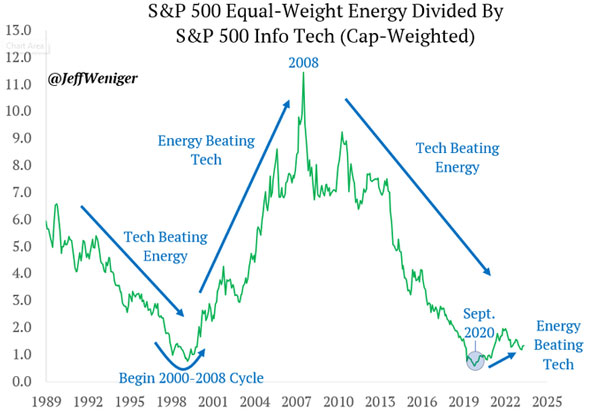

I came across an interesting chart this week.

Check it out:

| |

| Source: Jeff Weniger @ Wisdom Tree |

You can see the clear cycles in play.

From 1990 to 2000, tech stocks were the place to be.

After the ‘dot com’ bust, energy stocks performed much better until the GFC panic of 2008.

Tech then resumed its dominance until another crisis – this time, Covid – hit in 2019.

See that slight uptick over the past few years?

It’s early days, but if this pattern holds, energy could be the theme to follow over the next few years.

Could investing be this simple?

Perhaps.

But as a tech investor, I see an exciting way to invest through this, no matter what sector dominates…

Investing at the intersection

Governments the world over are trying to brute force a once-in-a-lifetime change to our entire energy system.

The goal is to achieve zero net carbon emissions (net zero), and fully electrify the system.

Whether this is anywhere near achievable in the time scales aimed for is a big question up for debate right now.

And some of my more sceptical colleagues think the world will continue to run on fossil fuels for a lot longer.

If you agree with that line of thinking, then you should be looking out for any opportunities that arise in the oil, coal and natural gas sectors.

I know our contrarian-in-chief, Greg Canavan, has some gas and coal plays in his Fat Tail Advisory portfolio right now.

On the other hand, our resident geologist, James Cooper, thinks copper and aluminium demand is set to soar as transmission lines are repurposed for a grid dominated by renewables.

He’s got some very interesting mining stock ideas based on that here.

But my beat is technology.

And on that front I think there could be some very exciting opportunities at the intersection of technology and energy.

I’m talking about energy tech stocks!

With that in mind, let’s look at several opportunities to ride a potential incoming ‘energy-led cycle’ – but with a tech twist…

Three ways to invest in energy tech

First up…

Small Modular Nuclear Reactors (SMRs).

Depending on who you listen to, they’re either the next big thing, or a pie in the sky fantasy.

So which is it?

I’ll get to that in a second, but first let’s look at how these SMRs work

As the name implies, SMRs work like regular nuclear fission reactors but on a smaller scale.

SMRs are a cheaper option for nuclear power and are seen as a safe alternative to traditional large-scale power plants.

They still use uranium as the ‘fuel’ to generate heat, though some advanced options are researching other options, such as thorium and even metallic fuels.

Of course, like regular nuclear plants, they’re a very green power source.

According to the WEF, there are 50 SMR concepts on the go globally with four at an advanced stage.

Argentina is building the CAREM reactor, which will generate 25MW of power. China is building the Linglon One reactor, which will produce 125MW.

And Russia has two SMRs under construction.

The much-publicised NuScale project in the US was mothballed last year, citing funding issues.

That has been highlighted by the naysayers a lot in recent times.

But I think this is a powerful technology that will be part of our energy future, and it’s definitely a trend worth following.

As an investor, this can mean looking for stocks aligned with constructing or running such plants or even just uranium miners in general.

Next up…

Bitcoin Mining!

Yes, I know I bang on a lot about Bitcoin.

But I bet you didn’t know that Bitcoin mining is very, very good for incentivising the rollout of renewable energy projects.

As Kiwi clean energy entrepreneur Daniel Batten wrote recently:

‘Just as NASA catalysed years of R&D into photovoltaics, Bitcoin mining is now catalysing R&D into an important form of baseload renewable energy technology that would otherwise have been cost prohibitive.’

The key thing to realise is that, unlike fossil fuel-powered plants, you can’t just turn renewable energy on or off.

Power will be produced when the Sun is shining, the wind is blowing, or the waves are rolling in.

But that can mean an imbalance between energy supply and demand at certain times.

Long-term, that will mean more batteries to store excess energy, but at the level of the entire grid, that could be decades away from being realistic.

Right now, the best option to manage this equation are Bitcoin miners.

Bitcoin miners are the ultimate partners in flexible demand.

Not only do they allow renewable power to balance itself out, but also provide additional revenue streams to fund the build out of renewable energy infrastructure itself.

There’s a wonderful company operating in Africa called Gridless that uses Bitcoin mining to help fund power plants for many communities in rural Africa.

Unbelievably, there’s 770 million people in the world without access to electricity; many of them in Africa.

Gridless wants to help fix that.

As a piece last year interestingly noted:

‘Gridless wasn’t born with a focus on bringing bitcoin mining to rural Africans. The company’s main aim was to offer affordable energy through microgrids.

‘Bitcoin just uniquely enabled that capability.’

Despite years of fake news on this subject, the world is slowly starting to recognise the reality.

As a piece in Forbes Magazine recently wrote:

‘The synergy between renewable energy initiatives and bitcoin represents major opportunities towards sustainable technological advancement. This integration opens new pathways for sustainability and enhances economic viability of renewable energy projects.

‘Companies like OceanBit and Sazmining show how this partnership can drive innovation and foster environmental stewardship.’

All these companies mentioned above are private companies – so you can’t invest in them directly.

Owning some Bitcoin gives you exposure to the overall Bitcoin eco-system.

And while Bitcoin carries risk and is highly volatile, I strongly suggest everyone should add a small stack to their overall portfolio for the long term.

There are also a number of Bitcoin miners listed on US markets you can invest in, including IREN, a Bitcoin mining and AI (Artificial Intelligence) data centre company run by two Aussie brothers.

They’re doing some really exciting stuff.

Talking about AI…

I’m running out of space today, but AI also has the potential to be a force in the energy market – as well as a huge user of energy itself.

As time is short, I’ll leave you to mull over this quote from the International Energy Agency (IEA):

‘It is therefore unsurprising that the energy sector is taking early steps to harness the power of AI to boost efficiency and accelerate innovation.

‘The technology is uniquely placed to support the simultaneous growth of smart grids and the massive quantities of data they generate. Smart meters produce and send several thousand times more data points to utilities than their analogue predecessors.

‘New devices for monitoring grid power flows funnel more than an order of magnitude more data to operators than the technologies they are replacing. And the global fleet of wind turbines is estimated to produce more than 400 billion data points per year.’

Things are changing on the energy front, that much is certain.

How can you take advantage of it?

That’s the trillion dollar question…

Good investing,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader