In today’s Money Morning…the hardest of money…the sad truth? Musk has his snout firmly in the fiat trough…context is everything…and more…

I’ve been in bitcoin since late 2013 and over that eight-year time period I’ve seen every kind of attack come and go.

‘China controls it.’

‘Governments will ban it.’

‘Quantum computers will destroy it.’

‘It has no intrinsic value.’

‘It’s too slow and expensive.’

And many more besides…

In the crypto world, we refer to these arguments as FUD.

It stands for ‘fear, uncertainty and doubt’, and it is used to try and keep ordinary people away from bitcoin.

Each time a new piece of FUD takes hold, the mainstream media jumps on it to say this is the end of bitcoin.

In fact, bitcoin has been declared ‘dead’ over 400-plus times since 2010 as this site here tracks.

But bitcoin is very much alive and it will be for a long time to come.

In fact, countertrading the FUD has been the best trade of the decade…

The hardest of money

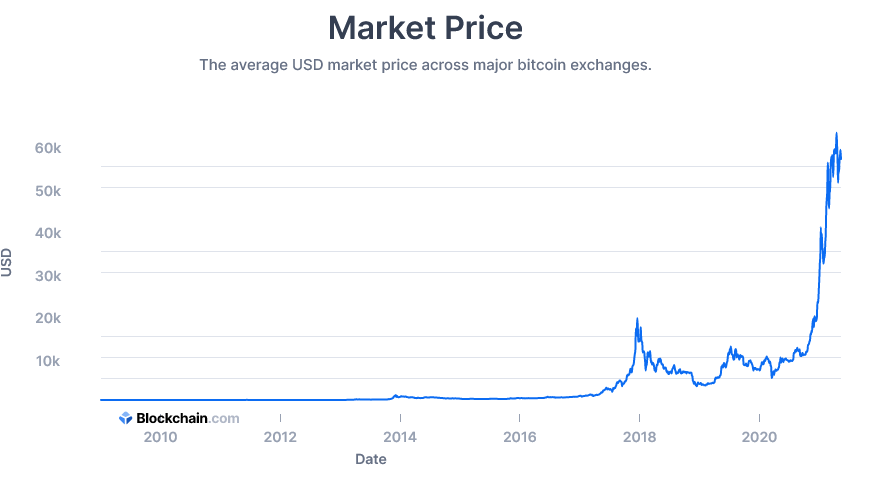

There’s no doubt FUD attacks hurt the Bitcoin [BTC] price in the short term.

The BTC price is notoriously volatile and it’s hard for the average investor to make good decisions in the heat of the moment.

Many buy in when it shoots higher, and sell when it plummets lower.

And yet, if you zoom out a bit, you can see that bitcoin always comes out more resilient:

|

|

| Source: Blockchain.com |

Over time, you can see how the last cycle’s ‘boom and bust’ ends up as a mere blip.

I personally had to endure a two-year bear market between 2014 and 2016 with an 80%-plus fall in BTC’s value before seeing any gains on my initial stake.

You can hardly see that ‘scary time’ on the chart now!

The fact is, despite the odds being heavily stacked against it — an entire system of grifters, middlemen and leaners who are gaming the system of money in their favour — bitcoin is now a serious alternative.

And in turn, a threat to the fiat gravy train.

