Aspiring liquor technologist firm Digital Wine Ventures Ltd [ASX:DW8] share price lower today. Seeing a 14.4% dip in its share price following an operational update released this morning. A sign that perhaps their digital logistics solutions aren’t quite hitting the mark.

Broadly speaking though, this isn’t the case at all.

It seems investors have just been a bit spooked by a short-term lapse in growth…

Monthly drop, but an annual boom

Digital Wine Ventures’ primary focus right now is WINEDEPOT.

An online site that sorts and collates partnered suppliers for alcoholic beverage distribution. Shipping wine, beer, and spirits to wherever it is needed, in a streamlined manner.

And while that may sound simple, it has proven quite popular over the past year or so.

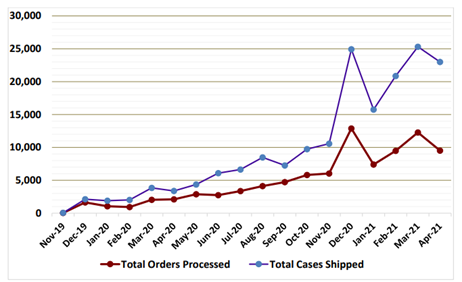

Just look at some of the growth that WINEDEPOT has seen in terms of orders and shipments:

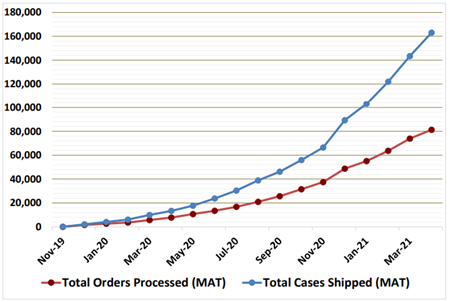

More importantly, on a moving annual total (MAT) basis, this growth is even more defined:

For the month of April, shipments were up 580% year-on-year. With total orders processed also up 350% year-on-year.

Proof that the company is growing strongly. And yet investors bid the share price lower following this news.

Why?

Well, simply put, it is because on a month-to-month basis that growth has stalled. As can be seen in the first chart.

Or as Digital Wine Ventures put it:

‘Case and order volumes were slightly down on the records set in March 2021, due mostly to the extended vintage preoccupying many winemakers.’

So, despite management’s best efforts to showcase the strong annual growth, investors are clearly far more concerned with the short-term slowdown. A blip that perhaps they are worried could turn into a much longer trend.

Then again, it could just be an overreaction too.

After all, WINEDEPOT did also add 19 new suppliers to its growing list. Expanding their product range and offering even more.

For that reason, the outlook may be far rosier than the market has concluded in today’s trading session.

What’s next for Digital Wine Ventures?

Looking ahead, it’s clear that the focus for the company will be to return to positive monthly growth.

At least, that is if they hope to please shareholders. Which is certainly achievable given the relatively small size of the business and a strong ability to scale its operations.

Granted, that doesn’t mean it is guaranteed either.

Wine, like many seasonal products, has plenty of ups and downs in terms of demand and supply. As can be seen with the ‘preoccupation’ with current vintages, according to management.

Therefore, it could be difficult to quantify how or even if this growth will be ascertainable.

And for that reason, investors will need to do their due diligence on this small-cap.

Speaking of which, if you’re looking for small-caps with fantastic foundations and great upside potential, check out our latest report. A detailed look at some overlooked and unloved stocks that are ripe for the picking.

Get your free copy, right now, right here.

Regards,

Ryan Clarkson-Ledward,

For Money Morning