Today we take a look at a newcomer, Credit Clear Ltd [ASX:CCR].

The Australian-based fintech company is experiencing an explosive start to life on the All Ords [ASX:XAO].

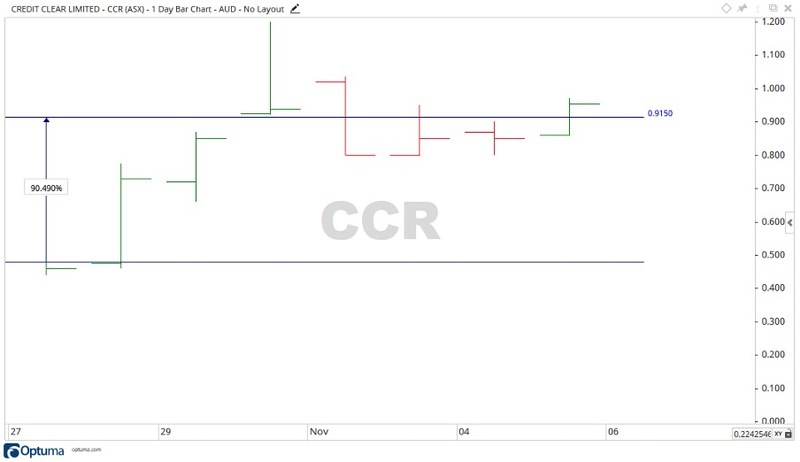

Being listed at the end of October (this year) at 44 cents, the CCR share price jumped over 90% to trade at 91 cents at the time of writing.

Source: Optuma

What’s happening at Credit Clear?

The company bills itself as, ‘a global solution, facilitating payments in any currency whilst automatically translating messages into your customers mobile phones default language.’

Running on the back of SMS communications, the system allows users to set up payment arrangements for things like household bills.

A bit of a different way to go about things and made to tackle the boring payments in life.

Being founded in 2015, the company experienced rapid growth and now acts for over 800 Australian and New Zealand clients across multiple sectors.

This translates into managing 250,000 active customers.

The month of September 2020 was the biggest in terms of electronic communications sent, with over 2.6 million being communicated to customers.

With so many people using their phones to conduct their financial business nowadays, engagement is strong for the company.

Where to from here for Credit Clear?

The chart history is limited as CCR has only been listed for less than a month. On the surface the company’s business model looks promising.

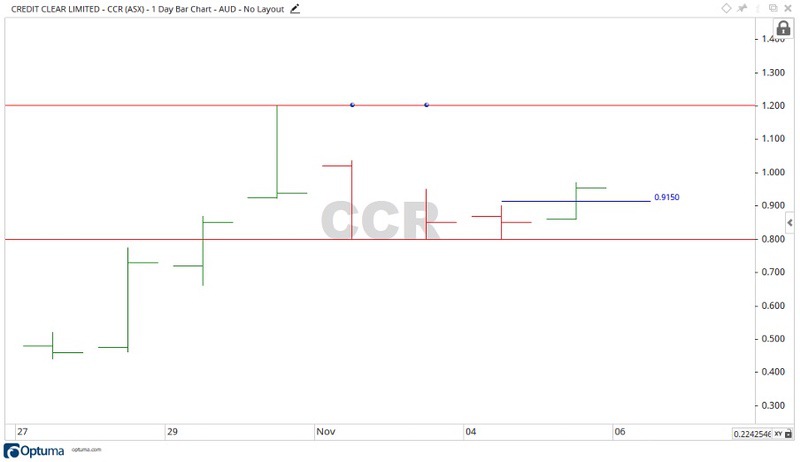

Source: Optuma

Being so new to the All Ords there isn’t much to go off. With the most recent high being $1.20 and the recent low being 79 cents, breaking through either level in the short term would give a bullish or bearish signal.

The company is looking to scale up to international markets and also have an end-to-end solution to deal with accounts that may fall into arrears through their law firm Oakbridge Lawyers.

With mobile payments only growing in popularity, Credit Clear may be one to put on a watchlist and keep an eye on.

And if you are looking for more exciting fintechs…click here to discover three innovative Aussie fintech stocks with exciting growth potential.

Regards,

Carl Wittkopp,

For Money Morning

Comments