It seems every day there’s a new calamity for us market watchers to devour.

But last week certainly took things to new heights.

For the first time in history we had negative oil prices. Then we had new job losses reported in the US of 4.4 million. That’s 26 million Americans now who have lost their jobs due to the coronavirus in just over a month.

What bad news is this week going to bring?

If 2020 was a horror movie, it would be written by Stephen King and directed by Quentin Tarantino (his early stuff, not that Once Upon a Time in Hollywood dribble.)

Yet, the guilty secret a lot of us harbour, is that it’s actually compelling viewing.

Don’t get me wrong, we’re not enjoying the human toll of these various disasters. Nor the effect on our bank balances.

Of course not…

But there’s an element of ‘what the heck is going to happen today?’ in the financial world right now.

It’s like the tinge of excitement you get from a scary roller coaster ride.

Bad news can become addictive. I don’t know why this is. I’d guess it has something to do with human psychology or perhaps it’s just the surge of adrenaline you get.

And ‘doom porn’ sells in the investing business.

Permabears like Professor Steve Keen, someone who has been predicting a house price collapse in Australia for as long as I can remember, can make a career out of it. And like a broken clock, they’re eventually right one day.

But here’s the thing…

If you want to succeed in your investing, you can’t get addicted to this way of thinking.

It can be tempting to start acting like some doomsday prepper always thinking the worst. And in investing, it’s common to seek out only the news which solidifies your viewpoint.

You find daily morsels of news that confirm your position rather than challenge it. So called ‘confirmation bias’.

To be clear, I’m certainly not downplaying this crisis. Or saying things can’t get worse.

But what I am saying is that you need to leave yourself open to the opposite possibility too. And even accept that things can — and probably will — get better.

That’s what the weight of history suggests.

(To which our bunkered down doomsday prepper friends respond: ‘Whose history? Take a look at Japan since the ’90s…!’)

So, on that note, today I’m going to show you why this actually might be the best time to invest you’ll get this decade.

Especially in one particular area…

A historic opportunity for you

I think the one thing we can all — both optimists and pessimists — agree on, is that the process of change has never been more rapid.

And that’s why I think the opportunity for savvy investors right now isn’t in large companies. No matter how cheap they might look.

I think a lot of these ‘dinosaurs’ will struggle to adapt to the new world that comes out of this.

But funnily enough, recessions are great for a certain subset of stocks.

And that’s small, nimble innovators. The kind of companies that can swerve past the dangers and grab a hold of whatever opportunities present.

Did you know that nearly half the top 500 companies on the US stock market were founded during a recession or bear market?

Technology stocks, med-tech stocks, big data stocks, and certain cryptocurrencies are my favourite places to look right now.

But there’s opportunity for you across the small-cap stock space if you look carefully.

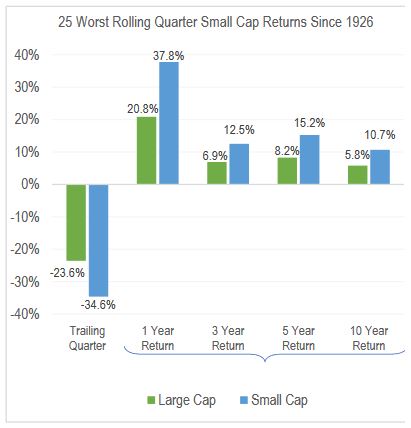

Check out this chart:

|

|

| Source: Ibbotson Associates |

It shows the 25 worst quarter returns since 1926, and then the following returns one year, three years, five years, and 10 years after for small-caps (blue) compared to large-cap equivalents (green).

As you can see on every time frame, the small-cap rebound outperformed large-caps. They almost doubled the return of large-caps over the next 10 years.

The research does contain a word of warning though:

‘While small cap value has a long record of generating meaningful outperformance, we must emphasize that investors should not simply buy the cheapest decile of small stocks.

‘Due to their size, small cap companies are generally more susceptible to economic shocks like the one we currently face.

‘By merely buying the cheapest group of small cap stocks, there is no safeguard protecting investors from unstable companies ill-prepared for an economic downturn. For this reason, it is crucial to incorporate quality factors in the investment process for avoiding these unprepared and ill-equipped companies.’

In other words, not all small-caps are the same…

The key to investing success in small-caps

The key, the research says, is to look for small companies strong in three areas.

The first is financial strength. So, not loaded with debt or going in for capital raises every few quarters.

Earnings quality is also a key feature of successful small-caps. I particularly like companies with recurring earnings models and diversified customer bases.

Lastly, growth of earnings was identified as the icing on top that will lead to huge returns down the line.

The flip side to all this, was to make sure you avoid small-caps that score badly on these three fronts. They don’t recover a lot of the time.

Long story short, look for the best small-cap stocks in the times when no one else is looking, and you could be setting yourself up for huge returns down the line.

Good investing,

Ryan Dinse,

Editor, Money Morning

PS: In this free report, Money Morning analyst Lachlann Tierney reveals two assets set to benefit as the ‘corona crisis’ worsens. Click here to claim your copy today.

Comments