In today’s Money Morning…PR stunt, or something more insidious?…the latest and greatest way to get rich…a new investing paradigm…and more…

It’s been a fascinating week here on the financial sidelines.

The ongoing threat of inflation has continued to bubble up in the media. It’s a topic that is particularly sensitive, as the Western world heads towards our shopping spree time of year…earmarked by sales events and the generosity of Santa Claus.

Nor can we ignore the importance of the COP26 summit. Because whether you view it as simple posturing or a true revolution, it will have ramifications for the global economy.

And of course, the biggest story over the past five days has to be Elon Musk’s sale of stock. A narrative that I’m sure he’s loving every second of, given the sheer size of his ego.

But hey, love him or hate him, he’s certainly made an impact on the financial world. And not just because of the enormity of his trade, or even the subsequent sell-off of Tesla shares in general.

No, the really fascinating part was the fact that he used a Twitter poll to make the decision…

PR stunt, or something more insidious?

If you’ve got no idea what ‘poll’ I’m talking about, then I’d urge you to read Ryan Dinse’s article from earlier this week. He did a great job of summarising the broader context and ramifications of Musk’s decision, which you can read here.

For those familiar with Musk and his antics, though, this Twitter stunt isn’t all that surprising. After all, we’ve seen him use the social media platform in far more controversial ways in the past.

The infamous ‘funding secured’ tweet is a prime example. It was a public tantrum that ended up seeing Musk butting heads with the SEC.

This time around, though, the most vocal group I’ve seen take issue with Musk’s hijinks is his fellow shareholders. Everyday people who have now seen billions of dollars of value wiped out by the tumbling share price. It’s a natural consequence of some 3.6 million shares being sold by Musk.

Call them greedy or stupid, but these retail investors have been blindsided by a seemingly impulsive decision. One that was telegraphed to the whole world in a 26-word tweet and decided by a simple yes or no vote.

Talk about ironic…

But that hasn’t stopped the conspiracy theories from cropping up. With at least a few (now deleted) posts discussing whether Musk was trying to manipulate the market in some way. Either for his own gain or a group of mysterious benefactors.

After all, Tesla is a very popular stock among traders. And not just between your average buying and selling of shares, but also options.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

The latest and greatest way to get rich

Now, if you’re unfamiliar with options, they may seem very confusing at first.

To give you a very basic summary, they simply act as a means for investors to leverage their gains and losses. They essentially allow someone to borrow capital to magnify their returns from a trade.

If you want to learn more about these unique derivatives, then you can check out our guide for beginners right here. It’s a no-nonsense rundown of how options work, and how to get started.

However, just know that in Australia options trading is fairly limited, compared to the US.

In fact, options trading in the US is now so popular that it’s dwarfing regular stock investing. And, more importantly, it has grown to some staggering heights in 2021.

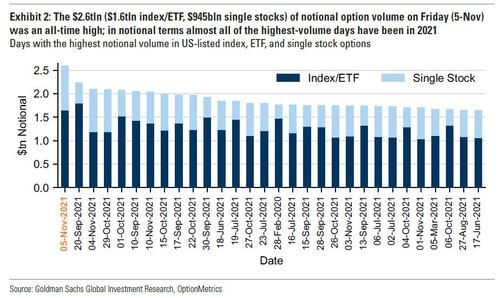

As Goldman Sachs’ Head of Index Volatility Research, Rocky Fishman, uncovered, a staggering US$2.6 trillion of notional capital was traded in options on Friday, 5 November. It was a new record for notional option volume, which has been steadily rising over the course of 2021.

Check out the following graph for a full list of record volumes, all but one of which have occurred this year:

|

|

| Source: Goldman Sachs Global Investment Research/Zero Hedge |

This goes to show just how popular options investing has become in the US. Particularly alongside the rise of meme stocks and the use of social media to spread investing opinions or trends. It’s the kind of culture that the media loves to criticise as ‘dumb money’.

So what does this have to do with Musk and Tesla?

A new investing paradigm

Well, when it comes to options trading, Tesla is a market favourite. As Fishman’s analysis shows, Tesla stock has accounted for around 75% of the total volume in the ETF option market recently. It has seen some US$241 billion worth of notional value traded every day in the past month.

Suffice to say, it’s clearly a fan favourite among this growing cohort of retail investors. Many of which may or may not appreciate the risks or complexity of options.

Either way, though, it is hard to ignore the potential influence of platforms like Twitter or Reddit on this crowd. They are places that have cultivated a way for everyday people to band together and invest together.

Whether or not you want to call that collusion is in the eye of the beholder. Hell, like I said before, some people seem to think Musk’s poll is a form of market manipulation.

I’ll leave it to authorities like the SEC to try and untangle that mess.

What I will say, though, is that 2021 has seen a dramatic shift in how people invest. Particularly in the US, but in Australia too. Because while options certainly aren’t as popular here, the ‘get rich quick’ sentiment and social media influences certainly are.

And while it is easy for the mainstream media to simply label these as ‘bad’, I think it’s a little more complex than that. I really do think we’re finally seeing the power of the internet make markets more accessible — for better or for worse.

As for whether it’s simply an outlier that may go away in time…who knows.

I certainly wouldn’t be surprised if a major crash burned a lot of retail investors. Particularly those who have been swept up by this incredible bull market we’ve had for the past two years.

But I also can’t see the influence of social media going away either. Not unless some sort of government intervention is used.

The genie is well and truly out of the bottle, so you best get used to it.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here