Brian Chu is on holiday this week, so I’m taking a look at the commodity markets for him.

In contrast to earlier this year, markets have reacted blithely to weak economic data from the US.

The ‘bad news is good news’ reaction from markets is on a bet of a dovish Fed that will likely keep rates on pause from here.

With interest rate hikes out the window in the eyes of many, the US dollar has weakened from selling pressure, helping commodity trading.

For all you gold bugs, I’m sure you’ll be happy to see gold surpassing US$2,000 again.

Silver and iron have also been on a tear, gaining 3–4% last week with the easing US Dollar Index. Uranium prices have also surged, topping US$80 per pound for the first time in 15 years.

But one key commodity has been trending in the other direction. Oil is down 10% in the past month, falling below the 200-day moving average.

WTI Crude is trading at US$75.04 per barrel, while Brent Crude sits at US$80.33 per barrel.

| |

| Source: TradingView |

It’s a different tune to a month ago when concerns of inflationary pressure from rising oil prices were in vogue. Let’s explore what’s changed in the market.

Geopolitical tensions shift

As the conflict in the Middle East began in October, oil prices feverishly rose to nearly $100 per barrel.

Concerns of a broader conflagration in the Middle East had all eyes on Israel, Iran and the Strait of Hormuz.

Approximately 21% of global oil goes through the strait. It serves as a vital artery for the Gulf states to supply the international markets, particularly Asian markets.

| |

| Source: Freeworldmaps |

The conflict between Israel and Iran’s proxies continues, with Gaza risking a confrontation between the two states. If Iran fell into a dispute with its neighbours, the strait would be the first move on the chess board.

Thankfully, tensions appear to be easing, with Iran’s rhetoric ebbing and Israel and Hamas extending their cease-fire.

While the issue still simmers, the risk premium has faded from oil prices, which are down almost a fifth from their late September highs.

Now traders are looking to another geopolitical tension brewing.

OPEC output takes centre stage

The OPEC+ group surprised the market late last week when it announced that it would be delaying its next meeting to 30 November.

The delay came after early talks struggled to reach a consensus on output levels.

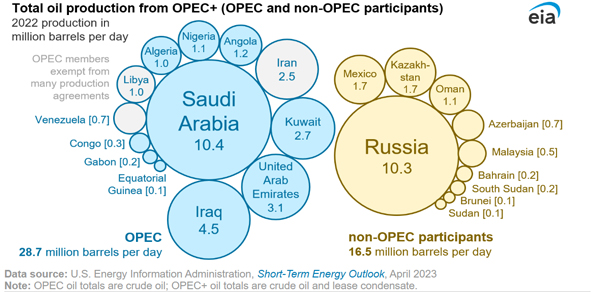

Saudi Arabia, Russia, and OPEC+ members have already pledged oil output cuts of about 5 million barrels per day (bpd), or about 5% of daily global demand.

These cuts began in late 2022 and then extended multiple times. They have also included voluntary reductions by Saudi Arabia of 1 million bpd and 300,000 bpd by Russia.

These were set to finish at the end of 2023, but with oil prices sharply declining, Saudi Arabia wants to deepen the cuts into 2024.

Saudi Arabia is anxious to restart growth in its economy as it struggles with looming demographic pressures.

43% of Saudis are under 15, and the Saudi government believes a high oil price is needed to create jobs for its growing population.

The Saudis have been pushing a further 1 million bpd cut and extension beyond 2023— but have hit a snag.

‘This postponement indicates difficulties within the OPEC+ group to reach and agreement to cut production,’ said Jorge León at Rystad.

‘Every member country acknowledges the need to reduce output to support prices into 2024. The question is how to share the burden of this.’

So, who are the members pushing back on these cuts, and will it make a difference?

Test of Saudi power

Saudi Arabia will find its de-facto leadership of OPEC tested when the group meets later this week in Vienna.

The cartel was already grumbling after members ignored Iran’s calls for Muslim countries to embargo Israel after the hospital bombing in Gaza.

