In today’s Money Morning…a sign of a looming market meltdown…it’s not punting if the probabilities are in your favour…get the probabilities right and learn to walk away when you’re up…and more…

Editor’s note: In this episode of The Money Morning Podcast, I rank the top 10 cryptos by market cap using two different metrics. The alternatives I propose are ‘usefulness’ and ‘worthy of investment’. I’ll have crypto expert Ryan Dinse on next week to tell me where I’ve gone wrong (and right).

The major news in Melbourne is that Crown’s casino licence may be revoked, pending the outcome of a royal commission.

Amid allegations of a culture that flouted the law, it’s a potentially major blow to the fortunes of billionaire James Packer.

But while Crown faces the wrath of an army of lawyers, what about the Crown Resorts Ltd [ASX:CWN] share price?

It’s actually up around 12% in a 12-month window, despite a rather nasty downtrend developing.

A potential takeover target once the dust settles, owning Crown shares is now its own form of punt on Melbourne’s favourite place to punt.

A punt layer cake of sorts. Or is this simply the market working out the probabilities of certain outcomes? I’ll get to that in a bit.

You see, the reality is that Crown is still up for the year.

And although this doesn’t seem to make sense and may reflect Australia’s deeply ingrained gambling habit — there’s another far large casino out there — the ASX.

The ASX Casino is its own kind of beast, and a quick jaunt onto the pages of Reddit’s ASX_Bets reveals a thriving culture of gambling interspersed with the odd nugget of sound reasoning.

It’s certainly not where I’d go for financial advice — but it goes to show you how much disdain younger investor types have for the stodgy world of suited-up financial advice where fees are the name of the game.

Advice be damned, I just want to see big green numbers, they say.

Can you blame them? These are generally young people who can recoup big losses through earnings.

It feeds through to the moves the big funds make too.

In both the US and to a lesser degree Australia, you’ve got a combination of algorithmic trading, a horde of retail investors cashed up with stimulus cheques, and trading platforms like Robinhood that on-sell top traders’ data to hedge funds flush with central bank liquidity.

It may look to be a sign of a looming market meltdown.

And yet…

After yesterday’s market pullback or carnage, the bullish ‘don’t panic’ side won out again. For now.

As per the Australian Financial Review before the market opened today:

‘ASX futures were up 49 points or 0.7 per cent to 7210 near 7am AEST. The currency however extended its losses, slipping 0.2 per cent.

‘The yield on the US 10-year note edged 3 basis points higher to 1.22 per cent near 5pm in New York; it initially fell to 1.13 per cent.

‘On Wall Street, the Dow was up 550 points or 1.6 per cent at the close, recouping most of the 726 points it lost the previous day.

‘The S&P 500 rallied 1.5 per cent, with industrials and financials pacing 10 of the 11 industry groups higher. The Nasdaq gained 1.6 per cent.’

Which brings me to an important point about small-caps and expected value that many suit-types and bears don’t want to acknowledge.

It’s not punting if the probabilities are in your favour

Horse racing analogies don’t quite line up with what happens in the ASX Casino, but a lot of your success on the market comes down to expected value.

I’ll be brief, but the notion from statistics is important.

This is a quick summary:

‘The expected value (EV) is an anticipated value for an investment at some point in the future. In statistics and probability analysis, the expected value is calculated by multiplying each of the possible outcomes by the likelihood each outcome will occur and then summing all of those values. By calculating expected values, investors can choose the scenario most likely to give the desired outcome.’

And this is the equation:

|

|

Looks like scary maths, but it’s not.

The point is that many investors aim to be ‘right’ as often as possible instead of generating a return.

The mantra is that, if you can be ‘right’ six out of 10 times, as in be in the green, you’ve cracked the code.

That’s god-like investing.

But what if I told you, you could be right just four times? What about two or three times?

Hypothetically, if the wins are big enough, you don’t need to worry about a number of small losses.

And herein lies the problem with both the ASX_Bets crowd and the big funds/old advice types.

It all comes down to probability. While the big funds make frequent perceived low-risk bets with large sums, the forum types prefer to make infrequent perceived high-risk bets with small sums.

There’s a feedback loop between the two, which is potentially dangerous given various order flow shenanigans.

This isn’t a bear case study, though, and here’s how you can get one up on the house…

Get the probabilities right and learn to walk away when you’re up

Getting the probabilities right is easier when you have a handle on a likely future.

Sure, markets can mean-revert or return to a baseline, stretched valuations (Tobin’s Q, Schiller’s ratio, Buffett’s market-cap-to-GDP) — all of these are great for understanding index movements over extended periods of time.

