The origin of Latin is thought to date back to 1000BC.

However, it wasn’t until 100BC that the Romans organised its language into what we know as Classical Latin.

Classical Latin was the language used by philosophers, poets, and scholars.

One of those scholars was Marcus Terentius Varro (116–27BC).

Varro’s writings are credited with being the origin for the Latin saying:

‘Mundus vult decipi, ergo decipiatur’

The English translation is:

‘The world wants to be deceived, so let it be deceived’

While the world has changed beyond recognition over the past 2000 years, Varro’s observation proves that one thing hasn’t change…human nature.

Man wants to be tricked, deluded, and misled.

Throughout history, man has demonstrated an extraordinary capacity for belief in the totally unbelievable.

In the 1630s, the world wanted to be deceived into believing a single tulip bulb was worth more than a house.

In the 1920s, the world wanted to be deceived into believing a scheme promoted by Charles Ponzi would deliver a 50% return within 45 days.

In October 1929, Yale Professor Irving Fisher told the world that ‘shares have reached what looks like a permanently high plateau’.

Adolf Hitler was a master in the art of deception.

He proudly boasted that:

‘If you tell a big enough lie and tell it frequently enough, it will be believed.’

And he followed that up with:

‘What luck for rulers that men do not think.’

Society (generally speaking) lacks the ability to apply independent thought, to question what we’re being told, and to challenge the accepted ‘wisdom’.

Climate crisis

When a Swedish schoolgirl took time off school to demonstrate for bold climate action, her protests at the lack of political action on the so-called ‘climate crisis’ became a social media sensation.

Those controlling the climate change agenda — the ones who tell big enough lies and tell them frequently enough for them to be believed — had a new public face for their deception.

The journalists fawned over young Greta.

Microphones were at the ready to capture every prophetic word she uttered.

Children the world over gathered to greet their heroine.

School kids went on strike over climate change.

Now that’s a real waste of energy.

They should get back to the books…especially the history books.

If the education system was fair dinkum, it should be teaching these young impressionable minds about the perils of group think.

When the climate crisis turns out to be nothing more than a storm in a teacup, has anyone considered how this mollycoddled generation will cope with being duped?

Oh, how the world wants to be deceived.

Shares always go up

And when it comes to deception, there’s none better at it than Wall Street.

If you believe the hype, there is never a bad time to invest.

Shares always go up in the long term.

Keep telling those ‘porky pies’ often enough and it becomes folklore.

Everyone believes it…especially novice investors.

But very few stop to ask: What’s propelling those prices higher, and can it be sustained?

Fortunately, there are some in the investment business that are real thinkers and want to share their wisdom with the investing public.

Ray Dalio is one of those. He’s the founder of Bridgewater Associates (the world’s largest hedge fund firm).

In a research paper titled ‘Paradigm Shifts’, Ray Dalio states (emphasis added):

‘There are always big unsustainable forces that drive the paradigm. They go on long enough for people to believe that they will never end even though they obviously must end. A classic one of those is an unsustainable rate of debt growth that supports the buying of investment assets; it drives asset prices up, which leads people to believe that borrowing and buying those investment assets is a good thing to do.’

People want to be deceived into believing the trend will never end.

But it always ends.

The cycle always turns.

The trends, UP and DOWN, exhaust themselves.

Going from under to over and back to undervalued.

Where are we now in the cycle?

To quote from this month’s The Gowdie Advisory:

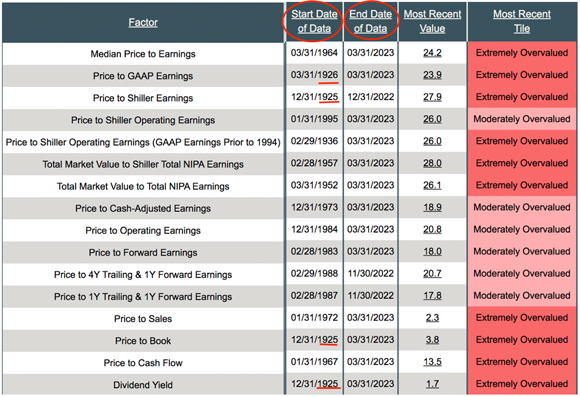

‘The following valuation table is the latest monthly update (published 31 March 2023) from NDR (Ned Davis Research).

|

|

| Source: Ned Davis Research |

‘Of the 16 valuation metrics, 10 are in Extremely Overvalued territory. And four of those metrics date back almost 100 years. That’s a whole lot of data (including the 1929 and 2000 market peaks) against which the current market is being benchmarked.

