Large debt collector Credit Corp Group [ASX:CCP] saw its shares plummet on Tuesday after flagging a weak outlook.

CCP shares were down 10% in late Tuesday trade and down 35% year-to-date.

Source: www.tradingview.com

Credit Corp’s FY22

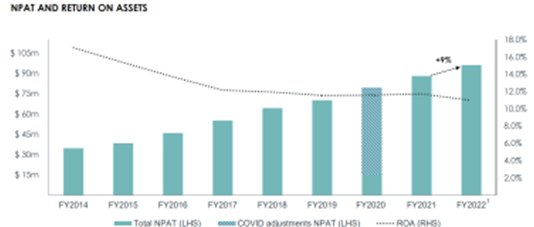

Credit Corp reported a 9% increase in net profit tax (NPAT) to $96.2 million, while annual investments were boosted by a US purchased debt ledger (PDL) of 80% on FY20.

According to Credit Corp, this was due to substantial improvements in ‘charge-off volume’.

CCP’s return on assets improved in FY22, as evidenced by the chart below:

Source: CCP

Credit Corp CEO Thomas Beregi commented on the results:

‘Market volumes have stepped up in recent months and further increases are expected during FY2023. As resource constraints are addressed, this segment will support consistent annual investment of more than A$200 million and be capable of producing medium-term earnings similar to those of the AUS/NZ operation.’

Credit Corp is also looking at expanding into buy now, pay later (BNPL) options and lending in the US. Initial trials (pilots) having begun, with more developments expected in FY23.

Soure: CCP

CCP guidance and outlook

Due to unfavourable patterns in the year, Credit Corp said it doesn’t expect much of a recovery for Australia and NZ, and said that its US constraints aren’t likely to improve right now:

‘In FY2023 growth in US segment earnings is not expected to offset the impact of run-off in the AUS/NZ debt buying business. While FY2023 has started with a solid investment pipeline, regular investment is expected to moderate from the record levels achieved in FY2022. This should release substantial free cash flow, positioning the Company to secure any sizeable one-off purchasing opportunities that may arise in an uncertain economic environment.’

Source: CCP

How to survive the bear market?

ASX stocks have had a tough time of it this year. With inflation still elevated, markets everywhere are set to see further interest rate hikes as central banks fight to tamp down inflation.

Stocks may fall further from here.

So — should you stick with cash or buy the dip?

These are common questions in today’s market.

And if you’re looking for answers, I recommend reading the latest ‘Bear Market Survival Guide’ from our very own editorial director, Greg Canavan.

As Greg notes in his report:

‘What you decide to do in the next few weeks will determine the success of your portfolio in the next few years.’

If you’re feeling lost in the current market and are wondering how to protect your portfolio, click here to access Greg’s latest report ‘Your Bear Market Survival Guide’.

Regards,

Kiryll Prakapenka