In today’s Money Morning…two market scenarios to consider…you could’ve literally bought everything and done almost three times better…how BTC goes to zero — two options…and more…

Markets had a mild fit overnight.

Here’s the carnage as per the AFR:

‘Australian shares are poised to drop sharply at the open amid a rout in global markets with European equities falling more than 2 per cent, Wall Street in retreat, oil collapsing and US Treasury yields sliding.

‘Apple fell 2.9 per cent, Alphabet shed 2.2 per cent, Amazon was down 1.7 per cent. Tesla slid 1.5 per cent. Bitcoin was 2.3 per cent lower at $US30,717.44.’

Ah yes, the end times are finally upon us.

Great news for all the bears who missed the rally since April of 2020.

They rub their hands in glee at the prospect of ‘being right’ once and for all.

And yet, some important context is needed here.

Bitcoin vs Gold: Which Should You Buy in 2021?

Two market scenarios to consider

First of all, the S&P 500 hasn’t had a 5% correction since October of 2020.

Take that in for a moment.

This breakneck, straight line market had to shake out a few more people after more than nine months without shedding 5%.

While there’s a bear case for a market apocalypse out there, I’d say given ‘peak economic data’ plus the you-know-what resurgence, we won’t see the same kind of ‘all stonks go up’ rally over the next six months.

Expect a bit more sideways movement and an increased focus on cash positions and cash flows in the medium term.