‘Rhetorical question…“Do you make money from a) buying HIGH and selling LOW or b) buying LOW and selling HIGH?”

‘Let’s go with b).’

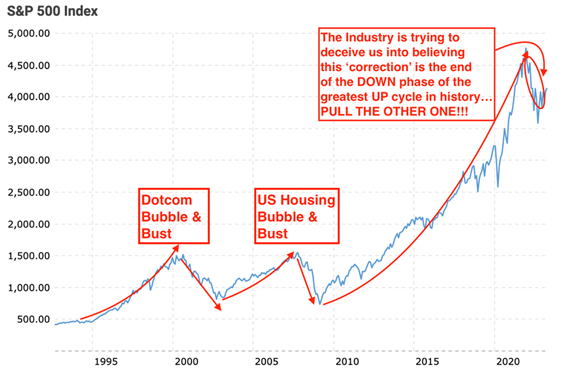

And here’s why, even with the so-called ‘correction’, the valuation metrics are all flashing RED…when bubbles bust, they’re brutal affairs.

We are NOT even close to seeing any brutal downside action…yet.

|

|

| Source: MacroTrends |

Getting to the point of UNDERvalued means there’s a WHOLE lot more downside left in this market. We are nowhere near the point of downside exhaustion.

All the lesser bubbles — Tulip Mania, the Roaring Twenties Bubble, Dotcom, and US Housing — collapsed in spectacular fashion.

Don’t be deceived into believing the Greatest Asset Bubble ever blown in history can end any differently.

GDP growth

And another great deception is the one we’re told about GDP growth reflecting economic strength.

This is a lie that’s told every quarter and it’s swallowed ‘hook, line, and sinker’ every time by the media and public.

We Aussies pride ourselves on our world record breaking recession-free run.

Well done us.

But how have we achieved this dream economic run?

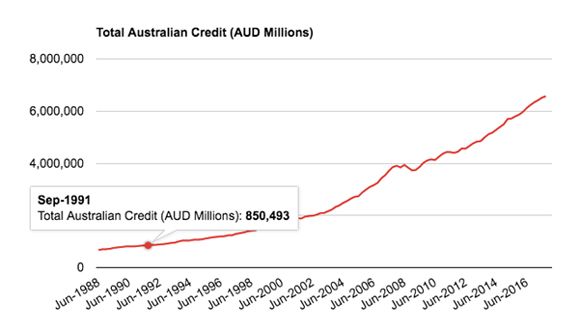

Australia’s last official recession finished in September 1991.

Our nation’s total outstanding debt at that time was $850 billion:

|

|

| Source: Australian Debt Clock |

Today, according to the Australian Debt Clock, our total debt is estimated to be:

|

|

| Source: Australian Debt Clock |

Since 1991, we’ve added more than $8,000 billion ($8 trillion) of debt to our personal, corporate, and public balance sheets.

What should be a national disgrace is marketed as a positive…our ‘strong’ economy.

This is deception on the grandest of scales, and it cannot continue.

Why?

Here’s my alteration (the underlined sections) to an extract from Ray Dalio’s ‘Paradigm Shifts’:

‘But it [borrowing on the never, never] can’t go on forever because the entities [households] borrowing and buying those assets and items of consumption, will run out of borrowing capacity while the debt service costs rise relative to their incomes by amounts that squeeze their cash flows.’

The injection of $8,000 billion over the past 30 years is what’s kept our GDP needle in the positive.

Our love affair with debt has been the driver behind our so-called ‘economic success’.

We cannot borrow indefinitely to bring forward so much future consumption.

Every singly debt crisis in history has ended the same way…with defaults, debt restructuring, and a whole lot of pain.

Don’t be deceived into thinking otherwise. Actions always have reactions.

What if we have a decade or more of persistently high inflation and higher interest rates?

Or the share market collapse is so severe; we enter into a period of deflation?

Being at either end of the ‘flation’ spectrum spells bad news for overindebted private and public sectors.

And when the cycle does turn, we’ll go through a period of excruciating withdrawal symptoms.

Jobs lost. Business bankruptcies. Properties foreclosed.

We’ve seen this before with those other, once touted, ‘miracle’ economies…Japan, Ireland, and Spain.

Prolonged credit booms always end badly.

Perhaps this is something the education system should be teaching our youth…rather than scaring them witless with this climate change nonsense.

The world may want to be deceived, but you don’t have to be.

As we edge closer to the coming paradigm shift, there’s never been a more crucial time to exercise independent thought.

Your family’s financial wellbeing depends on it.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia