Downer EDI [ASX:DOW] shares are up by 2.41% today, trading at $4.035 per share. This comes after the announcement that it had achieved a contractual close on the Queensland Train Manufacturing Program (QTMP), the largest investment in new rolling stock in QLD history.

In the last 12 months, DOW has seen shares tumble by 20.69% as one of the worst performers in the sector. Today’s news will be very welcome by shareholders that have seen a turbulent year as Downer continues to feel the sting of controversy.

Last December, Downer revealed an overstatement of earnings of $40 million in one of its maintenance contracts — blaming ‘accounting irregularities.’

As a result of this disclosure, shares plummeted by 20% in a single day, leading to a lawsuit, an anti-corruption probe, and the forced resignation of several directors — including former chairman, Mark Chellew.

Will today’s news turn around the ailing infrastructure giant?

![Downer EDI [ASX:DOW] shares are up by 2.41% today, trading at $4.035 per share. This comes after the announcement that it had achieved a contractual close on the Queensland Train Manufacturing Program (QTMP), the largest investment in new rolling stock in QLD history. In the last 12 months, DOW has seen shares tumble by 20.69% as one of the worst performers in the sector. Today’s news will be very welcome by shareholders that have seen a turbulent year as Downer continues to feel the sting of controversy. Last December, Downer revealed an overstatement of earnings of $40 million in one of its maintenance contracts — blaming ‘accounting irregularities.’ As a result of this disclosure, shares plummeted by 20% in a single day, leading to a lawsuit, an anti-corruption probe, and the forced resignation of several directors — including former chairman, Mark Chellew. Will today’s news turn around the ailing infrastructure giant? Source: TradingView Better news for Downer Shares of integrated services giant Downer are up today after it signed a contract with the QLD Government to design, manufacture, and commission 65 new six-car passenger trains. The trains will be manufactured in Queensland and be used on the Southeast QLD public transport system to help bolster public transport in time for the 2032 Brisbane Olympic Games. The agreement will also see Downer build a rail facility on the Gold Coast in Ormeau to maintain the fleet for 15 years with a possible extension to a maximum of 35 years. According to Downer's release today, the contract is worth approximately $4.6 billion and will create up to 3,000 jobs in the region. Chief Executive Peter Tompkins said that he was proud of supporting QLD jobs and the Olympics project. ‘Downer has more than 100 years of experience in delivering rollingstock projects….we look forward to working closely with the DoT and Main Roads to deliver this iconic project for the people of QLD.’ Downer will also establish Australia’s first standalone Green Syndicated Bank to support the delivery of the project. ‘This new facility emphasises Downer’s position as a leading provider of sustainable transport services,’ Mr Tompkins said. Outlook for Downer It’s unclear if the bolstered share prices will improve the long-term outlook for Downer as the company continues to struggle to shake off the controversy and post substantial profits. Its biggest investor Allan Gray called the leadership ‘inept’ in February after the company issued another profit warning downgrade. The continued downgrades were blamed on similar contract accounting issues at the start of FY23. Current group earning margins are approximately 2.2% for the first half of the year, a far cry from their goal of 4.5% by 2025. This shows that the company has a long path to cut costs and drive profits for the future. In the last annual report, the company blamed rising subcontractor costs as it struggled to find staff for many of its big projects. Source: Downer EDI In April this year, Downer announced it planned to cut 400 full-time jobs by mid-2024 as it tries to boost earnings and restore investor confidence. Downer also plans to save $100 million in FY25 by combining the AU/NZ businesses and selling off more non-core assets, but investors may need clearer signals to get back on track. If industry giants continue to downgrade profit guidance and markets look shaky — where can investors find wins in this market? Small-caps overlooked opportunity Want to learn more about small caps and our editors’ strategy? We can show you how in our new report. Our small-caps experts will show you three ASX small-cap stocks with a market capitalisation of less than $500 million…stocks that are turning steady profits and paying dividends. One is a mining services company serving Australia’s booming mining sector…and growing its earnings by 29% annually. Another is a leading retailer in its niche that ended 2022 with an $18.5 million profit. But despite their bright prospects, the market is currently undervaluing these stocks. Will they soar once the market realises its mistake? We can’t say for sure. Investing in small caps is highly risky. But given their proven business models and healthy balance sheets, they could. This is why adding these stocks to your watchlist today could be a smart move. Learn more about these three stocks in our new FREE report. Regards, Charles Ormond For Money Morning stock chart news 2023](https://daily.fattail.com.au/wp-content/uploads/2023/06/ASX-DOW.png)

Source: TradingView

Better news for Downer

Shares of integrated services giant Downer are up today after it signed a contract with the QLD Government to design, manufacture, and commission 65 new six-car passenger trains.

