Successful investors adapt quickly to change.

It’s also about knowing when things aren’t changing.

And today’s piece is almost contrarian when it says mining and Chinese debt could underpin Australia’s economic recovery.

‘Strong opinions, loosely held’ is the mantra my colleague Ryan Dinse drills into me.

You can get his insights by following him on Twitter here.

With China–Australia relations in the news again, today’s piece will go as follows:

- China’s economic recovery plans

- Australia’s looming resource boom

- Two metals that could get the limelight

So, let’s dive in.

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

It’s all one-way traffic on China debt

With total debt in China upwards of 300% of GDP as of last year, don’t expect the one-way traffic on debt-funded growth to change.

China knows it will have to build its way out of this mess and get manufacturing going again.

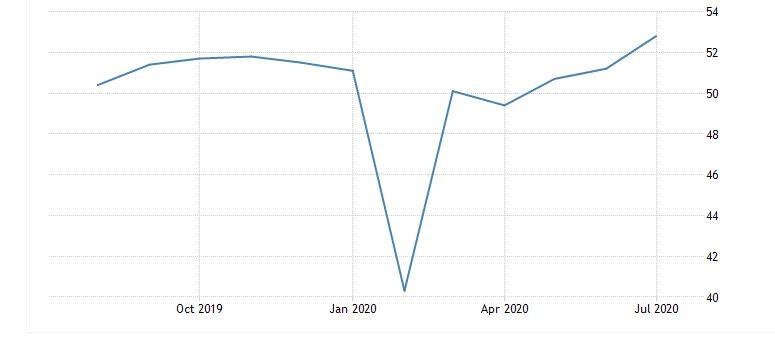

You can see the sharp ‘V-shaped’ recovery in the Caixin China General Manufacturing PMI:

|

|

| Source: tradingeconomics.com |

And this is what’s happening with Chinese banks via Bloomberg:

‘China’s biggest banks posted their worst profit declines in more than a decade as bad debt ballooned and the government called on them to help backstop the slumping economy, putting pressure on plans to pay dividends next year.

‘Profit at Industrial & Commercial Bank of China Ltd., the world’s largest lender by assets, China Construction Bank Corp., the second-largest, Agricultural Bank of China Ltd. and Bank of China Ltd. dropped by at least 10% in the first half, the lenders said on Sunday. Loan loss provisions jumped between 27% and 97% at the four banks.

‘China’s $45 trillion banking system has been put on the front-line of helping alleviate the worst economic slump in 40 years, triggered by a large scale shutdown due to the virus outbreak. Authorities have required lenders to forgo 1.5 trillion yuan ($218 billion) in profit by providing cheap funding, deferring payments and increasing lending to small businesses struggling with the pandemic.’

What does this mean?

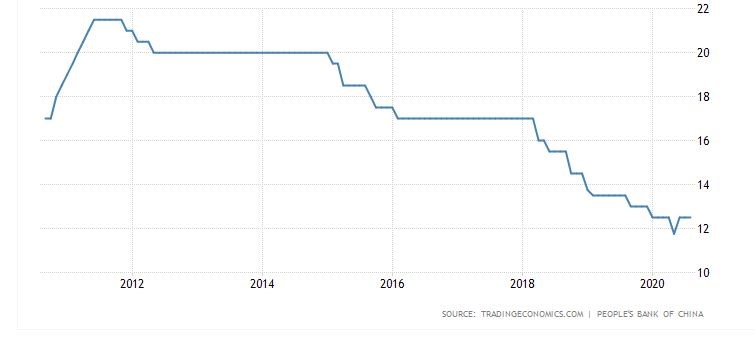

Well for starters, I expect the reserve requirement ratio to come down further:

|

|

| Source: tradingeconomics.com |

This is the amount of cash that Chinese banks need to keep on hand.

I expect despite the small recent uptick, the RRR will continue to come down as the government seeks to support its manufacturing base.

And when the debt becomes unsustainable — they might launch a digital yuan to extricate themselves from a debt-fuelled cataclysm a decade in the making.

The point here is, don’t expect China to change its modus operandi anytime soon.

If all you know is debt-funded growth underpinned by manufacturing then why would this change, at least in the medium term?

So, here’s what that means for Aussie investors.

It’s hit the mainstream

We’ve been following the resources story closely here at Money Morning.

It started with this article by Ryan Dinse, where he looks at the stocks-to-commodities ratio.

That was over two months ago, and now right on cue, it’s hit the mainstream.

This from the Australian Financial Review today:

‘Over their long careers working both as geologists and investors, Acorn Capital’s Rick Squire and Karina Bader have developed a few rules of thumb about investing in the resources sector… the two are readying for the next so-called super cycle — an energy-led boom — and extracting minerals that will power this shift to battery-dominated energy is trickier than mining iron ore or gold.’