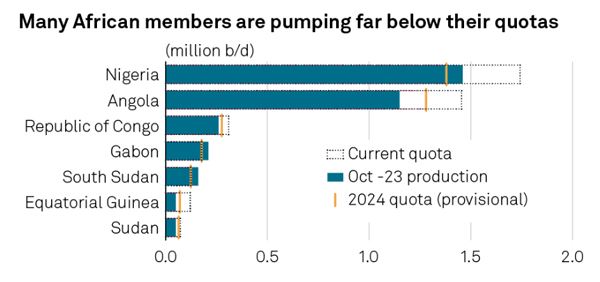

But OPEC’s Thursday meeting’s primary source of disquiet has been from its African members.

Angola, Nigeria and Congo have baulked at the idea of further cuts. The countries have pushed back on early informal talks by OPEC members, saying the extensions would sap crucial investment in their oil infrastructure.

So far, none of the Sub-Saharan nations have come near their quotas and will likely see production cuts in the future— but for all the wrong reasons.

These nations have struggled with production problems due to underinvestment in their ageing fields.

|

| Source: S&P Global Insights |

The worst has been Nigeria, which has faced years of production woes that have cost the country over US$7.8 billion in the past five years.

For these nations, the forced quotas will be the central sticking point for Thursday’s meeting.

According to one unnamed African delegate, a minor reduction would be tolerable, while a significant cut was ‘not even an option’, adding:

‘We are looking at a quota that would help us attract investors. If investors hear that our quota has been slashed, that is not a good signal.’

‘There are big troubles if the value is too low,’ said another delegate. ‘It has a direct impact on the revenue of our countries. It is a delicate matter.’

Another significant issue facing these producers is that Russian crude oil has undercut their Asian market share. Since the invasion of Ukraine, Ural crude oil has seen its price plummet.

China and India have been happy to ignore Western sanctions on Russian oil and buy it at a discount of as much as US$40 per barrel.

Russia is the most prominent member OPEC+ and has strengthened its ties with Saudi Ruler Mohammad bin Salman. Acting as a second enforcer in the negotiations for further cuts.

| |

| Source: US Energy Information Administration |

The cuts will benefit their country’s revenue but can also serve as a wider move against the Biden administration and Western powers. Raising our fuel costs and adding to inflationary pressures as payback for our criticism of their poor human rights.

Short-term oil outlook

The OPEC+ meeting delay ‘heightens the drama, probably not the outcome,’ Citigroup’s Eric Lee said in a note.

Saudi Arabia will likely roll its one million-barrel-a-day voluntary cut into 2024, while other members will likely broadly commit to existing quotas through next year.

But even if OPEC falls behind Saudi Arabia, it may not be enough to bring oil out of its shorter-term declines.

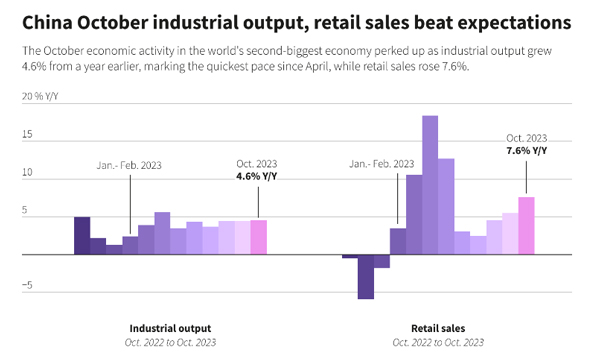

As the world’s largest oil importer, markets look towards China as the driver for demand, but its economic output remains subdued.

Fresh stimulus to China’s indebted property sector could be positive for oil markets, but it’s slow going so far.

The latest industrial output beat expectations, but only because analysts pitched them so low.

| |

| Source: Reuters |

Meanwhile, pressure is being placed on oil producers as the United Arab Emirates (UAE) hosts the next climate change conference this week.

The controversy surrounding the appointment of an oil and gas executive to head the conference could mean public pressure on oil producers to transition.

Reporting has already revealed that the UAE is using the meeting to discuss oil deals with 15 nations.

Now, they have stressed that the industry must not be seen as hindering progress and accept the inevitable ‘phase-down’. What that means for supply is still up in the air.

The International Energy Agency forecasted that oil would tip back into surplus next year, giving credence to cuts. But for now, oil markets are anxiously watching OPEC.

Wherever the deals end up, we’ll likely see further volatility in the oil markets in the months ahead.

Regards,

|

Charlie Ormond,

Editor, Fat Tail Daily