And small-caps are not divorced from index moves.

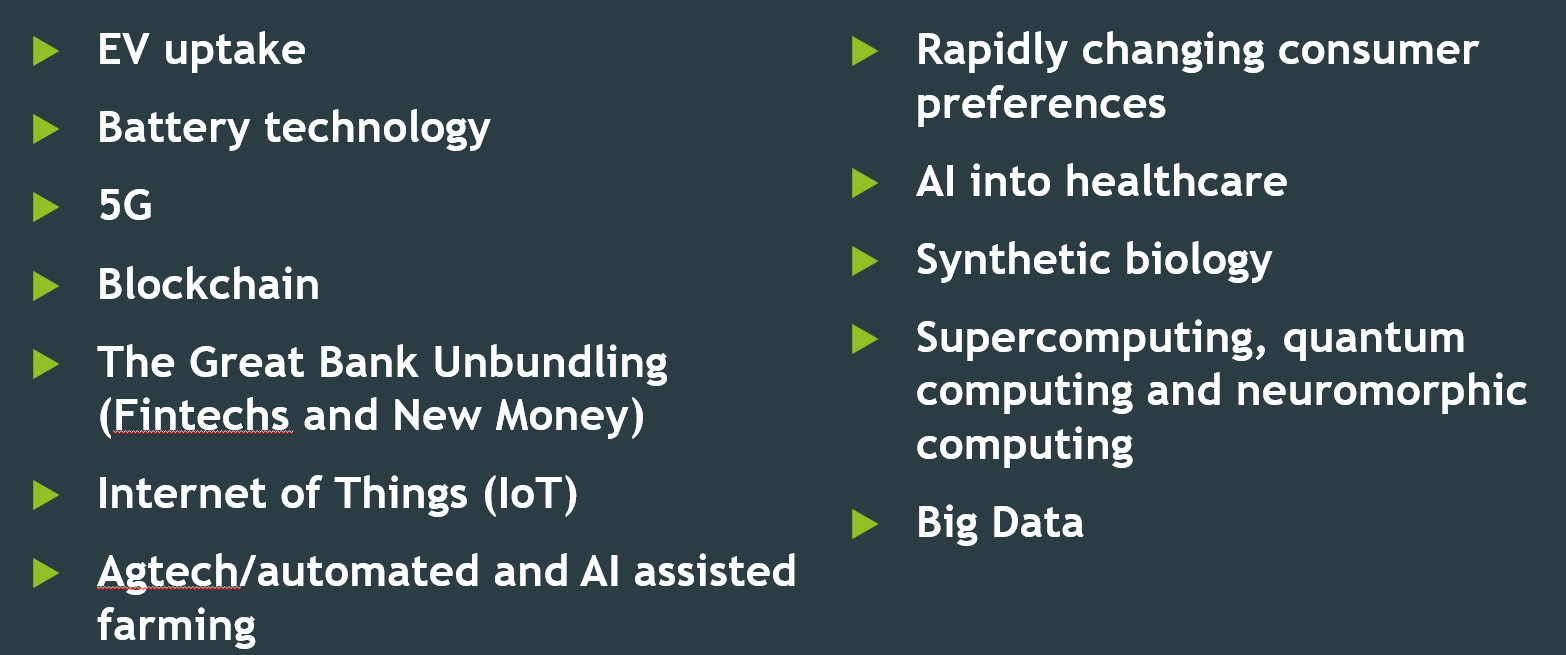

But here’s what we do know about a likely future, to name a few (drawn from a recent internal presentation):

|

|

| Source: Lachlann Tierney |

Find companies that have the right exposure to this likely future, and you can get the probabilities working in your favour.

Maybe anything but bonds and cash is still gambling. But it’s a cheap point.

I’d say these asset classes have their own hidden risks, particularly in light of changing concepts of money, technology, and modern monetary theory (MMT — code for print ‘til you drop).

So when you’re in the ASX Casino, it’s about getting the probabilities working in your favour and learning when to walk away when you’re up.

Do meticulous research, vet companies from multiple angles, and remember how they align with a likely future.

Or if you can’t be bothered with all that work, let us do the hard yards for you.

Then it’s more of a market than a casino.

So maybe Crown goes under, maybe its licence gets revoked, maybe it gets bought out. Who knows?

But always know there’s a strategy for seeking out better opportunities than Crown punts.

And if you’re scared of the ‘mega-crash’ there’s also something called a stop-loss if you don’t have time to constantly check the market.

Happy punting. Better yet, good investing.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.