An old friend called me yesterday.

‘Did you see, Bitcoin’s crashed to US$100k’, he told me, exasperated.

I hadn’t noticed. My strategy has remained unchanged from when I first put it into a hardware wallet back in 2017.

Set and forget. HODL (Hold on for dear life), as the crypto enthusiasts would call it.

You could see the strategy as a hedge against the dollar-based system. You could see it as a gamble on magical internet money.

Either way, it’s a bet that’s unlikely to improve by me panicking every time Bitcoin drops.

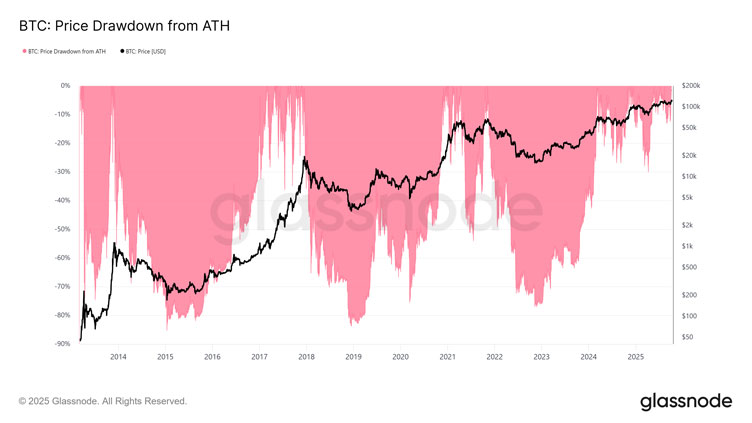

Since 2013, Bitcoin has had four 70% drawdowns.

Source: Glassnode

[Click to open in a new window]

I wouldn’t be surprised if we see one again. Replete with the usual commentary of ‘Bitcoin is dead’ that comes with a bear market.

We’re far from that point. But it hasn’t stopped the usual panic.

James Altucher has seen this before.

In his most recent piece, which I’ll share with you below, he’ll give you the veteran’s perspective of the recent falls in crypto.

Regards,

Charlie Ormond,

Small-Cap Systems and Altucher’s Investment Network Australia

***

Investing in cryptocurrency is not for the faint of heart.

Just weeks after hitting a record high above $126,000, Bitcoin dropped by more than 20% – falling below $100,000 for the first time since June.

For crypto investors, the whiplash has been brutal.

But this volatility isn’t new to crypto veterans. This week’s declines follow a flash crash on October 10th that caused professional trading firms to pull back and reduce their exposure.

With fewer big players actively trading, prices now move more dramatically in both directions.

Adding fuel to the fire, the Federal Reserve surprised markets last week by suggesting that another interest rate cut won’t be coming next month.

Earlier stage investment opportunities like cryptocurrency typically do better with lower interest rates.

The combination has been painful for crypto investors.

But beneath the surface of this selloff, something interesting is happening…

Three Reasons To Be Bullish On Crypto

- Wall Street Embraces Bitcoin

Last month, Bloomberg reported that JPMorgan Chase is planning to allow large professional investors to use Bitcoin and Ethereum (ETH) as collateral for loans by year’s end.

This is massive news.

Not long ago, CEO Jamie Dimon called Bitcoin a “hyped-up fraud.” Now his bank is treating it like gold or stocks.

This means large investors can borrow against their crypto instead of selling it when they need cash.

The announcement represents a major vote of confidence for Ethereum.

In order for a bank to be willing to lend against assets, they need to be confident that the price will be reasonably stable.

JPMorgan is not the only bank throwing its weight behind cryptocurrency.

Morgan Stanley plans to allow E*Trade customers access to cryptocurrencies beginning next year.

Other financial firms like State Street, Bank of New York Mellon, and Fidelity are setting up services to securely store cryptocurrency on behalf of customers.

Wall Street firms that once mocked crypto are now lining up to get a piece of the action.

For cryptocurrency investors, this is a major opportunity.

More support from banks means easier access, more competition, better services, and ultimately, more demand.

And JPMorgan isn’t the only name-brand business pushing deeper into crypto…

- Western Union Launches Stablecoins

Last week, Western Union announced plans to launch a stablecoin on the Solana (SOL) blockchain.

Western Union is a global giant in money transfers, moving over $100 billion annually.

When a big company like Western Union starts using crypto, it shows that crypto is real and useful.

Every year, more than $1 Trillion is sent by workers to their families back home in other countries. These transactions are often expensive. It takes days for the money to arrive.

Stablecoins have the potential to make these transactions cheap and nearly instantaneous.

Historically, companies like Western Union have had trouble offering cryptocurrency services..

But that might soon change…

- Congress Gets Serious

Despite the government shutdown, last week, industry leaders met with senior congressional leadership to talk about new rules for crypto.

About a dozen executives, including Coinbase CEO Brian Armstrong, held nearly three hours of meetings with Democratic and Republican senators.

The bill in discussion would allow banks, businesses, and exchanges to provide cryptocurrency services with clear rules on what they can and cannot do. While this might seem obvious, it’s a major missing piece for the industry.

Right now, the laws are not entirely clear, making things risky for banks and businesses.

While the bill is currently stalled in the Senate, it’s expected to pass next year.

When it does, we could see a rally similar to what followed the passage of the stablecoin legislation earlier this year.

Stay Strong Through the Storm

Dramatic swings like we’ve seen this past week are normal for this market.

They’ve happened before, and they’ll happen again.

It’s natural to feel frightened or disappointed when you see your portfolio shrinking.

But investors who can hold tight through temporary downturns are typically rewarded in the long run.

The real story isn’t in the day-to-day price swings.

It’s in the steady march of adoption and support from major banks, global payment networks, and government regulators.

Each of these developments brings us closer to mainstream acceptance.

JP Morgan lending against Ethereum.

Western Union building a stablecoin on Solana.

Congress working through a shutdown to advance crypto legislation.

These aren’t the signs of a dying technology.

They’re the foundations of a financial revolution still in its early chapters.

Historically, buying strong cryptocurrencies like Solana and Ethereum during downturns has been a winning bet.

Of course, you should never invest more than you are willing to lose.

That said, investors properly positioned today stand to make generational wealth as cryptocurrency becomes part of everyday life.

Regards,

James Altucher,

Investment Network Australia

Comments