This year will be a memorable one for all the wrong reasons for Crown Resorts Ltd [ASX:CWN].

The COVID-19 pandemic ravaged the CWN share price.

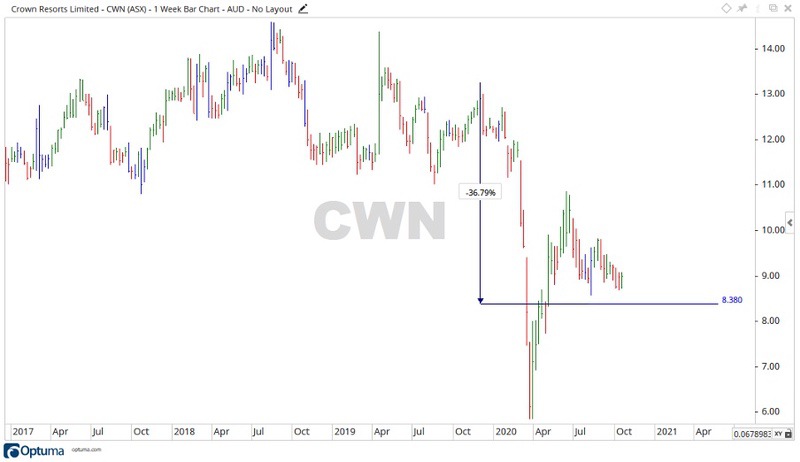

Now with the company trading at $8.38 at the time of writing, down some 36% from November 2019, there is more bad news on the way.

Source: Optuma

What’s happening at Crown Resorts?

In April 2020 the company announced that it had secured $1 billion in debt to help the company endure the forced lockdown, along with standing down 95% — or 11,500 — staff.

From this alone it’s quite easy to see the grim situation the company found itself in this year.

But there’s more.

Recently James Packer appeared before a NSW inquiry into whether his company Crown Resorts is fit to hold a casino licence. Compounding the media frenzy were allegations about Packer’s personal life.

ABC called it an ‘unravelling empire’.

With mentions of threats, abuse, money laundering, Mossad, unlawful operations in China, and more.

With the company already going through a rough year, they have now been informed by AUSTRAC of an investigation.

The notice today said, AUSTRAC:

‘Has identified potential non-compliance by Crown Melbourne Limited (Crown Melbourne) with the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 and the anti-money Laundering and Counter-Terrorism Financing Rules 2007.’

Where to from here for Crown?

Under all the lights, glitz, and glamour of Australia’s biggest casino, lurks quite a lot of trouble.

It’s fair to say right now the company might not have the best public profile and there looks to be a lot of government branches taking a serious look at the practices of Crown Resorts.

All this before the even bigger issue of opening the doors again and the massive task of not only getting people back to work, but convincing people it’s safe to be back in public places like a casino.

Source: Optuma

The price is sitting down around levels not seen since the GFC.

With the headwinds the company is facing on multiple fronts, I would be surprised to see it generate much upward momentum.

Should the price continue to fall back further, then the level of $7.46 may be enough to halt a further decline — which happened to prove a strong level back through 2010–12.

On the upside should the price rise, then the levels of $8.63 and $9.32 may provide future resistance.

A recovery in the CWN share price may take some time it seems.

Regards,

Carl Wittkopp,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks: These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments