Today beaten-up fintech EML Payments [ASX:EML] was given a gratifying push in the share market, seen to rise 14% early Friday afternoon.

The momentum came despite the fact that Chief Executive Emma Shand revealed a revenue drop of 5% quarter-on-quarter at the company’s 2022 AGM.

Shand and Chairman Peter Martin laid all on the table, speaking about recent challenges and hopeful strategies to seemingly grateful investors even with business costs climbing 29%.

And yet EML’s stock value is still down 83% in the last full year, a sobering reminder of the difficulties fintechs have been battling throughout 2022.

www.tradingview.com

EML under the microscope

EML’s key management didn’t beat about the bush in acknowledging the pressure it has been under for the past 18 months, with plain challenges ‘to tackle in the short-to-medium term.’

In 2022 gross development value (GDV) went up 308% to $80.2 billion, while revenue increased 21% with a total of $234.1 million.

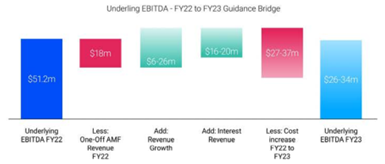

Underlying EBITDA had dropped 4% at $51.2 million, and there was also a dip of 1% in NPAT with a total of $32.1 million.

For the beginning of FY23, quarter-on-quarter GDV went up 304% from $5.7 billion in Q1 FY22 to $23.2 billion in Q1 FY23.

The difference reflected was primarily due to the consolidation of its Sentenial acquisition in October 2021.

Revenue slipped 5%, as did underlying EBITDA by 70%, from Q1 FY22’s $11.5 million to $3.4 million.

Overheads also climbed with further costs expected throughout FY23 linked to resolving ‘regulatory matters’ regarding Irish and UK subsidiaries PFS Card Services, and Prepaid Financial Services.

‘It is clear that uncertainty about EML’s future prospects has led to a loss of confidence and contributed to the fall in market value,’ said Mr Martin.

‘As previously advised, we have already taken a provision for potential fines from any enforcement action.

‘Despite our genuine efforts, there’s been a lack of clarity about what this means to EML and how we are going about fixing the problems. I and the Board take full responsibility and we’re determined to rectify both the issues.’

Mr Martin said the business has needed to ‘transform and streamline’ to overcome recent regulatory issues and to compete in a market which grows increasingly competitive globally.

Peter Martin was ousted from his position at the AGM today to be replaced by David Liddy.

EML says the rising interest rate environment is boosting key markets and its stored value float ($2.2 billion as at September 30).

Sentential has added open banking options for its customers, boosting functionality and growth in the payments area.

Source: EML

EML to implement streamlined strategies

Ms Shand says the company is in the process of correcting reviewed strategies to better integrate and extract necessary synergies.

‘We will optimise operations,’ said Shand.

‘Our structure, aligned to strategy, will be leaner and we will have more standardised, scalable products. We will have the right talent in the right roles, and we will have fewer technology platforms.

‘We have a target of controllable cost out of the business of 10-15% commencing in FY24 with full impact in FY25.’

The payments servicer expects its FY23 revenue to reach the range of between $240 million to $260 million (up on FY22’s $234.1 million) and a gross profit margin of 67% (down 1% from FY22).

Overhead costs are expected to jump to a range between $135 million to $145 million ($108.4 million in FY22).

Underlying EBITDA is to remain much lower than FY22’s $51.2 million, expected in the range of $26 million to $34 million.

Source: EML

Exciting and profitable fintech stocks 2023

2022 has been tough for the fintech sector, but fintechs can still provide valuable opportunities — at the right price and with the right growth prospects.

With some better decision-making, some fintechs can grow into very sturdy, lucrative businesses.

Our market expert, Ryan Clarkson-Ledward, has been busy finding such businesses.

He’s discovered three profitable fintech stocks flying under the radar. One of them, he says, is a start-up ‘wrestling with the big banks — and winning’.

Download Ryan’s free research report on three exciting fintechs here.

Regards,

Mahlia Stewart,

For Money Morning