In today’s Money Morning…maybe Dimon’s right about regulation, then what?…joke’s on Dimon…this is how you have the last laugh…and more…

JPMorgan Chase & Co CEO, Jamie Dimon, had some choice words about Bitcoin [BTC] recently.

I quote via Reuters:

‘No matter what anyone thinks about it, government is going to regulate it. They are going to regulate it for (anti-money laundering) purposes, for (Bank Secrecy Act) purposes, for tax… I personally think that bitcoin is worthless.’

This, as JPMorgan in the summer…

‘Gave wealth management clients access to cryptocurrency funds, meaning the bank’s financial advisers can accept buy and sell orders from clients for five cryptocurrency products.’

Mr Dimon justified the cognitive dissonance, saying:

‘Our clients are adults. They disagree. If they want to have access to buy or sell bitcoin — we can’t custody it — but we can give them legitimate, as clean as possible access.’

Unsurprising stuff from the penthouse dweller, bankers gonna bank after all.

And I’ll let you in on a little joke I heard from my time in the financial epicentre of Europe (London) too.

You see, I used to frequent a tiny Ethiopian café in Dalston, and the proprietor, Marcos, used to call me ‘The Banker’. Likely because of my dress sense and glasses.

Anyway, I didn’t like the nickname because I insisted that I was studying philosophy, not finance.

One day at the café, one of my neighbours popped in for a long black and overheard Marcos calling me ‘The Banker’.

He said, ‘You know what we say about those finance types…’

‘What?’

‘They’re a wunch of bankers…’

If you don’t get it…well, I’m not going to let you in on the secrets of spoonerisms. So moving on…

Maybe Dimon’s right about regulation, then what?

Suppose Dimon’s onto something and intends to profit from worthless financial products for the non-penthouse plebs that believe in crypto.

Pretty standard JPMorgan behaviour, but it’s worth considering a future where crypto is hyper-regulated or regulated out of existence.

Think about it in these steps:

- Can it be regulated out of existence, à la China?

- If not, consider buying crypto.

- If it can be regulated out of existence…

- Consider the survivalist lifestyle and a bunker.

Step 4 is a joke, of course, but not really.

Think about what would have to happen in order for the world (not just the US) to effectively regulate BTC out of existence.

You’d basically need to try and shutdown the Internet.

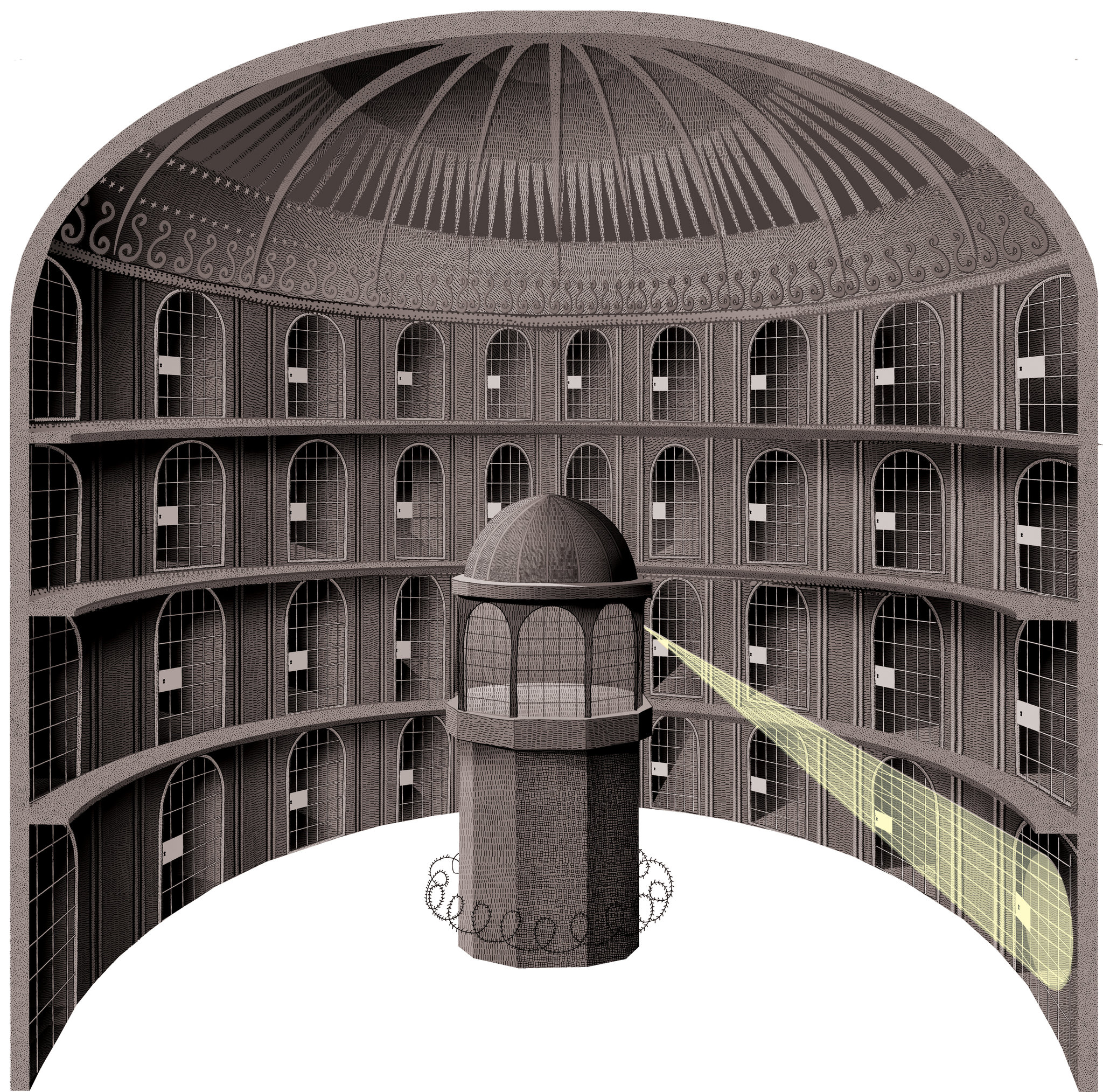

You’d ram through CBDCs, unleash a barrage of legislation targeting exchanges, establish a global currency enforcement agency with teeth (who runs this?), and increase transaction surveillance to such a degree that we’d all basically be living in the political equivalent of a Benthamesque Panopticon:

|

|

| Source: The New York Times |

Ignoring the fact that there are privacy coins and the fact that you can exchange bitcoin and other crypto privately without the use of an exchange, suppose this is the route the governments of the world intend to go down.

As Mr Dimon is alluding to. Maybe he’s privy to certain high-level discussions we aren’t?

Well, certain countries would balk at this blatant attempt at control and welcome blockchain innovators and crypto with open arms.

It’s even possible that in 20 years or sooner, new jurisdictions form that see crypto for what it really is.

One final stab at securing the future of capitalism as it was meant to be…

One last attempt at ensuring the primacy of the individual over the machinations of parties, the State, and the darker corners of humanity’s desire for control.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Joke’s on Dimon

You can call Dimon’s bluff and make sure the joke’s on him.

At what point does something that’s worthless become not worthless?

When Dimon says so?

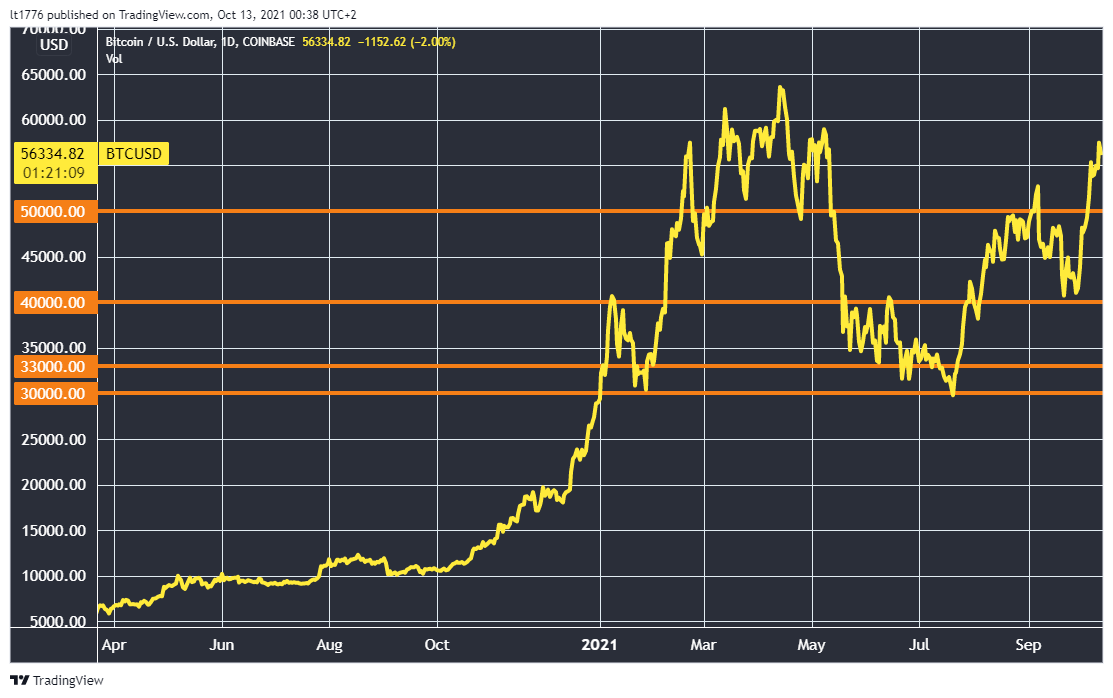

At US$55k?

|

|

| Source: Tradingview.com |

Or at US$300,000?

What about when it is so valuable that fiat doesn’t exist?

The fiat foot soldiers aren’t going to go down without a fight, but it’s entirely possible that they lose the money war.

In a world of techno-monetary competition, the great thing is that people can choose what they call money.

You could take away that choice, Mr Dimon, but the political price would be so high that you’d need to fundamentally reject all principles of liberty, subject human nature to history’s cruellest experiment in control, and effectively put the future of the world as a liveable planet in the bin.

Punchline: consider owning some crypto.

If you don’t have the stomach for that, there are a number of alternatives.

This is how you have the last laugh.

Remember, Jamie Dimon is, and always will be, a banker.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here