And here’s what Squire and Bader had to say about this super-cycle:

‘The next super cycle is not about the urbanisation of China, it’s about the switch to a low carbon economy — and lithium, nickel, rare earths and copper will do that.’

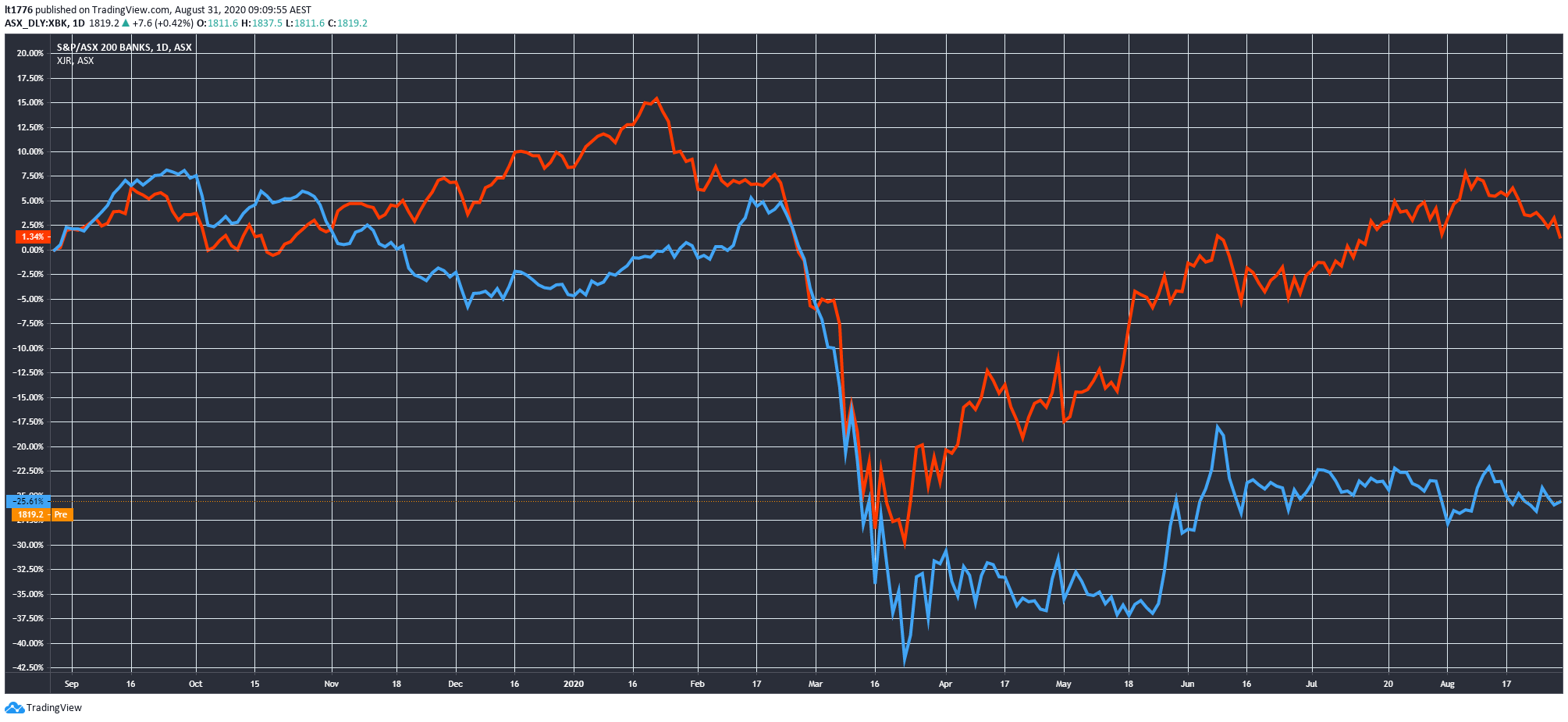

I’ve previously highlighted the fact that the S&P/ASX 200 Banks Index [XBK] is significantly underperforming the S&P/ASX 200 Resources Index [XJR].

And this trend continues (XBK blue line, XJR red line):

|

|

| Source: tradingview.com |

What’s happening with nickel and copper prices then?

You can see the nickel spot price is continuing its run:

|

|

| Source: Kitco |

And the copper spot price below:

|

|

| Source: Kitco |

Basically, identical charts.

Given their newfound tech applications, both these metals could steal the limelight in the coming years.

And in the process, give birth to a company of Fortescue-like proportions.

It’s all about knowing where to look.

A final note.

More debt in China could mean more demand for resources of Australian origin (particularly tech metals).

China’s reckoning with its ballooning debt is not materialising at the moment.

So, invest accordingly.

When the facts change, change your portfolio.

Regards,

|

Lachlann Tierney,

For Money Weekend

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Comments