In the Warring States Period (403BCE-221BCE) in Ancient China, the nation-state of Zhao occupied the central northern part of China.

To the south was the Yellow River and to its north and west were nomadic tribes.

The Chinese people at the time saw these nomadic tribes as uncouth and inferior.

However, these nomadic tribes had the upper hand against them in open battle, dealing punishing defeats and pillaging their land.

What held back the Chinese warriors was how they dressed for war. It was like in peacetime, except they wore armour.

Sadly, long-sleeve garments and flowing robes were a liability on the battlefield. Furthermore, Chinese armies used chariots, allowing the nomadic cavalry to outmanoeuvre them.

At the turn of the 3rd century, the ruler of Zhao State, Ji Yong (also known as King Wu Ling of Zhao) saw this problem and enacted reforms to turn the State around.

Dress up like a Hu barbarian and

fire arrows on horseback

King Wu Ling saw the Hu barbarians move freely on the battlefield; their mounted archers were formidable foes.

Therefore, he sought to cast aside social norms by having his army dress like the Hu barbarians. He also required the people to learn horseback riding and mounted archery.

It wasn’t an easy task. His most ardent dissenters were those closest to him. They thought it offensive to stoop to the level of the barbarians.

Eventually, though, his reform prevailed. Enhancing the State’s military capability.

During his reign, he expanded territory and elevated the State’s standing as a major powerbroker.

This change also revolutionised warfare and strategy for the Chinese civilisation.

The Zhao State could’ve been a match against the Qin State, which became the first to unite China under Qin Shi Huang some 60 years later.

When life as we know it changed

The story I recounted might seem antiquated.

I’m not saying to dress up like a nomad and learn mounted archery. Focus on the principle.

The key to success in life is having the right mindset. This includes seeing what works and identifying trends ahead of others.

Most of us have grown up in society believing that working hard, saving up and owning one’s home are the keys to prosperity.

Furthermore, many saw investing in the stock markets as gambling and avoided it.

I personally held that view for some time. While delivering classes in university in the early 2000s, I warned my students of the risk of succumbing to the lure of the financial markets as a ‘get rich quick’ scheme!

My reasoning was the conventional mindset on our livelihood worked for many generations.

But that all came to a screeching halt in 2009, after the subprime crisis.

The Zero-Interest-Rate era ended that.

Cutting the interest rate to zero removed the incentive to save, blurred the way markets priced risk and threw capital allocation into disarray.

While one could invest, many different modes of investing sprang up, including countless scams promising quick returns.

It became a free-for-all, but not the way free-market capitalists would like.

Some may argue that financial regulations would help rein in the scammers and keep the bastards honest.

But let’s get real about this one.

Remember how the subprime crisis came about?

Unscrupulous financial institutions flouted laws to create turmoil in the markets using debt and speculating in the markets using other people’s wealth.

Then, the markets threatened to come tumbling down. These institutions not only tried to cover their backs but even threatened the authorities to save them, or else everyone would suffer.

Even in the investigations after the event, very few people who were responsible had to bear the consequences of their actions and the damage they caused.

It was clear who ran the system. The criminals.

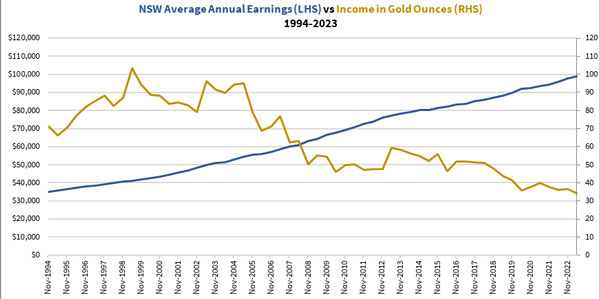

As for working to earn a living, the Zero-Interest-Rate era meant inflation would stealthily diminish the purchasing power of one’s salary or wages.

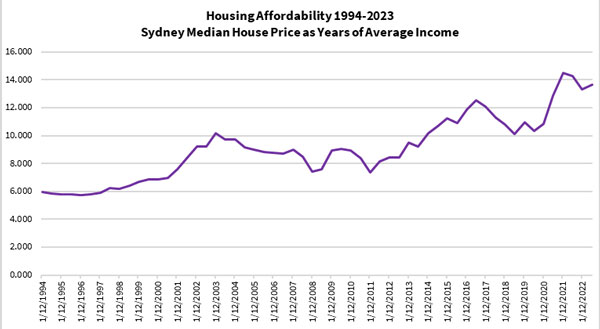

To show you what I mean, here’s the average salary for someone living in NSW relative to the price of gold and an average home:

| |

| |

| Source: Australian Bureau of Statistics, Refinitiv Eikon |

These figures are daunting.

Fact is, most Australians, and people worldwide for that matter, feel the squeeze economically.

Doing what they used to isn’t going to get them to their goals. Rather, it might cause them to fall further behind.

Meanwhile, building your wealth remains the same:

Generate more income.

Earn more profits.

Accumulate more assets.

Buy low, sell high.

But it’s harder to accumulate when the means to help you achieve all those are increasingly out of reach.

Mindset to move ahead of the times

As I said earlier, things aren’t like what it used to be anymore.

To succeed, it’s necessary to shift your mindset and change your plans.

Recognise the purchasing power of fiat currencies (what we have in our wallet) is declining consistently.

Understand you’re unlikely to become wealthy by merely relying on your pay cheque.

See through the consumerist attitude and avoid the temptation to conform.

And recognise that working hard to earn an income is the first yet critical step to let you invest to build your wealth.

Money and commodities to build

your wealth

Which comes to the next big question.

What to invest to grow your wealth and retain purchasing power?

Start by recognising what real money is and accumulating it.

If you don’t know what I’m talking about, it’s gold and silver. Currency is credit.

You can learn more about this via my precious metals investment newsletter, The Australian Gold Report.

Not only will you learn about the hidden secrets of money, but I’ll guide you to build a precious metals portfolio from bullion to precious metals ETFs and three gold producers to consider now.

Also, I encourage you to consider commodities as another option to build your wealth.

This might be an unusual proposal as commodities can be volatile assets and mining stocks are highly speculative.

That’s another aspect of changing your mindset.

The diminishing value of our currency means mineral wealth is relatively more attractive.

With governments desperately keeping this system hobbling along, they’ll no doubt implement massive building and spending programs.

This will spur the demand for commodities.

But you don’t want to go alone in this space.

My colleague, James Cooper, is an experienced geologist who closely monitors which commodities could be the next flavour.

You can find out more about his work in Diggers and Drillers.

You may not be early in changing your mindset to deal with the changing times. But you’re certainly not too late to act.

Let us take you on this journey.

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments