Leading building products and materials specialists CSR [ASX:CSR] filled the ASX with reports, presentations and appendixes collaboratively detailing its progress for the end of FY2023.

Among the figures, CSR reported trading revenue had climbed by 13% to $2.6 billion, with earnings climbing by the same degree to $330 million.

Although CSR posted many improvements today, the stock price for the building materials group was sliding by 1.8% in morning trade.

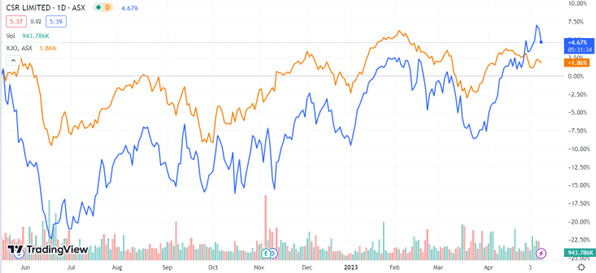

CSR may have gone up by 14% in the year so far, but against the wider market, it is trending down by 7.5% over the rolling 12-month period:

Source: TradingView

CSR raises revenue, profit and dividends

This morning, CSR revealed that its net profit after tax — that is, before significant items — came to $225 million for FY2023 ended 31 March 31.

This was a 17% increase on the group’s profit in the previous year.

However, shares were falling for the building products manufacturer today, which could have had something to do with a fall in statutory net profit after tax which had fallen from $271 million last year to $219 million.

Unfortunately, the aluminium side of the business had drastically slid from earning $40 million last year to $8 million ‘with higher aluminium pricing offset by increased raw material costs.’

Nevertheless, the group posted trading revenue of $2.6 billion, which was an increase of 13%.

Earnings too had climbed by 13% before interest, tax and significant items, and came to $330 million.

CSR’s building products gained EBIT of $273 million, up by 20% year-on-year which the group said was due to ‘good end market execution, disciplined price and cost management.’

Property EBIT also went up considerably from $47 million to $72 million.

Ultimately the results were strong given the current retail climate, which is a tough game for traders given the impacts of high inflation and interest rates, generally putting a dampener on consumer spending.

CSR’s improved results over the past year encouraged the company to declare a fully franked final dividend of 20 cents a share. This was an increase on the 18 cents share distributed in the prior year.

With the latest dividend now declared, this brings the full-year dividend to 36.5 cents a share.

It must be said that this does sit at the higher end of the group’s promised investor give-back scheme, which is to return 60%-80% of its net profit after tax to shareholders.

CSR said there is a strong pipeline of detached housing projects under construction at historically high levels, and in the apartment market.

It therefore believes that with particular focus on end markets and pricing discipline, it may manage inflationary cost pressures and continue to support revenues.

Source: CSR

From builders to miners, stocks to watch in 2023

The building industry is of course a vital part of our growing economy.

But where would builders be without their supplies?

This is where the mining industry really comes into its own…

Copper is a particularly hot topic right now, and there’s certain stocks worth watching in 2023.

If you subscribe to Fat Tail Commodities, our newest specialty publication, you could instantly download tips from our commodities expert, James Cooper’s, most recent copper stock report — all for free.

In James’ latest report, not only will you get instant access to three of the latest top stock picks for the copper industry, but also ongoing access to integral information that every resources investor should know, but might not know.

Learn about the copper supply crisis and how you can position yourself to take advantage of changes that are already happening.

Interested in jumping at a potentially lucrative opportunity reserved for the shrewdest of investors?

Keen to get started with three not-to-be-ignored copper stock tips?

Then you should click here today.

Regards,

Mahlia Stewart

For Money Morning