Opinions are divided.

Are cryptos the future or a fraud?

Do cryptos have a genuine financial value?

The answer to that questions is…‘it depends’.

If you are into porn, illicit drugs, ransomware, money laundering, and/or running Ponzi schemes, then cryptos are an extremely valuable tool of trade.

However, if you think this is an investment in the future of money, you’re likely to be disappointed…and a lot poorer.

This is an extract from a refreshingly honest CoinGeek article on (the now bankrupt) Three Arrows Capital operating as a Ponzi scheme (emphasis added):

‘In reality, serious institutions aren’t interested in buying and holding tokens like BTC and ETH that have no utility and are attached to blockchains that will never scale…serious institutions have had ample time to acquire digital currencies on their books, but few of them have taken up the offer.

‘Why? The reason is simple; banks, investment firms, and professional investors understand that the entire premise of the digital currency industry as we know it is unsustainable. The only way to drive token prices up is to lure in new buyers or greater fools. When combined with the fact the industry is rife with scams and fraud and is held together by an offshore stablecoin (Tether) that refuses to prove real dollar assets back it.’

Yes, Bitcoin [BTC] and Ethereum [ETH] have had ample time to prove they offer more than being a haven for fraudsters and drug dealers.

But they haven’t.

So why did bitcoin soar to US$67k in November 2022?

By luring in new buyers (or greater fools) to drive token prices up. And CoinGeek isn’t the only one expressing that view.

But we’ll get to that shortly.

No magic or hidden value in this stuff

Folks, there’s no magic or hidden value in this stuff. Sometimes things are just what they are. This is nothing more than an old con dressed up in 21st century technobabble.

Some big players in the investment business beg to differ.

One of those is US billionaire investor Marc Andreessen (net worth of US$1.6 billion).

In 2014, he said ‘bitcoin is like the internet in 1994’.

Earlier this year, he was on record again saying ‘bitcoin is like the internet in 1995’.

Boy, that’s glacial progress. Human years eight and internet years one…could this be…doge years? Sorry, couldn’t resist.

Marc Andreessen is one of the poster boys the crypto faithful worship. Here’s a seriously wealthy guy who ‘gets it’.

But there’s someone — with a fortune of US$104.6 billion — who could buy-and-sell Marc Andreessen many times over, and they see things a whole lot differently.

As reported by CNBC on 15 June 2022 (emphasis added):

‘Bill Gates is not a fan of cryptocurrencies or non-fungible tokens.

‘Speaking at a TechCrunch talk…the billionaire Microsoft co-founder described the [cryptocurrency] phenomenon as something that’s “100% based on greater fool theory,” referring to the idea that overvalued assets will go up in price when there are enough investors willing to pay more for them.’

Recruiting new converts is NOT easy

There’s that greater fool pricing mechanism again.

Who’s correct?

OK, for me, that’s a rhetorical question.

The stench around cryptos is putrid…‘pump-and-dump’ schemes, the New York Attorney General successfully prosecuting Tether for lying, the collapse of TerraUSD, Voyager, Celsius, and 3AC…and the list of shams and scams goes on and on.

Yet, the believers still believe. However, getting new converts into the cult is proving difficult.

If the aim of the game is to find greater fools drive prices up, then the findings of a recent survey by Pew Research isn’t good news for the crypto faithful.

As reported by The Washington Post on 24 August 2022 (emphasis added):

‘Over the past year, crypto companies like FTX, Coinbase and Crypto.com have shelled out tens of millions of dollars to attract new customers. “Fortune favors the brave,” Matt Damon famously said in a Crypto.com TV spot as he tried to induce Americans to open their digital wallets.

‘Now a core metric of how successful they were has been returned, and experts say it’s an eye-opening one: not successful at all. The number of people who invested in crypto has not expanded since last September before the push began, according to a new study led by Pew Research Center.’

The industry’s concerted and very costly marketing efforts to recruit more fools, sorry, investors, have been a dismal failure.

Perhaps the crypto promoters should have read a little history about fooling people…

‘You can fool some of the people all of the time, and all of the people some of the time, but you cannot fool all of the people all of the time.’