The trains will be manufactured in Queensland and be used on the Southeast QLD public transport system to help bolster public transport in time for the 2032 Brisbane Olympic Games.

The agreement will also see Downer build a rail facility on the Gold Coast in Ormeau to maintain the fleet for 15 years with a possible extension to a maximum of 35 years.

According to Downer’s release today, the contract is worth approximately $4.6 billion and will create up to 3,000 jobs in the region.

Chief Executive Peter Tompkins said that he was proud of supporting QLD jobs and the Olympics project.

‘Downer has more than 100 years of experience in delivering rollingstock projects….we look forward to working closely with the DoT and Main Roads to deliver this iconic project for the people of QLD.’

Downer will also establish Australia’s first standalone Green Syndicated Bank to support the delivery of the project.

‘This new facility emphasises Downer’s position as a leading provider of sustainable transport services,’ Mr Tompkins said.

Outlook for Downer

It’s unclear if the bolstered share prices will improve the long-term outlook for Downer as the company continues to struggle to shake off the controversy and post substantial profits.

Its biggest investor Allan Gray called the leadership ‘inept’ in February after the company issued another profit warning downgrade. The continued downgrades were blamed on similar contract accounting issues at the start of FY23.

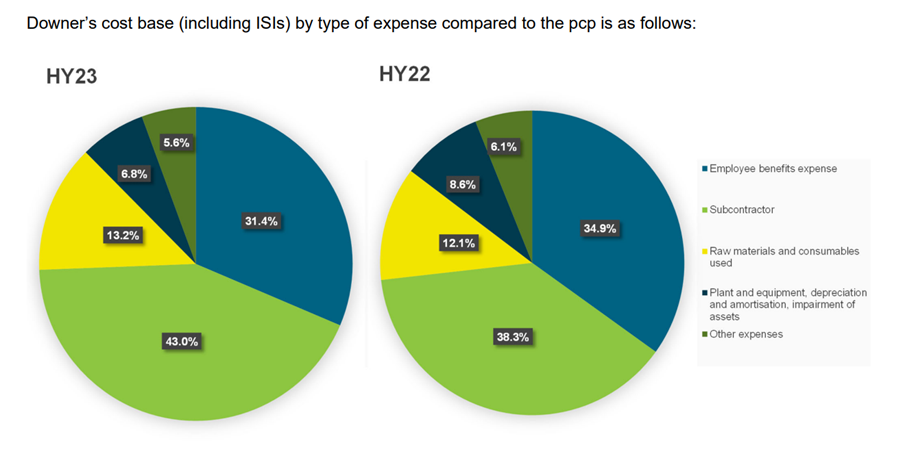

Current group earning margins are approximately 2.2% for the first half of the year, a far cry from their goal of 4.5% by 2025. This shows that the company has a long path to cut costs and drive profits for the future. In the last annual report, the company blamed rising subcontractor costs as it struggled to find staff for many of its big projects.

Source: Downer EDI

In April this year, Downer announced it planned to cut 400 full-time jobs by mid-2024 as it tries to boost earnings and restore investor confidence.

Downer also plans to save $100 million in FY25 by combining the AU/NZ businesses and selling off more non-core assets, but investors may need clearer signals to get back on track.

If industry giants continue to downgrade profit guidance and markets look shaky — where can investors find wins in this market?

Small-caps overlooked opportunity

Want to learn more about small caps and our editors’ strategy?

We can show you how in our new report.

Our small-caps experts will show you three ASX small-cap stocks with a market capitalisation of less than $500 million…stocks that are turning steady profits and paying dividends.

One is a mining services company serving Australia’s booming mining sector…and growing its earnings by 29% annually.

Another is a leading retailer in its niche that ended 2022 with an $18.5 million profit.

But despite their bright prospects, the market is currently undervaluing these stocks.

Will they soar once the market realises its mistake?

We can’t say for sure. Investing in small caps is highly risky.

But given their proven business models and healthy balance sheets, they could.

This is why adding these stocks to your watchlist today could be a smart move.

Learn more about these three stocks in our new FREE report.

Regards,

Charles Ormond

For Money Morning