Which brings me to the latest round of FUD…

The sad truth? Musk has his snout firmly in the fiat trough

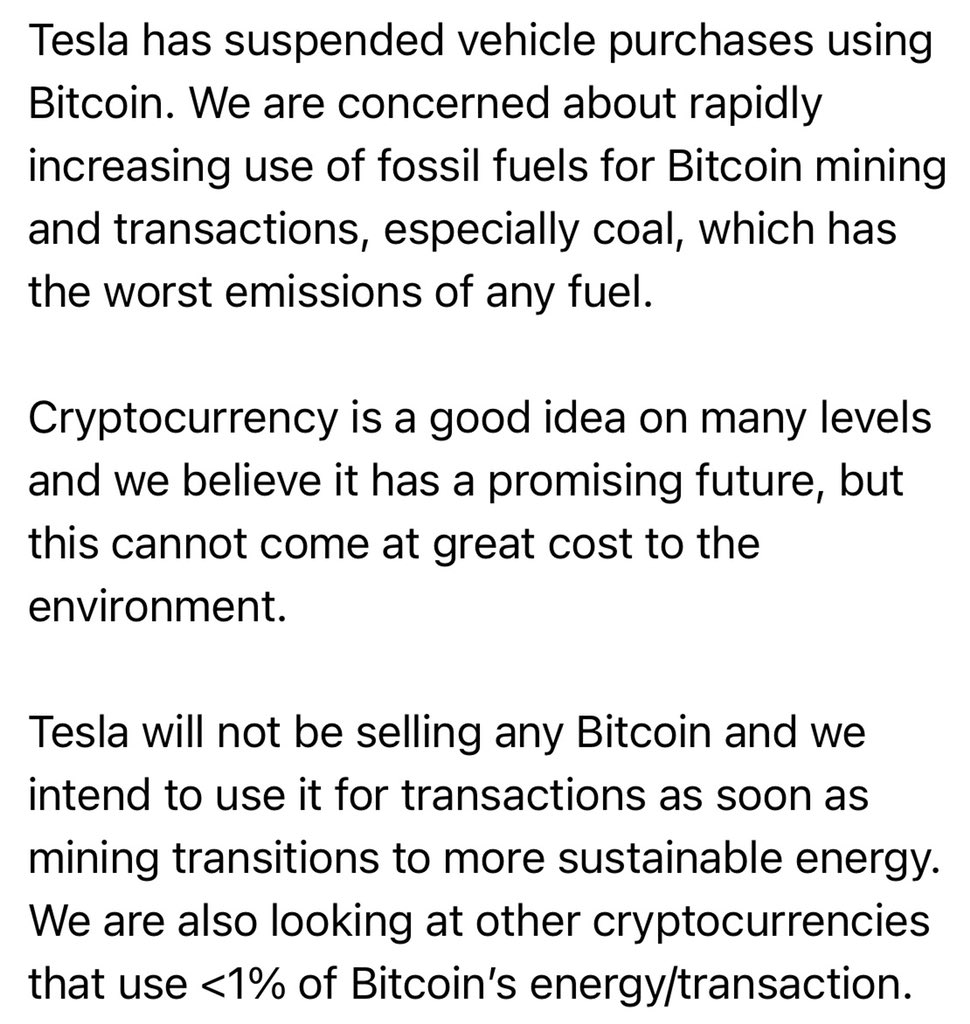

Tesla Founder Elon Musk made a big song and dance about investing in bitcoin earlier this year. Even saying you could now buy a Tesla with bitcoin.

But he shocked crypto markets last week by reversing this position, declaring:

|

|

| Source: Twitter @ElonMusk |

Are we really to believe Elon Musk invested almost US$2 billion into bitcoin without understanding the Proof of Work (POW) system that is the lynchpin that secures the network?

The only possible answers here are:

- He’s incredibly incompetent

- He’s being completely disingenuous

I’m opting for option two and this is why:

You see, just the day before the Musk backflip, it was reported on Reuters that Tesla was trying to get approved for a new US government renewable fuel credit scheme.

They wrote:

‘Tesla Inc (TSLA.O) is seeking to enter the multi-billion-dollar U.S. renewable credit market, hoping to profit from the Biden administration’s march toward new zero-emission goals, two sources familiar with the matter said.

‘The electric car maker is one of at least eight companies with a pending application at the Environmental Protection Agency tied to power generation and renewable credits, the sources said. The EPA produces a list of pending applications with some details, but not companies’ names.’

Some deeper digging revealed that Tesla was pretty desperate to get accepted into the new scheme after an old scheme that mandated petrol powered car companies like Chrysler buying Renewable Energy Credits (REC’s) from Tesla was likely coming to an end.

Tesla made US$1.58 billion selling these REC’s last year. A lot more than it made from selling cars!

And even when it comes to CO2 emissions, the hypocrisy of Musk is staggering.

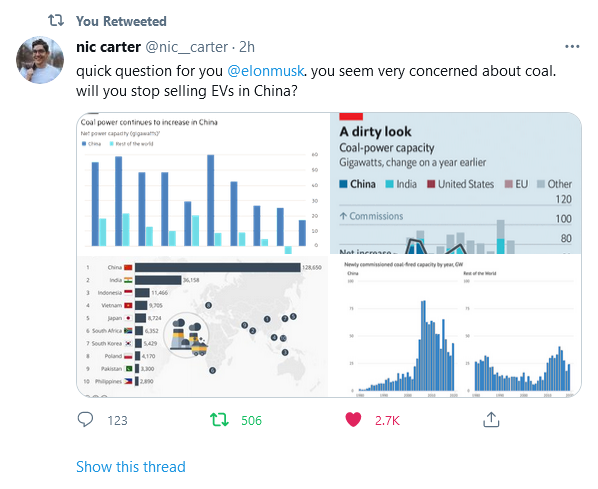

As Coin Metrics founder Nic Carter noted in a tweet:

|

|

| Source: Twitter @nic_carter |

Of course, Musk has no problem selling Tesla’s to coal hungry China.

Anyway, in my opinion, Musk’s change of heart is purely driven by self-interest. An attempt to get his hands on the gravy train of free government dollars.

It’s sad really…

But that seems to be the way of things right now for an awful lot of companies. The begging bowl comes out every time they are in trouble.

So much for free markets and capitalism, eh?

But let me finish off with the central point behind the FUD.

Is bitcoin bad for the environment?

Context is everything

Yes, the process of securing the bitcoin network relies on electricity.

But that in itself doesn’t make it bad for the environment.

The people that say this are usually the ones who don’t see any point in bitcoin at all. In their minds, any amount of CO2 emissions spent on BTC is therefore ‘bad’!

If you think the fiat system of money is working well, if you think centralised control of money where government money printing dictates winner and losers, if business becomes a game of how close you are to the fiat-laying golden goose…then fine, BTC has no value.

But if you think a decentralised system of money, free from government control, a system that allows open and permissionless transactions in a free market, is a noble cause; then bitcoin is the best chance of that we have.

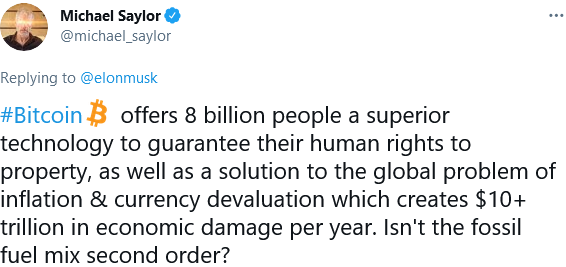

Or as MicroStrategy founder Michael Saylor put it:

|

|

| Source: Twitter @michael_saylor |

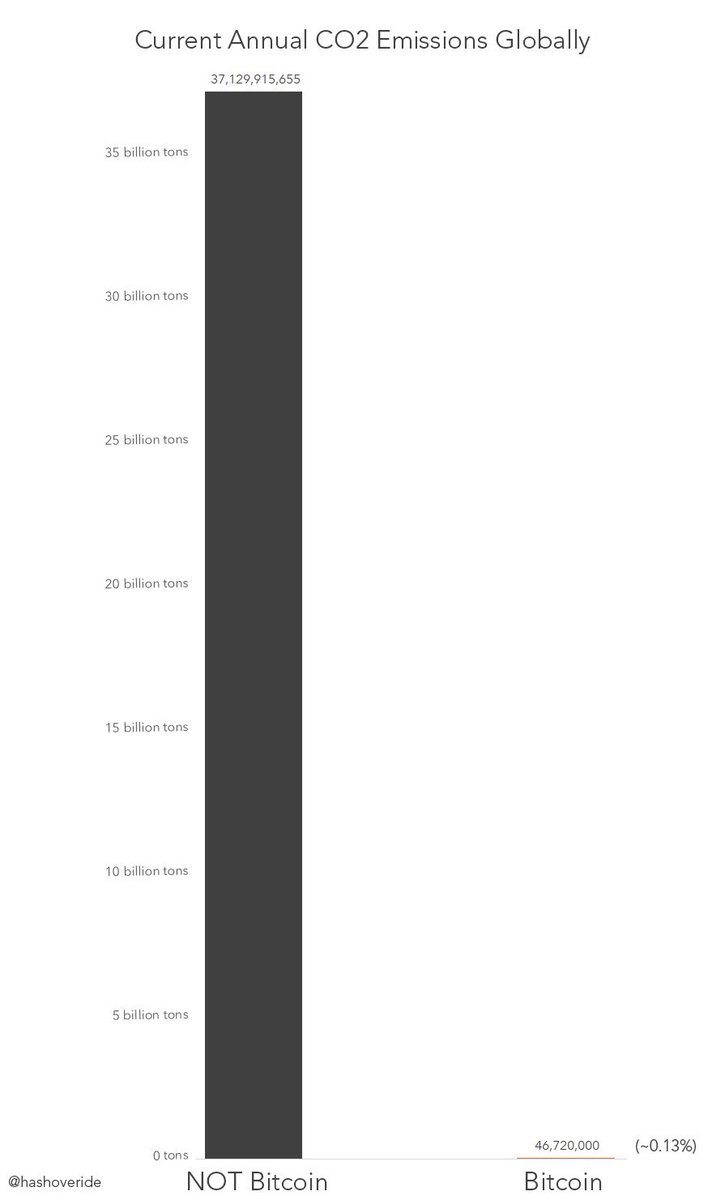

But let’s put bitcoin’s energy use in context too.

Check out this chart:

|

|

| Source: Hashoverdive |

More electricity is actually used on clothes dryers in our homes than on bitcoin. Ban the dryers!

Then there’s the fact that an awful lot of energy used in the BTC mining process comes from renewables.

You can never know this for sure, but some studies have suggested bitcoin mining uses close to 75% renewable energy.

And this figure is only likely to increase.

You see, the process of bitcoin mining actually lends itself to harnessing the power of renewables in remote locations that wouldn’t otherwise be economic.

Think Iceland, Siberia, or even the Aussie outback.

As Tillman Korb, head of Genesis Mining, a bitcoin mining company, told EuroNews:

‘Cryptocurrency mining can also help electricity grids operate more efficiently and increase their use of renewables, Korb adds.

‘He believes that renewables are the natural future for cryptocurrencies. As Bitcoin’s value increases and the rewards for mining it decrease (a feature that is built into the cryptocurrency as more coins are “discovered”) electricity costs have to go down.

‘“There is more pressure on the cost side, for the miners and for that reason, only renewables can be the power source,” Korb says.

‘“If you just look at the incentives, it doesn’t make too much sense to use coal.”’

Then there’s this knock-out blow…

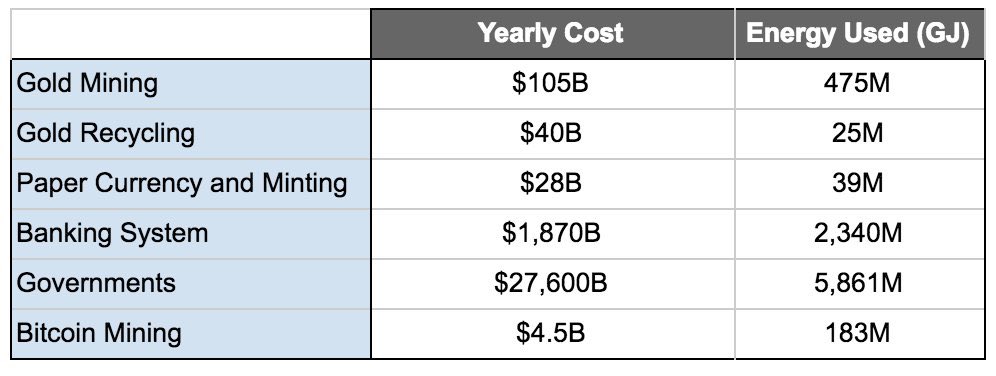

Let’s compare bitcoin to competing monetary systems too, shall we?

|

|

| Source: Twitter @danheld |

As it stands, bitcoin consumes less energy than gold mining (with a lot less environmental and political consequences) and far less than the current banking system with its army of ticket clipping middlemen.

Look, I’m certainly not saying bitcoin is a green solution.

But what I can confidently say is the people spreading FUD around about it, don’t have the first clue about how any of this works.

That’s how FUD works.

It’s an emotional argument designed to manipulate.

And as I explained at the start, historically, listening to such misinformed (and I’d argue manipulative) FUD has been a very bad move for investors.

Bitcoin’s transparent system makes it an easy target for simplified arguments, that don’t stand up to scrutiny.

If you actually want to look at some further facts on the ‘green’ matter, this page here is a great place to start.

Some of this is complex, some of this is transitory, and some of it is real issues to be fixed as bitcoin evolves.

There’s nuance to all this.

But just remember the promise of Bitcoin: To remove the power of centralised power over money.

If you don’t get the importance of that first, then none of this will ever matter to you…

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Bitcoin vs Gold — Expert reveals how these assets stack up against each other as investments in 2021. Click here to learn more.

Comments