Abraham Lincoln

Here’s a screenshot from the Pew Research survey…the percentage of investors is stuck at 16:

|

|

| Source: Pew Research |

Without an ever-expanding base of new money, pyramid schemes collapse.

And that should be a concern for naïve, starry-eyed crypto investors.

The ones who actually believe they are part of something exciting and revolutionary.

Newsflash…you ain’t.

You’re an unsuspecting victim of a massive con.

Without a greater number of fools to buy into this false narrative, it’s game over.

Broken promises and the Bitcoin Tumour

There’s been ample time to deliver on promises…but when it doesn’t happen, the story changes.

- Blockchain is NOT scalable.

- Bitcoin is an abject FAILURE as a commercially viable alternative currency…just look at El Salvador.

- Cryptos are most definitely NOT a hedge against inflation.

- Bitcoin is NOT an uncorrelated asset acting independently of other markets…we’ll get to that in a minute.

- Cryptos are NOT the internet…if we switched off the internet tomorrow, would it impact our lives? Hell yeah. If all cryptos were taken off the market tomorrow, would the broader population be any worse off? Hell no. In fact, they would be better off. One less scam to be suckered into.

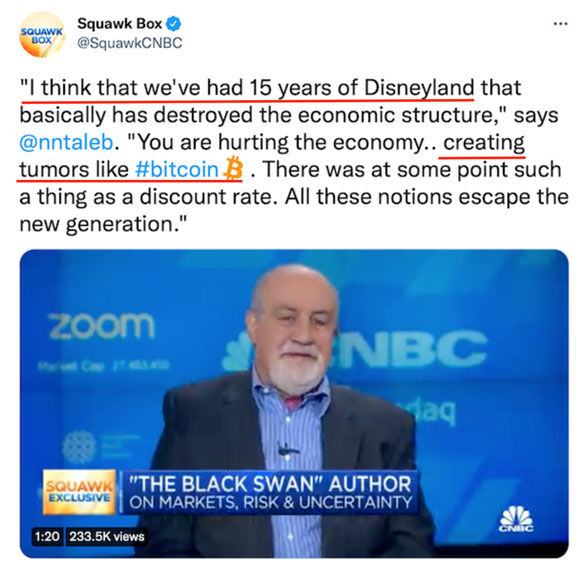

On 16 September 2022, Nassim Nicholas Taleb, the author of Skin in the Game, Antifragile, The Black Swan, Fooled by Randomness, and The Bed of Procrustes, was as a guest on CNBC’s Squawk Box.

Here’s the condensed version of what he said:

|

|

| Source: Twitter |

The tired and all-too-predictable retort by crypto cult members to crypto cynics is ‘they just don’t get it’.

This banal response implies a person of Taleb’s obvious investment intellect is…financially illiterate?

Seriously?

If that’s the best the believers have, then we know who the ignorant party is in this debate.

Taleb quite rightly expresses concern over the Disneyland investment environment created by the Fed’s reckless stimulus policies…and the tumour-like investments this make-believe world of investing has spawned.

Anyone under 40 years old has never invested in a world where markets were largely left to their own devices on price discovery.

Since late 2007/early 2008, the Fed has overstimulated and actively manipulated the cost and supply of money.

|

|

| Source: Federal Reserve Economic Data |

Intervention on this scale unleashed the animal spirits.

Speculation took hold.

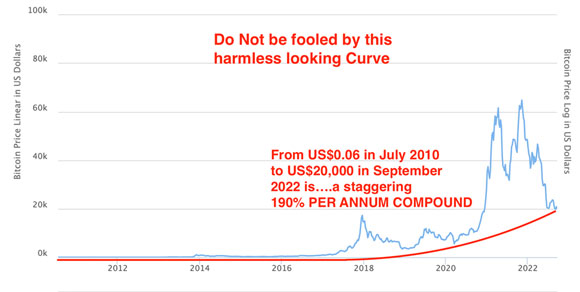

How can 190% PER ANNUM compound return for 12 years not be a bubble?

