Something interesting happened last week.

But I’ve not heard many people mention it.

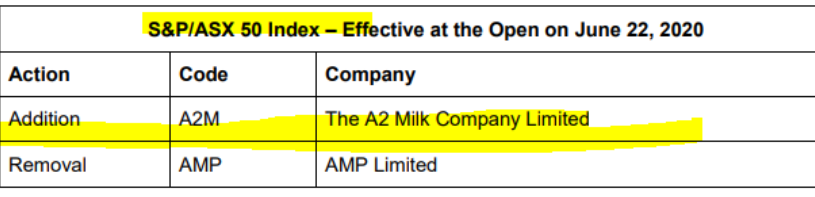

You see, milk producer The a2 Milk Company Ltd [ASX:A2M] just replaced (former) big bank AMP Ltd [ASX:AMP] in the index of Australia’s top 50 companies.

Here was the announcement:

|

|

| Source: ASX |

Now, A2M has been a more valuable company than AMP for a while, but this formal change on the official ASX 50 is a final admission that times have changed.

It would appear that dairy — or rather China’s demand for it and other Aussie produce — is growing faster than banking these days.

But that’s not the whole story…

While the dinosaurs of the banking industry — your AMPs, your ANZs, and your NABs — are certainly struggling to evolve with the times, smaller tech-based financial companies are actually flying along.

Free Report: ‘Why Your Bank Dividends Could Be Under Threat’

And last week was a big week for them too…

Shares in buy now, pay later firm Afterpay Ltd [ASX:APT] hit new highs, as did the less well-known, church-funding platform Pushpay Holdings Ltd [ASX:PPH].

So, it’s not banking that’s struggling as such, but rather the old-school banking models of the past.

Now, the fact is, most Aussie investors own bank shares. You probably do too, whether directly or through your super fund.

I think that’s a problem…

Even if you’re not the kind of person who is interested in investing in speculative fintech companies, you should be interested in knowing if your bank can survive in a new financial landscape.

I don’t think it can.

And a singalong social app is going to show you why…

Banks Undergoing a Shift: Tick, tock, tick, tock…

If you haven’t heard of TikTok yet, that’ll change soon.

Indeed, just today there are reports TikTok’s legion of young users sabotaged Trump’s latest rally figures by making fake bookings online.

The app is the latest hot fad sweeping the world.

Simply put, it allows users to create videos of themselves to music and share it with the world.

However, unlike most social media apps, it’s less about connection and more about content. To do something funny, amusing, clever, cute, or whatever else you think will be popular.

The dream of many young TikTokers is to become ‘TikTok famous’ — that is to create a popular video that attracts a lot of views. All to a catchy soundtrack.

My take is that it’ll upend the process of entertainment and music discovery.

Anyway, the bite-sized, user-created video format seems to have certainly tapped into the cultural zeitgeist.

TikTok is already huge.

It’s overtaken Facebook as the second most downloaded app in the world and has an astonishing 740 million users worldwide.

But what has any of this to do with banks?

Well, ByteDance — the company behind TikTok — are now getting into banking.

As reported on the finance industry site Pymnts.com:

‘The owner of TikTok, the Chinese video sharing social network, is reportedly expanding into financial services with the family that owns OCBC Bank, the global financial services corporation headquartered in Singapore.

‘ByteDance is negotiating with the Lee business family as the technology group seeks to add banking to its portfolio, sources told the Financial Times (FT).’

How does this move make sense?

Well, to understand that you must understand how the way we bank is undergoing a tectonic shift right now.

Let me explain…

The Era of Embedded Banking

ByteDance certainly isn’t the first tech company to get into the finance game.

WeChat, Facebook, Apple, and others are all in the process of building out finance capabilities. And it’s because they realise that banking is a process, not a destination.

Think about it…

You only bank when you want to do something like send someone money, pay a bill, or get a loan. Whether that’s online or in-branch, you only go there for a specific purpose.

It’s a necessary burden.

The new model of banking changes this…

It’s called embedded banking.

This graphic show how it works on the Chinese chat smartphone app, WeChat:

|

|

| Source: Aperture |

Embedded banking is there when you need it, where you need it.

It makes banking frictionless.

It abstracts away the hassle.

If you can simply press a button to pay for something, send money overseas to a friend, or get a loan, you don’t really care how it happens. As long as it happens easier and cheaper than the alternative.

Behind the scenes, embedded banking uses tech to tap into your existing data trails. That’s the ‘how’ behind how these apps work. And it’s the secret sauce of what makes them so powerful.

But for users, it’s just pure convenience.

People spend a lot of time on apps like Facebook and TikTok and this eyeball time is very valuable to a lot of different companies.

And with that eyeball time, a tremendous amount of data comes with it. Data the tech companies — unlike the banks who still use outdated systems — know what to do with.

Some smart banks are trying to hitch a ride with their new tech overlords.

Goldman Sachs, for example, just announced a partnership to provide credit of up to $1 million to Amazon retailers.

A business selling on Amazon can do a loan application online in minutes and get an answer in real time. After all, Amazon already knows your finances pretty well!

Compare that to the old process of meeting a business banker, providing paper copies of out of date financials, waiting for a credit officer to get back to you, and so on, and so on…

There’s no stopping this

This new model of banking is coming fast and, in my opinion, is unstoppable.

It’s why a company like TikTok could become a financial powerhouse. And it’s why companies like Afterpay and Pushpay are succeeding right now too.

They’re there when the customer needs them. They make banking a part of life, not a separate burden.

I’ve said it before and I’ll say it again, I think Australia’s big banks are in terminal decline and it’s only a matter of time.

It won’t happen overnight, but unless they can find a sustainable niche in this evolving ecosystem, we could see a few more big banks join AMP in the years ahead.

Big bank investors, you’ve been warned!

Good investing,

Ryan Dinse,

Editor, Money Morning

Ryan is also editor of Exponential Stock Investor, a stock tipping newsletter that looks for the biggest investment opportunities on the market. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.

PS: In this free report, Money Morning analyst Lachlann Tierney reveals two assets set to benefit as the ‘corona crisis’ worsens. Click here to claim your copy today.

Comments