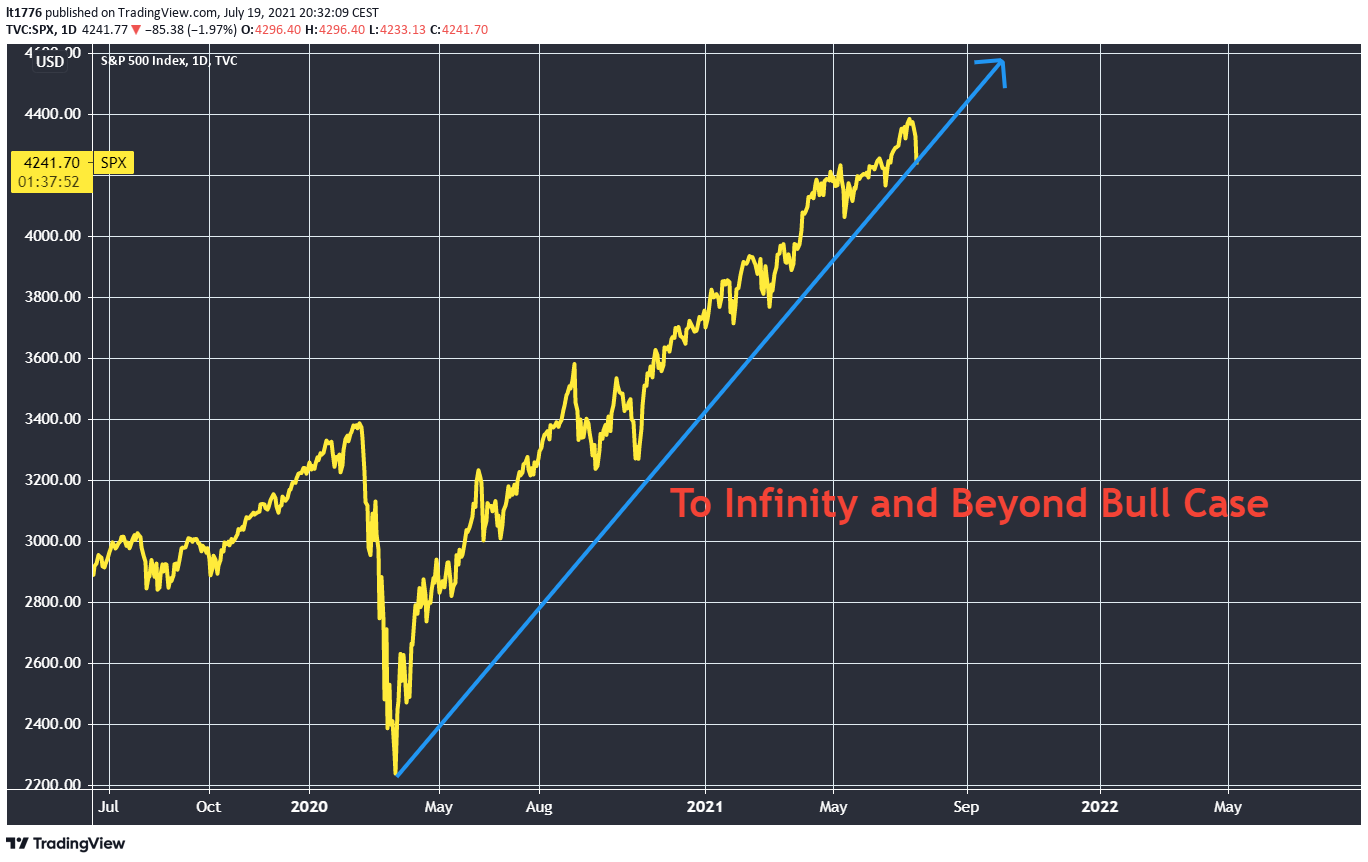

So instead of the S&P 500 [SPX] doing this:

|

|

| Source: Tradingview.com |

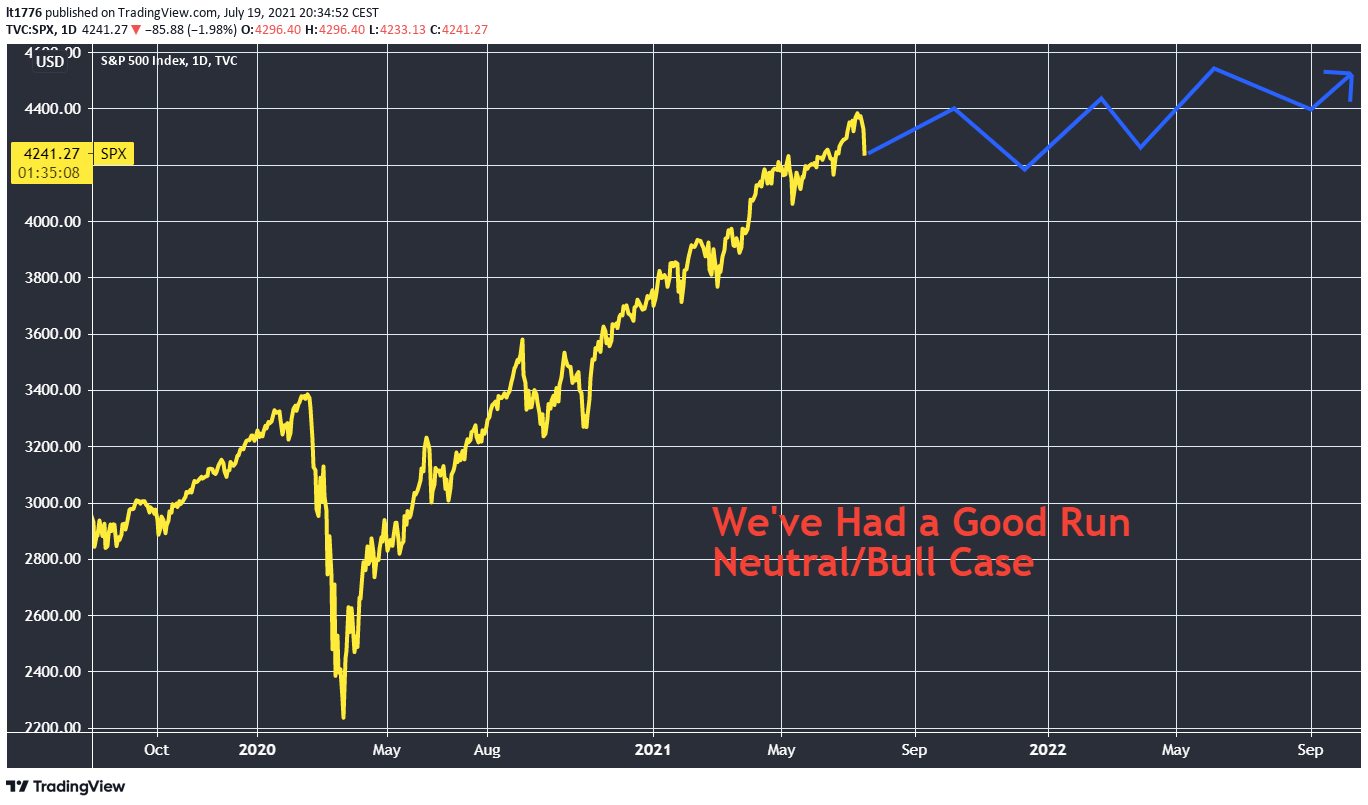

Maybe it does this:

|

|

| Source: Tradingview.com |

In this more likely second situation, picking wisely is important. A focus on value or some hybrid of value and growth may outperform the more stagnant index.

The message is however — don’t panic. Yet.

Today’s market action is likely the market trying to milk a bit more QE and low rates out of central bankers, and it appears that at least in Australia, the RBA is ready to oblige.

After all, the Fed and RBA make the money, for now.

And that means they make the market.

But not the rules anymore, so let me explain the crass attempt to grab your attention with today’s headline.

You could’ve literally bought everything and done almost three times better

With a headline in the AFR reading, ‘Billionaire Magellan boss says bitcoin going to zero,’ co-founder Hamish Douglass had this to say about Bitcoin [BTC]:

‘Cryptocurrencies, I have to say, are one of the greatest irrationalities I’ve seen in a very, very, long period of time because of the cult-like following it has behind it and the scale that is behind it… I can’t tell you when that [crash] will happen by the way. It could happen shortly, it could happen quite some time into the future … I think when we look back in 20 years it will be the case study of the irrationality.’

He said he expects to be attacked — so I’d hate to disappoint.

These quotes come from a head honcho at an organisation whose flagship global fund ‘returned 10.8 per cent for the year to June 30, versus a 27.5 per cent return for its benchmark the MSCI All World Index.’

The MSCI All World Index:

‘Is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 27 emerging markets. As of June 2021, it covers more than 2,900 constituents across 11 sectors and approximately 85% of the free float-adjusted market capitalization in each market.’

For shorthand — pretty much everything.

And if you’d just taken the punt on everything in the last year, you would’ve returned nearly three times more than if you trusted your dosh with the Magellan geniuses.

For a fee.

But it’ll all work out for Douglass because the end is nigh for markets. Oh, and Western/developed countries’ governments will shut down the Internet or regulate BTC out of existence.

There’s only fealty to the state and fiat, but don’t worry, I’ll be cosy in my penthouse as the West tries to out-China China.

From the mind of Hamish Douglass and all underperforming billionaire fund types: ‘Sell BTC, I swear I’m not bitter. And also, I know more than you.’

How BTC goes to zero — two options

OK, maybe I’m being a bit harsh on Mr Douglass and his fellow billionaire fund types.

They are far richer than I am. Or you for that matter.

That being said, the market and money rules are changing, which means there are only two scenarios (to my knowledge) where bitcoin goes to zero:

- The West throws in the towel on democracy and becomes an autocratic dystopian hellscape

- Fiat goes to zero because BTC is the bedrock of all transactions

So yes, BTC can go to zero in a world where that zero is in fiat, because fiat doesn’t exist anymore.

And while I wouldn’t completely rule out an autocratic dystopian hellscape playing out, there would be much bloodshed and a few formerly democratic leaders would probably shuffle off the mortal coil on the path to this Orwellian outcome.

You don’t need to hold a 100% BTC portfolio. That’s its own kind of nuts.

At the same time, however, it’s a risk not to have an insurance policy on a vastly different money future.

As for the market, I’ll continue working hard on making sure subscribers of Exponential Stock Investor are positioned to get a better return in the next six months than whatever meagre scraps Douglass-types offer up for a big fee.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.