The Douugh Ltd [ASX:DOU] has launched an in-app member-get-member feature to accelerate its customer acquisition.

As an emerging fintech set first and foremost on securing market share, securing and retaining customers is crucial for Douugh.

The market was upbeat on the news, with the Douugh Ltd [ASX:DOU] share price currently up 4%.

But today’s price action comes after a tough year for DOU shares, with the fintech down 65% over the last 12 months.

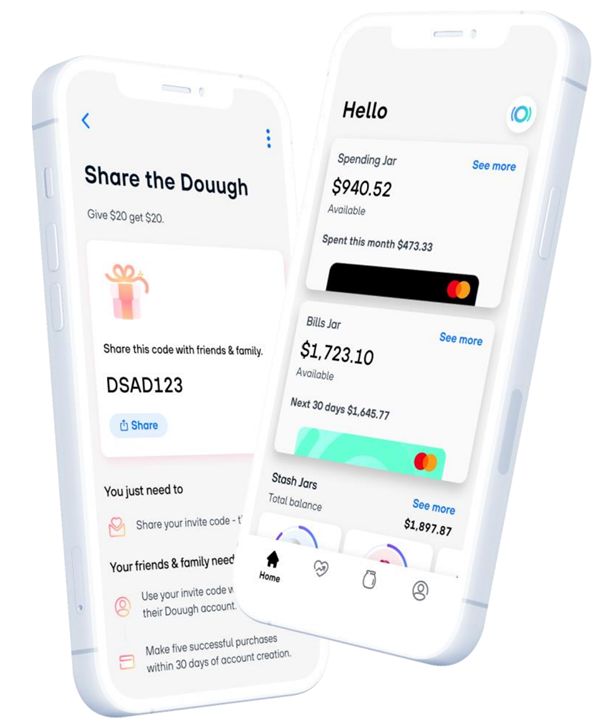

Douugh’s new app feature to attract customers

Douugh, the financial app, has launched a new member-get-member service integrated on DOU’s app.

The new feature lets customers earn a $20 credit for every person they refer to the Douugh platform, with each new member receiving $20 when they sign up, deposit funds, and transact.

Douugh’s founder and CEO Andy Taylor said:

‘As we work to build out our responsible financial super app that truly empowers those on the platform to improve their overall financial health, we have developed an end-to-end referral mechanism that our members have been waiting and asking for.

‘We want to encourage our members to not only share the Douugh experience with their social connections but also profit on it whilst doing so.

‘This feature further improves our growth scalability and allows us to invest more time and effort into further improving the core value proposition of the product to help our members get financially fitter every day.’

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

Will DOU’s feature drive customer growth?

DOU said the MGM feature is a ‘key initiative’ to reduce the blended customer acquisition cost (CAC) across all of Douugh’s key marketing and distribution channels.

For reference, in FY21 DOU spent $1.81 million on advertising and marketing, as well as $1.63 million on research and development, ending the financial year with a total loss after tax of $13.49 million.

While acquiring customers is vital, the cost of this acquisition should not threaten a firm’s going concern.

This is especially so for Douugh, whose customer acquisition cost-cutting measures come after DOU ended FY21 with $10.33 million in cash on hand on net cash outflows from operating activities of $7.06 million.

Douugh thinks the MGM feature ‘offers a significant opportunity’ to reduce Douugh’s cost of acquisition, with development and spending going into the DOU app rather than external marketing channels.

While investors bid up Douugh’s stock today, others may wonder what this new acquisition strategy signifies.

One question some may have is why Douugh didn’t try this acquisition strategy at the outset if it is a significant opportunity to reduce costs.

A second question relates to the feature’s efficacy. Will the MGM tactic get Douugh more customers than its previous external marketing channels?

Only time will tell, and I’m sure investors will be analysing DOU’s upcoming quarterlies with interest.

Now, if fintech has you excited, then I recommend reading this report on three small-cap fintechs.

Each offers a niche product that could help reorder the current financial system.

You can get the full rundown on these companies here.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here