At time of writing, the share price of Douugh Ltd [ASX:DOU] is up more than 7%, trading at 29.5 cents.

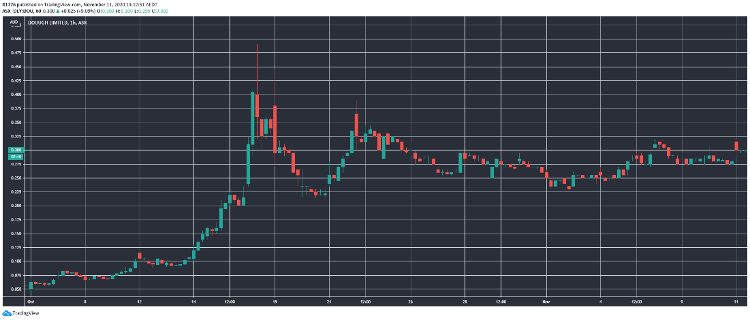

The DOU share price broke out in early October:

Source: Tradingview.com

We take a brief look at why the DOU share price is up today.

Beta testing complete before launch in lucrative US market

Here are the main points from the release today:

- Beta testing done

- All compliance and regulatory approvals in place

- On schedule for final submission to Apple App store

The App store submission is expected on 13 November.

For those who don’t know what Douugh is, it’s been touted as a ‘financial wellness’ tool.

Or as the company puts it:

‘A purpose-led fintech and next-generation neo bank…Douugh’s vision is to become a fully autonomous financial control centre.’

Outlook for DOU share price

Douugh is certainly on trend, as a tech-savvy organisation going after traditional banking and finance.

As such, should their US launch go off smoothly and we start to see some good user data come back, the outlook for the DOU share price could be promising.

Their slick investor presentation explains briefly how their edge is derived in part from their AI features.

I’ve previously discussed the now dead in the water Ant Group Co IPO.

Their AI is so powerful that a loan can be approved in less than four minutes.

If Douugh replicates Ant Group’s success big things could be in store further down the track.

But have you heard of these three fintechs?

In this report you will find a unique BNPL provider, a neo-bank in the making, and a SaaS platform for small business that uses data analytics.

If you are excited about what we call the ‘Great Bank Unbundling’ it’s a great read.

You can download that for free right here.

Regards,

Lachlann Tierney,

For Money Morning

Comments