Australia’s economy has always a been a simple yet resilient one.

We’re a commodity exporter.

It’s what we have a competitive advantage in. And it’s the starting point for the creation of wealth in our society.

It’s as basic as that…

The wealth generated from this sector trickles down through jobs, tax revenues, superannuation, and property — to the rest of us.

But if my colleague Greg Canavan is right, this process is in danger of an imminent collapse.

You need to read his special report here to understand why. And if you think he’s right, you’ll have some big investing decisions to make.

Anyway, give it a read and make your own mind up…

But in my piece today, I’ll give you a glimpse of what this potential turning point could mean for property prices.

I warn you upfront, it’s not pretty…

Is Lithium Ready for a New Bull Run in 2020? Free report reveals three stocks that could make serious gains. Download your report now.

From the sheep’s back to the Chinese smelters

Back in the early days of settlement, it was another commodity, wool, that was the starting point for Australia’s wealth.

Though the motherland also preferred the ‘colonial’ wines of the Barossa Valley over ‘foreign’ French plonk. And we had our gold rushes too.

So, it wasn’t only wool we exported.

But wool was the proverbial money spinner.

We famously rode the sheep’s back to prosperity for almost an entire century. All the way from the 1870s through to the 1960s.

But then the rise of cheaper synthetic materials put an end to it.

Vested interests tried to keep the game going as long as they could, of course. And a protectionist policy of a ‘reserve’ wool price was put in place by politicians eager to please them.

Eventually though, the industry succumbed to its fate.

As Radio National reported:

‘But the Australian wool industry had some exceptionally determined advocates in the ranks of government and agri-politics who forced through a protectionist scheme in 1972.

‘The Australian wool reserve price scheme remained in place until February 1991 when it was buried under a stockpile of wool so massive, it threatened to overwhelm the entire Australian economy.’

At the time, the Australian Wool Corporation (AWC) collapsed in one of the biggest company failures in Australian history. Farmers and wool-related businesses went broke too.

And they almost brought the Australian economy with them.

We went through some tough times in the ’90s, with Prime Minister Paul Keating warning we were in danger of becoming a ‘banana republic’.

But then in the early 2000s, a new commodity boom erupted in China. And once again Australia’s natural advantages sprung to the fore.

Not wool this time, but metal, coal, and the raw materials needed to drag the world’s most populace country from poverty to the modern age.

Iron ore — and commodities in general — became the new wool, so to speak.

It’s no secret that China has been the source of our wealth for the past two decades.

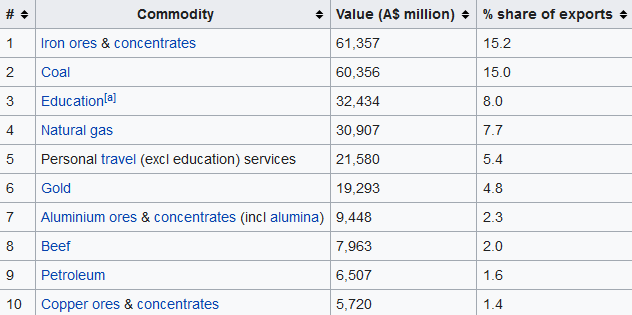

You only have to look at our top 10 exports to see the ongoing wealth we generate from China’s rise:

|

|

| Source: DFAT |

Things haven’t changed all that much since the late 1800s.

We’re still a commodity exporting nation. But the difference this time is that we are almost completely reliant on one trading partner.

A whopping 38% of our exports go to China. And as you can see, even the non-commodities in that top 10, education and travel, have heavy ties to China!

Which leaves us in a bit of a pickle right now…

The reverse wealth effect

As my colleagues Ryan Clarkson-Ledward and Lachlann Tierney wrote about last week, the ongoing US–China trade war is bad news for Australia.

That’s obvious enough so I don’t want to regurgitate that.

But what might be less obvious is the knock-on effect it could have on Aussie house prices.

The current government has pegged their fortune to protecting the wealth of property owners.

It was an election winner for them, no doubt.

And at the time, they were probably confident that they’d have the financial muscle to live up to it.

Government debt was low and commodity tax revenue was high.

Remember, iron ore royalties generate immense revenue for the government’s coffers — BHP paid US$9.1 billion alone in 2019.

But everything has just turned on its head…

The government splurge on JobKeeper and JobSeeker has changed the budget position significantly.

Just last week, the government revealed a record $86 billion budget deficit. This time last year, they thought they’d have a $5 billion surplus.

In short, they’ve now a lot less room to support house prices than they thought they had before. And with interest rates near to zero already, there’s little room left there either.

Which brings us to the potential trigger point…

50% falls to come?

If the US–China trade war starts to result in real economic decline in China, it’s bad news for our commodity exports.

We’re in danger of seeing a repeat of the 1990s after the wool peg finally collapsed.

In such an environment Australian house prices, which are some of the most expensive in the world, will plummet.

I’m not talking a mere 10% correction; I’m talking about 50% or more as falls in our commodity exports filter out into the economy like a house of cards.

Economist Harry Dent recently predicted as much. He said in a recent interview:

‘It’s the crash of a lifetime.’

Adding:

‘And I think it’s going to be 30 to 50 (per cent).’

Now, it mightn’t come to that.

And right now, thankfully, I’m seeing the opposite occur.

Iron ore, copper, nickel, lithium…they’re all heading higher in price. For now, China is still buying the lion’s share.

But what if that changes?

As we said at the start, commodity exports are the key starting point for Australia’s wealth. So, if that stops or slows significantly, we could see economic conditions we’ve not see for three decades.

It’s why I say you need to be paying very close attention to this US–China story and how it might start effecting Australia.

You can read my colleague Greg Canavan’s excellent insights here, so you can start preparing your strategy, come what may.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also editor of Exponential Stock Investor, a stock tipping newsletter that looks for the biggest investment opportunities on the market. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.

PS: Four Well-Positioned Small-Cap Stocks: These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments