Defence spending is increasingly in the news, so a quick look the Electro Optic Systems Holdings Ltd [ASX:EOS] share price is in order.

The Sydney-based aerospace and defence company recently announced the completion of negotiations with the Commonwealth of Australia to provide new weapons systems.

The EOS share price rose more than 5% to trade at $5.80 on the back of the news before falling back down 1.8% to trade at $5.45.

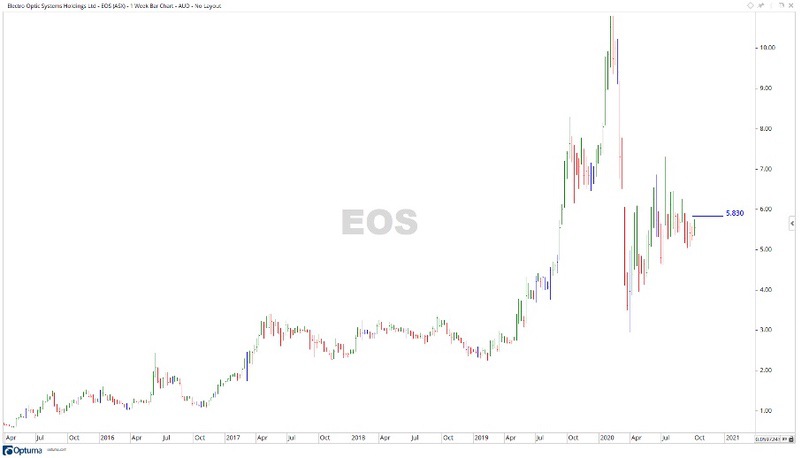

Source: Optuma

What’s happening at Electro Optic Systems?

The company released their full-year results recently. One of the most notable aspects was the strain COVID-19 put on the company.

Not just in the financials, but also according to the results, a ‘slow down in supplier responsiveness, product delivery delays, delays in contract negotiation and execution.’

Along with an increase in supply chain costs.

The company also had one staff member in the US and three in the UAE test positive for the COVID-19 virus.

This had a flow-on effect.

EOS’ products need to be shipped internationally, installed on military vehicles, tested in combat situations, etc.

This can take four to six weeks.

But a new contract win was forthcoming.

It was for ‘251 Remote Weapon Systems (RWS) and related materiel’ valued at $94 million.

Where to from here for Electro Optic Systems?

The contract will see $28.5 million of that $94 flowing to the company in cash by Q4 2020.

This will be welcome news after a difficult year already.

Let’s take a look at the EOS share price chart:

Source: Optuma

The difficulties of the year are evident in the plunge of over 46% from the high of $10.80 at the end of January to where it currently sits.

At this stage, the EOS share price is holding in a pennant pattern and looks ready for a breakout.

Should it move to the upside, then the levels of $6.10 and $6.50 may provide future resistance.

If the move is to the downside, then the levels of $5.05 and $4.60 may become the focus.

It’s worth noting that the recent move up took place on comparatively lower volume, indicating the buyers may not yet be committed to pushing the price north again.

Regards,

Carl Wittkopp,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks: These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments