Uranium miner Deep Yellow [ASX:DYL] released the latest drilling results from the Tumas Project in Namibia.

The drilling set out to expand the current field west of the Tumas 3 deposit to extend the life of the mine from 22.5 years to 30-plus years.

Many were hoping today’s results would hit the 30-year mark, but instead, the company said they were ‘advancing towards’ that goal.

Investors were disappointed, sending shares down by -5.68%, to trade at $1.038 per share.

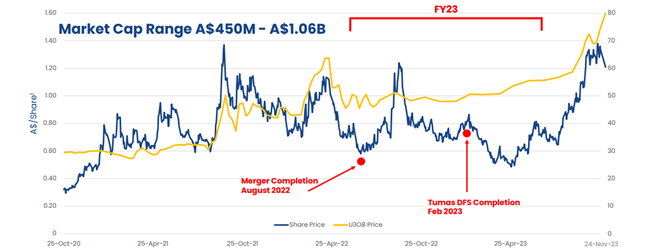

Despite today’s pullback, the company’s share price is up 53.70% in the past 12 months, tracking climbing uranium prices.

The company has been building its resource base in recent years, merging with Vimy Resources in August 2022 to secure an advanced WA project.

DYL also completed its Definitive Feasibility Study (DFS) of its Tumas Project in February 2023. The combination puts DYL on the cusp of becoming the ASX’s largest pure-play uranium producer.

Source: Deep Yellow

Drill results and developments

The two-phase drilling totalled 235 holes, with 8,071 reverse circulation (RC) drilling.

This increased the Tumas 3 Mineral Resource to 66.8 Mlb at 300ppm uranium.

Indicated Mineral Resource also upgraded to 60.6Mlb at 325ppm uranium, meaning an 11% increase in resource achieved without grade loss.

Together with Tumas 1, 2 and Tubas deposits, the area contains approximately 139 Mlb of Inferred and Indicated resources.

Commenting on the results today, Deep Yellow Managing Director John Borshoff said:

‘The Tumas 3 Mineral Resource upgrade, which was a result of the recently completed RC resource and infill drill program across targeted areas west of the Tumas 3 deposit, has expanded the Indicated Mineral Resource of the deposit and continues the Company’s push towards identifying an additional 25Mlb to achieve a 30-plus year LOM for the Tumas Project.’

‘The results from this program, together with the resource growth potential through future exploration across the Tumas Project area, provide us great confidence that we can deliver on our long-term LOM target at Tumas.’

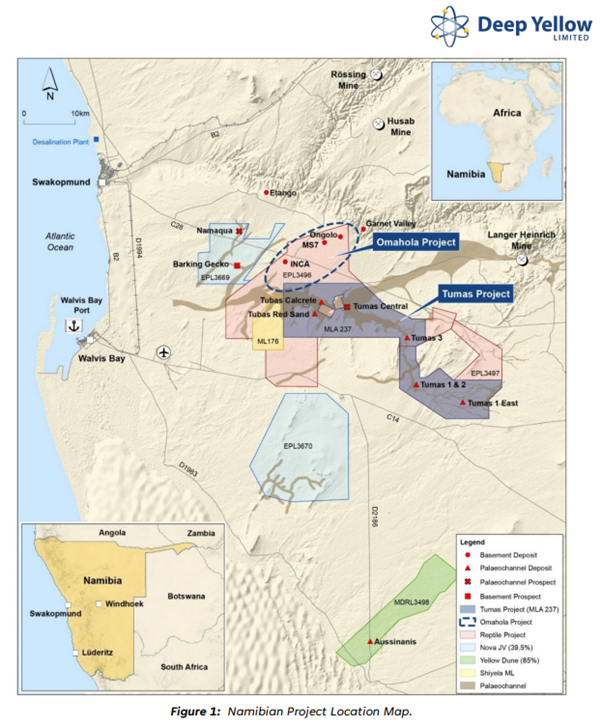

The Tumas site is in central Namibia and runs 125km across. The company hopes to continue testing to add another 10-plus years to its mine life, with approximately 50km to be tested.

Source: Deep Yellow

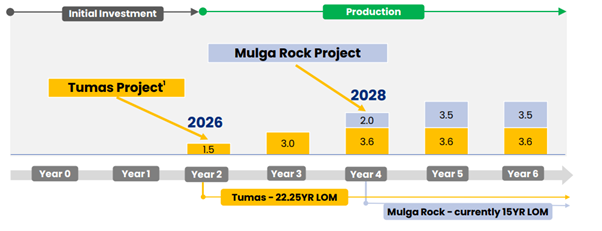

Deep Yellow kept its guidance of a final investment decision expected in mid-2024 and production in mid-2026.

At the company’s Australia site, Mulga Rock, DYL plans to begin its post-acquisition DFS revision in 2024.

Outlook for Deep Yellow

While investors were unimpressed by today’s low MRE upgrade, there is still potential.

Deep Yellow boasts it’s the only ASX company with two advanced projects, but others are closer to production than DYL.

What they do hold is a large amount of ‘pounds in the ground’. The company claims to have approximately 409 Mlbs of Measured, Indicated and Inferred uranium in the ground.

This puts DYL with the largest resource base of any ASX-listed company. But the difference between claims of large deposits and actual production is important.

DYL hopes to be the first ASX company to capitalise on the higher uranium prices. But others may get there first, with Tumas planning to begin production at 1.5Mlb annually in 2026.

Source: Deep Yellow September Update 2023

Another big factor is that the company is not fully funded to production with its current spending rate. They will likely have to raise capital some time in late 2024 or early 2025.

This would most likely occur as the Tumas Final Investment Decision arrives, and will likely dilute current shareholders and lower share price.

For now, ‘pounds in the ground’ could attract more investors as uranium prices continue to climb.

But executing the following stages will be more important to investors who want to see timely production to capture these prices.

Stocks to capture uranium bull run

As the world looks towards low-carbon energy, many countries — including Australia — haven’t fully explored all options.

Many of our eggs are in the renewables basket and have sadly discounted nuclear as part of the mix.

But markets and governments are waking up to that fact and changing course.

Around 30 countries are considering, planning, or starting nuclear power programs. A further 20 have expressed interest.

Now that the fears are subsiding after the Fukushima accident, nuclear power is again back in vogue.

But Australia is still far behind. Editorial Director Greg Canavan has concerns about the current Net Zero policies. He thinks Australia’s focus on less energy-dense forms of power could see us left behind.

He’s written a special report on the subject that includes five stocks to watch as the Net Zero agenda crumbles.

Click here to learn more about five ASX uranium stocks that you may want to consider.

Regards,

Charlie Ormond

For Fat Tail Daily