DroneShield [ASX:DRO] announced today that it has been awarded a US $33 million contract by a US government agency. The contract is to supply DroneShield equipment and multi-year services, propelling the company’s position as a trusted partner in the defence and security industry.

The contract represents a significant milestone for DroneShield and is expected to contribute to a record-breaking year for the company. The company expects full payment for the order before the end of 2023. Investors were buoyed by the news, sending the share price up by 28.3%, trading at 34 cents per share.

DroneShield anticipates that this year will be another record year, following a great year of sales in 2022. Shares are up by 83.78% over the past 12 months as governments and other sectors increased their spending on counter-drone equipment.

Source: TradingView

DroneShield awarded a US $33 million contract

DroneShield has been awarded a record US $33 million contract from a US government agency to supply and service DroneShield equipment.

The contract is a major win for DroneShield, a young but growing provider of counter-drone solutions. Militaries, law enforcement agencies, and critical infrastructure operators worldwide use the company’s interesting array of products.

Matt McCrann, CEO of DroneShield, expressed his excitement about the award, saying:

‘We’re honoured to receive this contract and are fully committed to supporting this esteemed customer. The trust they have placed in DroneShield and our solutions is truly humbling. This contract is a testament to our dedication to their mission and underscores our ability to deliver value to our customers worldwide.‘

In January 2023, the company was awarded a US $9.9 million contract by an undisclosed customer in the Five Eyes security community.

With the addition of this latest contract, DroneShield’s order backlog now stands at US $62 million.

It’s an impressive start for the young company, which began in 2014 selling simple privacy-focused sound sensors for detecting flying vehicles.

The current order book for the company is at a record-breaking US $29 million — making Q4 its best yet.

So, with investor interest rising, what’s next for the company?

Droneshield’s outlook

The Sydney-based company has seen impressive growth over the past five years, and the latest contracts highlight the opportunity before them.

The company’s products have matured at the perfect time for the market as we move into a new geopolitical era with the Ukraine war and China’s rise.

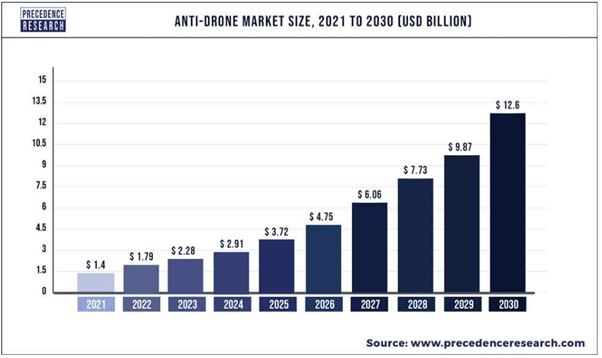

The global anti-drone market value was approximately US $1.79 billion in 2022 and is predicted to reach US $12.6 billion by the end of 2032.

That’s an impressive CAGR of 27.6%, highlighting potential demand for DroneShield’s counter-drone and electronic warfare solutions.

DRO contracts span various sectors, including intelligence communities, military, governments, law enforcement, critical infrastructure, and airports worldwide.

Source: Precedence Research

As we’ve seen from the war in Ukraine, drone warfare is no longer a futuristic idea but a present threat.

In the US alone, the Department of Defense plans to invest US $2.6 billion into unmanned systems across sea, air, and land.

Droneshield’s reported opportunities pipeline consists of approximately 80 projects, representing a potential value of more than US $200 million.

Many of these potential projects will see the company move into cutting-edge artificial intelligence (AI)-based platforms and electronic warfare solutions that will keep it on the radar of governments and investors alike.

As DroneShield looks forward with a strong financial position, an impressive order backlog, and a robust pipeline, DroneShield is well-positioned to achieve continued success as it moves into 2024 and beyond.

Other small-cap opportunities

Are you looking for ways to make money from small-cap stocks? If so, you’re in luck.

Our new report reveals three ASX small-cap stocks with a market capitalisation of less than $500 million that are turning steady profits and paying dividends.

One of these stocks is a mining services company serving Australia’s mining sector. The company is growing its earnings by 29% annually and has a strong balance sheet.

Another stock in our report is a leading retailer in its niche. The company ended 2022 with an $18.5 million profit and is well-positioned for growth in the coming years.

Despite the bright prospects, the market is currently undervaluing these stocks.

This means there is a potential for significant gains if the market realises its mistake.

Of course, investing in small caps is always risky. But given these three stocks’ proven business models and healthy balance sheets, we believe they are well worth consideration.

Click here to learn more about these three stocks and how you can add them to your watchlist today.

This FREE report is yours to keep.

Act now before the market realises its mistake.

Regards,

Charles Ormond,

For Money Morning