At time of writing, the share price of Credit Intelligence Ltd [ASX:CI1] is down more than 12%, trading at 6.8 cents.

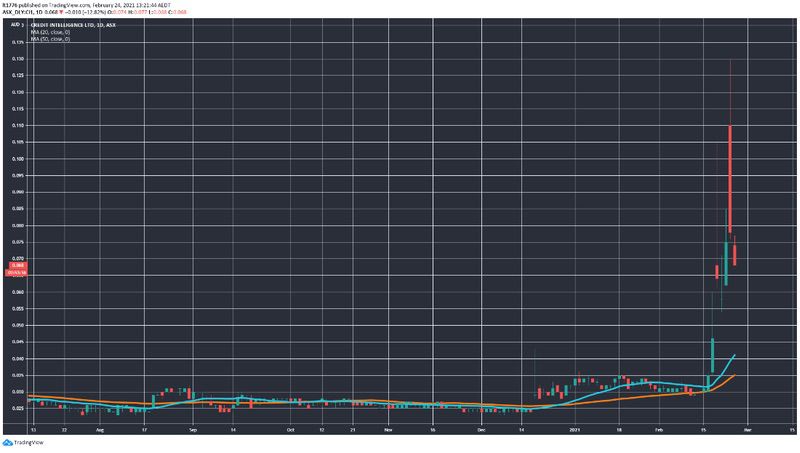

You can see a mammoth spike in the CI1 share price in the chart below which tells a familiar BNPL story:

Source: Tradingview.com

We take a look at the announcement that triggered Credit Intelligence’s massive move and the subsequent financial report. We also look at the outlook for the CI1 share price.

Highlights from launch of CI1’s BNPL product

Here are the highlights from the announcement that triggered that big spike (in the company’s own words):

- ‘CI1’s unique BNPL service launched for the SME market leveraging the AI engine developed in collaboration with UTS Sydney offering borrowers a range of proprietary features has commenced lending activities to SMEs

- YOZO Pay BNPL provides SME borrowers a line of credit facility with more flexible repayment frequency options where costs are only occurred on facility drawdowns

- Through the AI engine YOZO Pay BNPL offers same day loan approvals and automatic borrower limit changes based on repayment histories with minimal human interaction required in the process

- YOZO Pay finance is provided on business revenues without the need for property collateral’

And the highlights from the half yearly below:

‘• Profit for the half-year increased by 42% over previous half year

- Profit for the half-year attributable to members of the parent entity increased by 25% over previous half year

- Revenue increased by 21% over previous half year’

What to make of all this?

Here’s my take.

Outlook for CI1 share price

If you look at the most recent half yearly this company is actually profitable, and its revenue and profit are both up by around 20–25%.

Not bad by BNPL standards, so perhaps the hype is somewhat justified.

That being said, I am still of the view that we may be reaching a saturated market on the ASX with so many new entrants to the BNPL space.

Which in turn may play into regulatory risk, in addition to competition risk.

As with many small-cap breakouts, today’s retracement is not surprising either.

From here, some sideways trading may play out while investors wait for more news from the company.

You can catch an extended breakdown of CI1’s prospects in the video below:

You can also catch our special fintechs report right here — all the companies profiled are still quite small with some serious growth potential.

Regards,

Lachlann Tierney,

For Money Morning

Comments