Australia’s largest debt buyer and collector Credit Corp Group [ASX:CCP] had a rough start to the month, with shares down by 13.60%, trading at $20.39 per share.

Despite reporting some positive signs of growth, the FY23 financial report has raised eyebrows and captured the attention of investors concerned about its growth prospects.

Trading this morning has wiped out all the company’s gains seen this past 12 months with the share price now down by 15.67%.

This is a stunning reversal for CCP, which was the most overbought stock early last week after reaffirming it would meet expectations of its net profit guidance of $90–96 million.

What are the final numbers, and what does this mean for the company moving forward?

Source: TradingView

Credit Corp’s day in the red

CCP released its FY23 results today, showing a mixed bag of results that scared investors who pushed the sell button today.

Here are the highlights of the release:

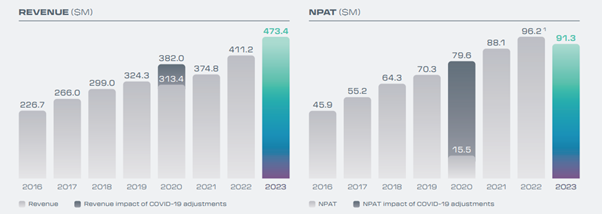

- Net Profit After Tax (NPAT) fell by 5% to $91.3 million

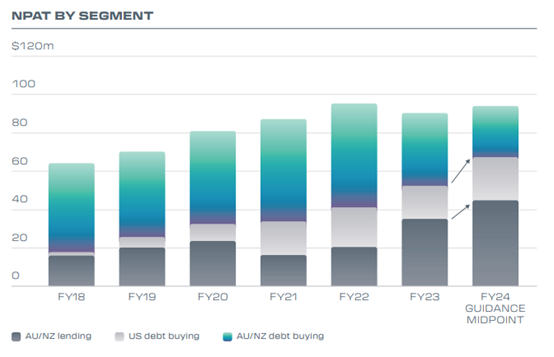

- 70% growth in lending segment NPAT

- 43% growth in consumer loan book to record $358 million

- 29% decrease in AU/NZ debt buying

- Rise in payment delinquency in all markets

One of the standout performers for the company was its lending segment which experienced a 70% growth in Net Profit After Tax.

This was mainly through AU/NZ lending, which has seen increased demand from lower-income consumers who have re-leveraged after the pandemic.

These groups raised the consumer loan book by 43%, reaching an all-time high of $358 million in gross closing balance.

However, amidst these accomplishments, there was a less optimistic aspect of the report.

The overall NPAT for the company was down by 5% compared to the previous year, settling at $91.3 million.

Source: CCP

This decline in profitability was attributed to lower sales and the ongoing run-off in Credit Corp’s AU/NZ debt-buying as Interest-bearing credit card balances remain approximately 40% below pre-COVID levels.

The company also faced additional costs from resourcing efforts in the US to revamp its sluggish revenue growth there.

After a flat first half of the year, the company eventually saw a 14% growth in collections in the US, but this was offset by rising delinquency rates that added to the financial strain.

Credit Corp’s CEO Thomas Beregi remained upbeat about the future, saying:

‘Despite the core business facing headwinds arising from reduced purchased debt ledger (PDL) supply, it has remained critical that we continue to invest in developing our advantage.

‘The outlook for the US debt purchasing and Australian consumer lending segments is for a year of solid profit growth. We invested heavily in the US in 2023 and have worked hard to grow and improve our operations.‘

Initial expectations for FY24 NPAT are for growth of 4% at the mid-point of the $90–$100 million range.

Outlook for Credit Corp

The small display of vulnerability from CCP has come at an interesting time, resulting in a clash between bullish and bearish attitudes within the overall market.

Today’s share trading has seen large swings, showing some very different calculations in the underlying growth prospects.

Considering the mixed results, investors should closely watch Credit Corp’s strategic response to ensure that it can find profitability — especially in the US.

The company’s management acknowledged the challenges faced in the market and promised increased automation and Australian overnight shifts to bolster the US team.

They also promised a cautious approach to lending, with tightening of credit requirements and reduced loan size and duration to riskier cohorts.

The record starting loan book should produce strong lending segment earnings growth in 2024. With a higher headcount and increased automation, the US market should deliver improved collections growth also.

However, investors are obviously concerned about the sluggish debt buying as consumers keep their credit cards in their wallets and pay down loans in uncertain times.

Source: CCP

Investors should closely monitor future delinquency rates and credit buying to gauge Credit Corp’s resilience and growth prospects.

Credit Corp announced a final dividend of 47 cents per share, providing some consolation to investors who may have been disappointed with the financial performance.

Credit Corp’s results present a tale of two halves. The growth in the lending segment and the record-breaking consumer loan book were highlights, but the decline in NPAT and the challenges in the AU/NZ market and US expansion efforts raised concerns.

Other opportunities in the market

Strap in as the share price of CCP continues to swing today.

If the hope of a recovery of the share price excites you, then you might be joining the turnaround.

What’s the turnaround? It’s a dramatic shift in sentiment we are seeing throughout the markets.

Everyone is watching Wall Street climb higher and higher and hoping the ASX will be next.

But no one is watching WINDOW 24 — which will open soon.

What’s WINDOW 24? According to Fat Tail Investment Research’s best-performing trader of the last five years, recognising this turning point for what it is — and making a couple of trades now — could potentially be the most defining moment in your 2020s investing.

Too good to be true?

See for yourself in our free company-wide online event.

Click here to find out how to join us for our biggest call of the year.

Regards,

Charles Ormond,

For Money Morning