In today’s Money Morning…a brief history of how banks work…it starts with this and ends with this…a bit of autocorrect humour tells you the truth about banking…and more…

Last week, I shared some internal comments from Ryan Dinse about the first real-world example of a crypto-based loan.

He was right on the money when he said that this is the banks’ ‘bread and butter’.

And the decentralised finance (DeFi) movement won’t stop until it’s disembowelled the banking system.

So, today I want to talk a bit about the next tokenised real estate loans and how this sets up crypto for an almighty clash with regulators.

But first, a bit of history behind how banks work is in order.

This is how you can see the big picture — and why DeFi is such a threat to the old order.

A brief history of how banks work

It’s all about a process called fractionalisation.

The idea that you lend out more than you have based on the assumption that not all borrowers will need their money at the same time.

People lining up outside of banks is perhaps the quintessential sign of economic panic throughout history.

Which is why capital ratios (how much cash you keep on hand) are the cornerstone of banking regulation today.

Fractionalisation was initially all backed by gold deposits.

The first modern bank (the Bardi, Peruzzi, and Acciaiuoli) companies sprung up in Medieval Italy, particularly Florence at the beginning of the 12th century.

But they went bankrupt funding (amongst others) Edward III in 1345 — during this period the bubonic plague was sweeping through Europe.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

[Editor’s note: Will today’s modern plague cause a repeat of history? That’s an interesting thought worth pondering.]

Back to the story of fractionalisation.

You see, the Catholic Church had a ban on ‘usury’, meaning no charging of really high interest rates.

This put a dampener on the growth of banks, but also lead to things like Letter of Credit and the Bill of Exchange.

After the plague, Italy once again returned as the centre of the banking world.

When it returned the system of banking at this time was more ambitious — it was increasingly used to fund wars and exploration.

Eventually the first ‘modern’ central bank popped up in Sweden in 1668.

The Sveriges Riksbank arose in the aftermath of the collapse of Stockholms Banco in 1664, which was the first European bank to issue bank notes.

This was a major innovation for fractionalised banking.

The crafty Swedish central bankers also set the rules of the game with reserve requirements for other banks to ensure that less banks would go bust.

Europe was thereafter awash with central banks.

You know what happened next — gold was the standard until Nixon put it on the outer in 1971.

Here’s where this mini history lesson collides with crypto though.

And this is absolutely crucial, pay attention!

Instead of funding wars and discovery, fractionalised banking now funds real estate speculation.

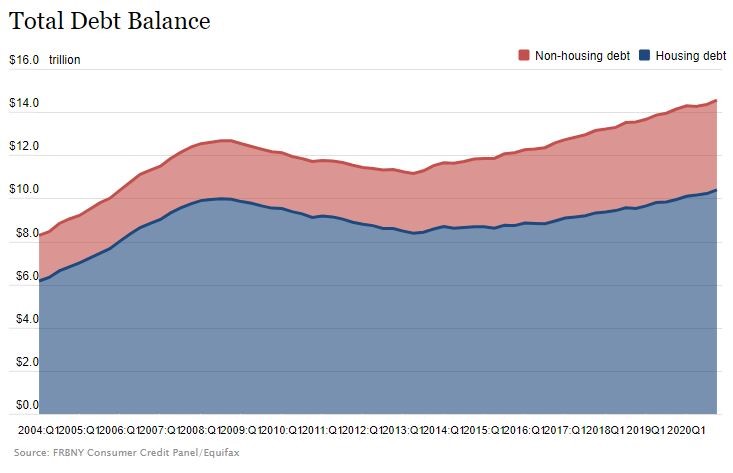

Check out the US total debt balance below:

|

|

| Source: Newyorkfed.com |

This is the bread and butter of the current banking system that Ryan was on about.

And what if we could replace all that messy banking infrastructure in one fell swoop?

Enter MakerDAO’s crypto real estate loans.

It starts with this and ends with this

It’s really interesting to learn that the first real-world crypto loan was made using physical silver as the collateral. This was where MakerDAO, a DeFi organisation, took a real thing and then loaned off from it.

That’s a real throwback if ever there was one.

A throwback to the good old days when you had to have a hard asset to loan off, as per the mini history lesson above.

But then comes the big thing — real estate.

As per CoinDesk:

‘Maker is now treading the same hunting grounds as not only banking behemoths such as Wells Fargo, but also A+ Federal Credit Union of Austin and thousands of other credit unions… MakerDAO does things a bit differently. It spins up dollar-denominated deposits, known as dai, on a decentralized ledger, the Ethereum blockchain, and then lends them using smart contracts…’

And the technical language on the loan:

‘Last month, MakerDAO created and lent around $500,000 dai to fund “fix and flip” U.S. residential properties. A homeowner applies for a mortgage, uses the borrowed funds to improve the house, sells it and pays the loan back.

‘New Silver, an originator of real estate loans, set up a special purpose vehicle, or SPV, which holds title to the fix and flip loans. Technology from Centrifuge, a fintech, dices the loans into senior and junior tranches and encodes the securities as non-fungible tokens (NFTs) on Ethereum. New Silver keeps the junior, riskier tranche for itself and submits the senior tranche to Maker as collateral in return for fresh dai financing.’

It’s complex to be sure — what if New Silver’s SPV goes under? What if the flip goes wrong?

Well, the hope is that the on-chain transactions and smart contracts will sort out the mess.

I’m not an expert on smart contracts — but you can imagine the legal challenges springing from Maker’s foray into real estate.

The good thing is that transparency will be heightened because all the activity will be on-chain.

Cut and dry if anything goes wrong.

Regulation in this space will need to adapt to a new version of fractionalisation, this time one where the ledger is available to all.

It’s more exciting than scary at this point.

As I said to Ryan in our internal email chain discussing this loan:

‘The trick is killing off the middlemen in the fractionalisation that has run the show since the start.

‘Replacing bank loan infrastructure with Dai would be willlllld.’

Wild, indeed.

A bit of autocorrect humour tells you the truth about banking

When I told a colleague this morning what I was writing on, I tried to type in ‘Working on a piece about Maker and fractionalised banking right now.’

Autocorrect kept trying to get me to say fictionalised not fractionalised.

Too true, autocorrect.

Banking is a fiction because money is a (very useful) fiction.

And the truth is, the world of money is about to get ‘stranger than fiction’.

If you’re not onto this quick, you may struggle to adapt to the rules of the ‘New Game’.

It’s a great watch, and you’ll definitely learn a number of valuable things along the way.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Promising Small-Cap Stocks: Market expert Ryan Clarkson-Ledward reveals why these four undervalued stocks could potentially soar in 2021. Click here to learn more.