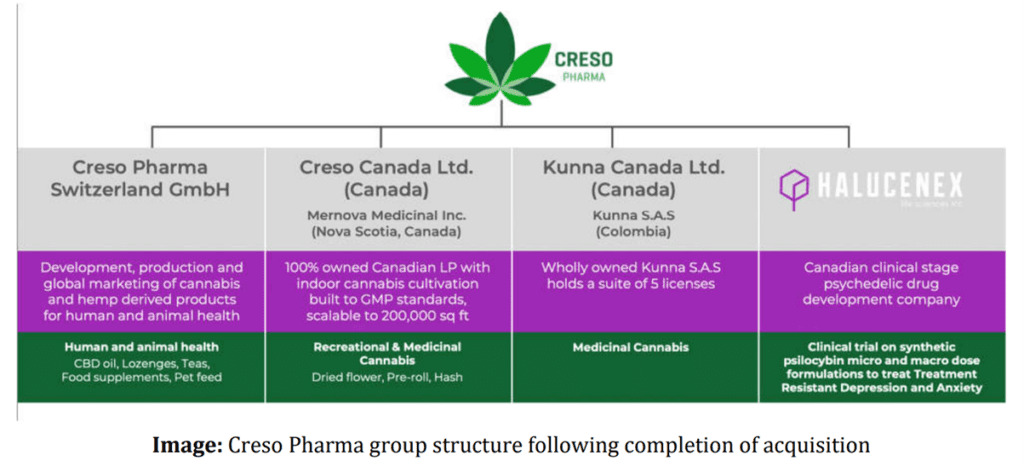

The Creso Pharma Ltd [ASX:CPH] share price jumped 8% after completing the acquisition of Canadian psychedelics company Halucenex Life Sciences.

Creso says the acquisition gains access to a global market for psychedelic medicines worth an estimated US$100 billion.

CPH shares were up as much as 11.5% in early trade on the news. Pulling back somewhat in midday trade, the pot stock was still up 8% at time of writing.

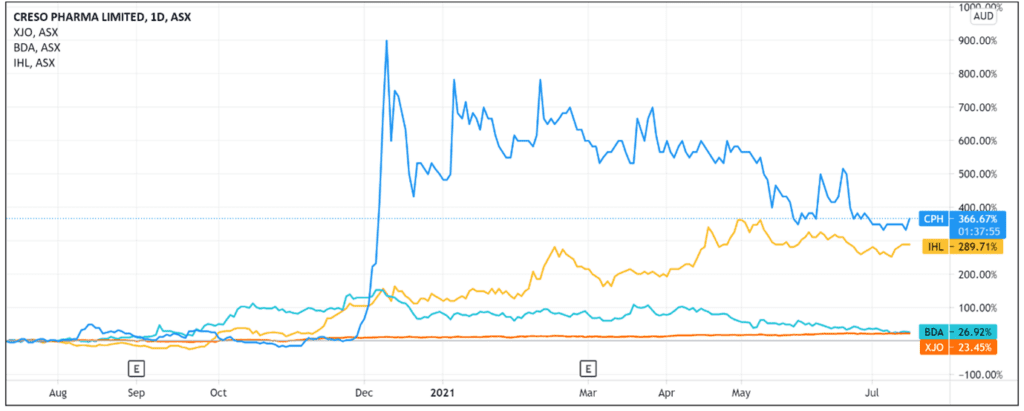

Today’s gains contrast with Creso’s recent share price performance, having dropped 20% since the start of 2021.

Despite a sluggish year so far, CPH shares are still up 350% over the last 12 months.

Target acquired

Target acquisition no more.

After weeks of prefacing Halucenex updates with ‘target acquisition company’, Creso finally obtained its target.

In Creso’s view, the completion of this much-discussed transaction marks an ‘important milestone’, as it grants CPH access to the psychedelic-assisted psychotherapy sector and unlocks a ‘number of opportunities for the company in the near term.’

Halucenex Founder and CEO Bill Fleming thought that with Creso acquiring his firm, ‘we will be able to expedite our clinical trial and potential product development strategies which will unlock significant value for shareholders.’

CPH Share Price ASX outlook

When analysing pot stocks, it is informative to look at the performance of the wider industry.

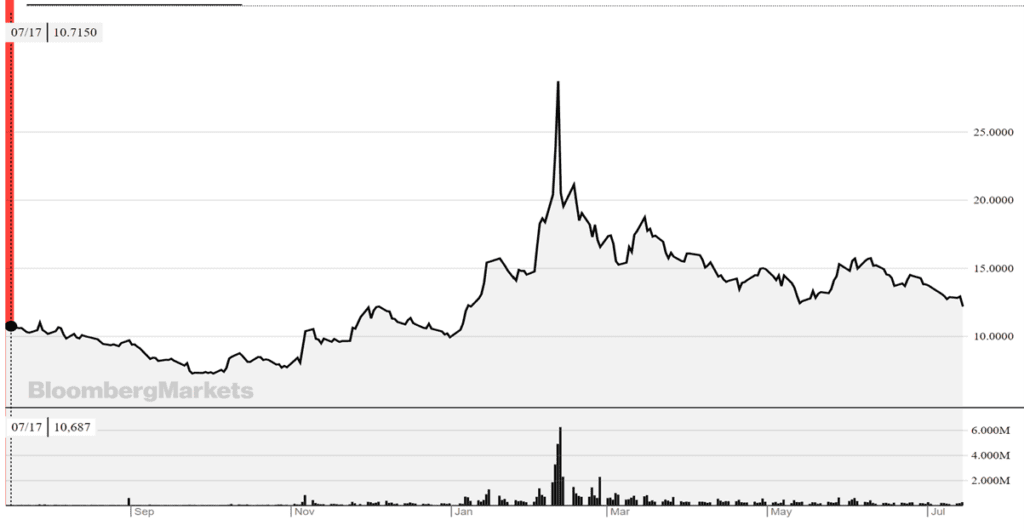

For instance, the Global X Cannabis ETF (POTX) is one of the largest cannabis-themed ETFs on the market.

It is also exposed to the global cannabis industry, seeking to invest in companies worldwide and across the supply chain.

The ETF is currently trading down 55% from its 52-week high, although it is up 20% year-to-date.

POTX trading down from its 52-week peak echoes Creso’s situation, with CPH itself currently down more than 60% from its 52-week high.

This could be partly explained by the inevitable retracing that followed a vertical spike last December.

CPH shares went from 5 cents on 1 December 2020 to more than 30 cents a mere fortnight or so later.

Not often can such frenzy be sustained, and Creso’s negative performance year-to-date may result from last year’s optimism cooling off.

That said, today’s healthy spike suggests investors are feeling positive about Creso finally completing the long-awaited acquisition.

Bullish investors may argue that with Halucenex having a strong presence in Canada — a solid cannabis market — Halucenex’s acquisition will offer commercially beneficial synergies.

Creso itself said today it would now leverage the expertise of Halucenex to ‘expedite product development initiatives, ongoing R&D and potential market entries.’

Pot stocks can be volatile, but the wider cannabis and psychedelic trend is one worth following.

If you’re looking for more insights into the sector and pot stocks in particular, then check out our latest free report, which discusses three pot stocks worth looking at right now.

Get your free copy here.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here