Watching President Biden and Speaker of the House, Kevin McCarthy’s charade of acting responsibly, while giving the green light to another two years of unfettered and wasteful spending, was nauseating.

Does anyone buy the BS these guys are selling?

Surely not?

Insincerity oozes out of their every pore.

All that Biden and McCarthy have done is buy (or, should that be, borrowed) more time. The massive debt problem is NOT going away, just deferred. Pass the borrowed buck to another administration to fix. For now, we’ll keep doing what we’ve done for the past four decades…spend more than we earn and pretend we are acting responsibly.

Did the clowns in Washington bother to read the article Reuters published on 17 May 2023?

The one that alerted us to the enormity of the global debt load (emphasis added):

‘A measure of debt across the globe rose in the first quarter to almost $305 trillion, and the rising cost to service that debt is triggering concern about the financial system’s leverage, a widely tracked study showed.

‘The Institute of International Finance, a financial services trade group, said on Wednesday global debt rose by $8.3 trillion in the first three months of this year compared to the end of 2022 to $304.9 trillion, the highest since the first quarter of last year and second-highest quarterly reading ever.’

As a point of reference, global debt in 2008 (when the world went to the brink of a full-blown debt crisis) was around…US$140 trillion.

Wow.

In the space of 15 years, we have more than doubled global debt and continue to delude ourselves into believing we can go on our way without there being any consequences.

Seriously, how stupid can society be?

I’m not sure whether it’s listening to the claptrap from these so-called leaders of the free world or the thought of the hardship that waits for my children that has me reaching for the bucket.

Strains are global

To be fair, monetary madness is not isolated to the US.

The debt disease has spread to all corners of the world.

Fitch Ratings recently highlighted growing concerns over the Old Continent’s debt load…

|

|

| Source: Bloomberg |

To quote from the article:

‘Europe’s biggest economies will struggle to cut debt this year, leaving their borrowings still significantly higher than before the pandemic struck, according to Fitch Ratings.’

And it’s not just the debt load that’s higher…so too are the debt servicing costs.

The heady days of European sovereign debt being issued at negative rates (can you believe how stupid that era was?) are long gone. Benchmark borrowing costs in the Eurozone are now around 3.25%.

What’s happening in the US and Europe is being echoed in China’s heavily indebted local government sector…

|

|

| Source: Bloomberg |

As reported by Bloomberg, one of the major pillars upon which China’s economic fortunes rests, Local Government Financing Vehicles (LGFVs), are under pressure:

‘Financial stress faced by China’s local governments is limiting fiscal support for the economy’s recovery, with half of cities experiencing difficulty in managing the interest payments on their debt last year.

‘That’s according to a report by Rhodium Group researchers, who examined annual reports from 205 Chinese cities and nearly 3,000 local government financing vehicles, or LGFVs, the state-owned companies that carry out infrastructure investment.’

It’s evident, with the normalising of interest rates, that the world is finding it a struggle to meet commitments on current debt loads.

On what planet do people think adding to this debt load — with tens of trillions of dollars in more loans — is going to end well?

Well, sadly for us, that planet is…Earth.

How we got here…in pictures

Here’s an ‘Around the World in 80 seconds’ pictorial of how we got to this point of insanity and why things are going to get far worse before the market forces compel future political leaders to act decisively.

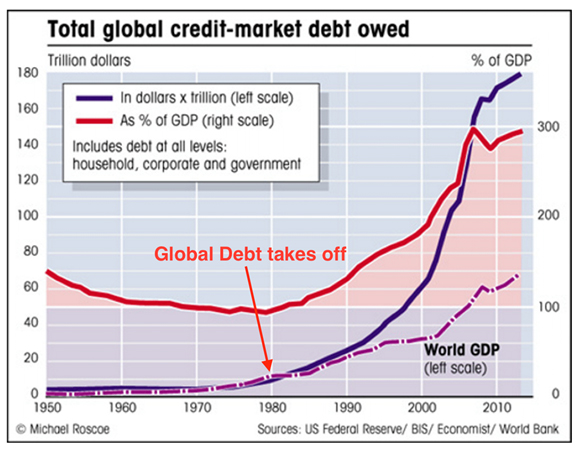

The timing of China’s decision to modernise its society in the late 1970s/early1980s was perfect.

Interest rates peaked in the early ’80s.

Falling rates enabled the developed world to borrow more (and, more) money.

|

|

| Source: Market Cap |

The borrowed funds were primarily used for consumption and making unfunded promises to secure electoral victories.

China’s low-cost manufacturing base exported low inflation (which resulted in lower interest rates) and low wages (resulting in the need to borrow more to maintain living standards) around the world.

|

|

| Source: World Bank |

Producing all those material goods for (debt-funded) Western consumption required more mining, factories and transportation.

Therefore, it should come as no great surprise to see China’s CO2 emissions increase significantly after 1980.

|

|

| Source: Our World in Data |

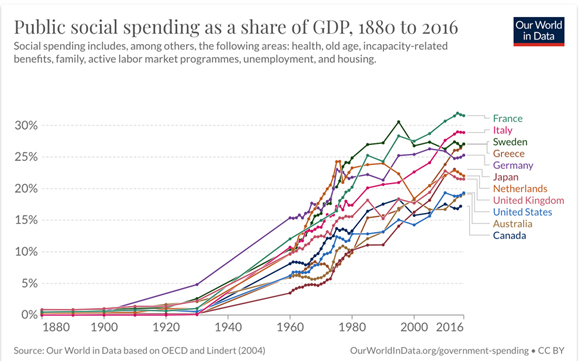

With developed world GDP growth ticking along at an annual clip of around 4% (thanks to the infusion of debt into the system to boost headline GDP numbers), more expansive welfare and healthcare promises were made…

|

|

| Source: Our World in Data |

So, here we are four decades later.

- Global growth is slowing (due to debt loads).

- Populations are ageing…more health care and welfare costs.

- Social spending promises are widely regarded as irrevocable entitlements.

- Whether we like it or not, we are committed to funding a multi-multitrillion-dollar campaign to reduce CO2 emissions.

- Our once friendly and mutually beneficial ‘Chinese maker and Western taker’ arrangement is under considerable strain.

This grand experiment in living off the ‘never, never’ must surely be in its final stages.

If something cannot continue, then it won’t.

At some point — possibly in the next few years — one straw too many is going to be added to the back of this 40-plus-year-old economic camel.

Ironically, the one upside of an abandonment of the debt-funded economic growth model will be…less CO2 emissions.

I wonder if the climate change zealots will be cheering this outcome.

Lifting the debt ceiling has taken us one step closer to the economic trapdoor.

Shame on them.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia