The Dubber Corp Ltd [ASX:DUB] share price is down 7% at time of writing, following a $110 million capital raising announcement.

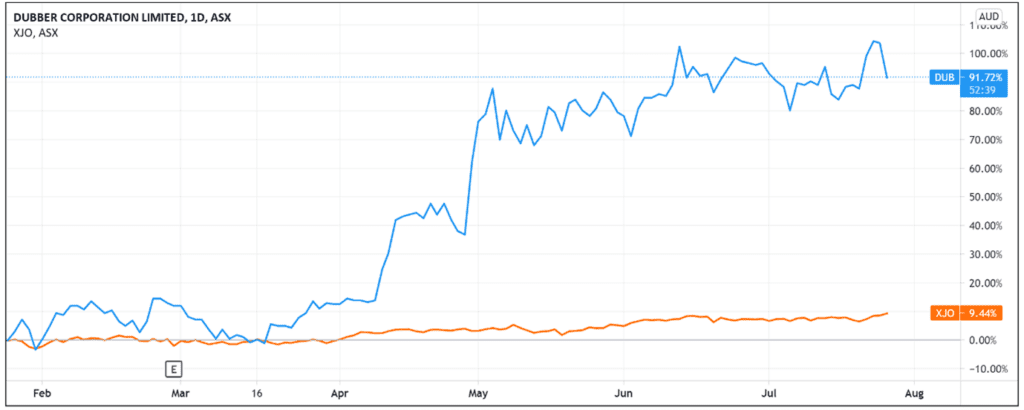

DUB shares fell quite sharply today, as you can see on the chart below:

The announced $110 million capital raising comes after the call recording and voice intelligence cloud service released its June quarterly results yesterday.

Successful $110 million equity raise

Today, Dubber revealed it received firm commitments for a two-tranche, fully underwritten placement of new fully paid ordinary shares to institutional investors in Australia and overseas.

DUB expects to raise $110 million before costs at a price of $2.95 per share.

The details of the two tranches are as follows:

- ‘Tranche 1 of the Placement of 33,086,809 shares will be issued pursuant to the Company’s placement capacity under ASX Listing Rule 7.1, and is expected to settle on Friday, 30 July 2021.

- ‘Tranche 2 of the Placement of 4,201,327 shares will be issued subject to and conditional upon shareholder approval at a general meeting scheduled to take place on Thursday, 2 September 2021, and expected to settle on the following day.’

Dubber noted the interest in the capital raise was ‘significantly in excess’ of the funds the company sought to raise.

Dubber’s June quarterly results

Here are the key highlights from DUB’s latest quarterly:

- Revenue grew 12% ($800,000) to $7.4 million

- Total users exceed 420,000

- Annual recurring revenue rose 14% ($4.8 million) to $39 million

- Over $32 million in cash

While Dubber was able to grow its revenues this quarter, it was at a slower rate than posted in the March quarter.

As we covered then, DUB’s revenue grew 54% in the March quarter while ARR grew 20% quarter-on-quarter.

Dubber ended the June quarter with a net cash loss from operating activities of $5.85 million on $6.73 million from customer receipts.

The company recorded $6.55 million from operating cash receipts in the March quarter.

Year to date (12 months), DUB notched a net cash loss from operating activities totalling $18.06 million.

What’s next for the Dubber share price?

Annual recurring revenue of $39 million may not sound like much against Dubber’s current market capitalisation of about $765 million.

That’s a price-to-sales ratio north of 60, quite lofty. For reference, another growth stock — Afterpay Ltd [ASX:APT] — has a price-to-sales ratio of 45.

But the high market cap may suggest investors are pricing in a lot of future anticipated growth for Dubber.

The recent slump, however, may suggest the market is reassessing Dubber’s valuation. For instance, the DUB stock is currently 11% down from its 52-week high.

If you’re interested in reading about promising AI-related small-caps, then Money Morning’s got you covered.

Be sure to check out our ‘Next BrainChip’ AI stocks report.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here