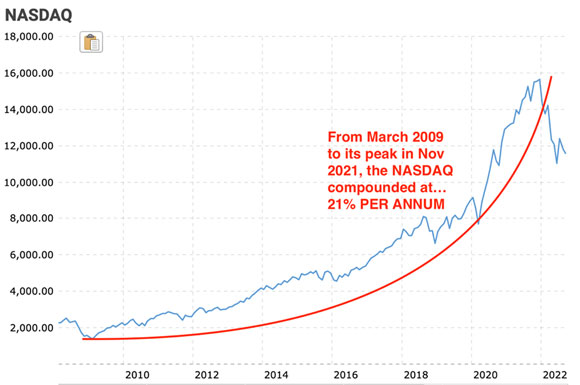

For a little context on the following charts, the long-term growth rate of equity markets is around 5–6% per annum.

Since March 2009, the tech-laden NASDAQ Index — chock-full of loss-making start-ups and overindebted zombies — soared in value…returning an oversized 21% PER ANNUM over a nearly 13-year period:

|

|

| Source: Macrotrends |

Anyone who think this is normal, doesn’t know market history.

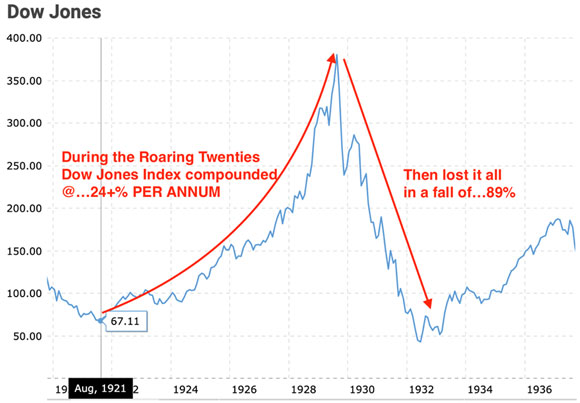

Here’s another period when the US market pumped out 24%-plus PER ANNUM over an eight-year period:

|

|

| Source: Macrotrends |

This sort of rampant speculation ALWAYS has consequences. The ledger has to be squared up. Excesses in one direction need to be corrected with an equal and opposite force.

Only the brave or foolish would bet against this natural order of life and markets happening to the NASDAQ (and other major indices) in the near future.

The Piper ALWAYS gets paid.

I’ve read and heard a lot about how Bitcoin is nothing like Tulip Mania or the South Sea Bubble or the Roaring Twenties or the dotcom bubble.

And I agree…it is far, far worse.

Over the past 12 years, bitcoin has compounded at the rate of…190% PER ANNUM.

No, it’s not a misprint.

|

|

| Source: Buy Bitcoin |

Nothing in history compares to this…nothing.

And the 190% PER ANNUM compound return is to the current price of around US$20k.

If we calculated the return to bitcoin’s peak price of US$67k, the number would be more than 200% per annum.

All this nonsense about the worst of bitcoin’s price fall — from US$67k to US$20k — being almost over is just ridiculous.

There’s a lot of space — between US$20k and 6 US cents — the price can fall into.

Oh, that’s right, bitcoin is a stand-alone asset…not correlated to other markets.

Therefore, it must be pure coincidence the greatest speculative bubble in history just happened to record peaks in bitcoin and the NASDAQ within a week of each other in November 2021.

Since that unbelievable fluke in timing, this is how the much-hyped uncorrelated bitcoin has performed compared to the NASDAQ:

|

|

| Source: Yahoo Finance |

Well, what do you know, Disneyland’s two most speculative assets have taken their investors on a wild ride.

And if the Dow Jones’s experience after the Roaring Twenties is any guide, there’s a lot more downside to come for the NASDAQ.

Which means bitcoin and others in the cryptoverse are in for a torrid time.

If the price continues to fall and with greater fools in short supply, it’s going to be interesting to watch which of the crypto ‘whales’ blink first.

What’s the bitcoin price point of panic?

US$15k or lower?

Maybe…but if everyone is thinking around the same number, then you can be assured someone will jump sooner and not risk being trapped in the rubble of this crumbling pyramid.

Crypto investors should listen to Bill Gates and find yourself a greater fool while you still can.

Talking of greater fools, there’s ANOTHER form of crypto in town. This one is programmed by the central banks themselves. That’s right; I’m talking about central bank digital currencies (CBDCs).

Today, I’ve discussed my views on bitcoin. Here’s a fascinating (and scary) view on CBDCs from my friend and colleague Greg Canavan.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia