.

Source: EML

EML share price outlook

Two weeks ago, EML clarified media speculation regarding a potential takeover by Bain Capital.

EML confirmed it held unfulfilled discussions with Bain but did not rule out hearing new proposals.

But would today’s share price collapse make a takeover less or more likely?

EML is now 70% down in the last 12 months and more than 40% in the last month alone.

Does this present a bargain-hunting acquisition opportunity? Or will EML’s slide serve as a warning, keeping bidders away?

It’s been a tough year for fintech stocks, both in Australia and globally.

Many of 2020’s fintech stars are this year notching 52-week lows, none more so than ASX BNPL stocks.

Sezzle Inc [ASX:SZL], for instance, is down 8% today and 89% in the last 12 months, hitting a new low of 88 cents.

Sezzle hasn’t traded this low since March 2020.

It’s a similarly downcast mood for fintech globally.

The Global X FinTech ETF [FINX], for instance, is down more than 30% in one year.

What will the next years hold for fintech stocks, which promised so much but are now dealing with heavy competition, rising interest rates, and regulation?

Now, beyond the fintech industry, you may have heard, is the metaverse — an industry that encompasses more than just fintech but other technologies and beyond.

But with everyone coming up with their own predictions surrounding the metaverse, it may have become a bit of a buzzword.

How can you tell, while sifting through all the opinions out there, what is concrete and sound?

Our experts have compiled a report that explores the stakeholder possibilities that break down the mysteries of the metaverse: ‘The METAVERSE Explained for Aussie Investors: Myths, Mania…and Five Hidden Ways to Stake Your Claim Now’.

Regards,

Kiryll Prakapenka,

For Money Morning