Today we were meant to talk about the investment opportunities opening up in the truck sector.

And I was also going to bring you into the inner sanctum of the Fat Tail Media email chain.

But that’ll have to wait until Friday.

Because today we are diving into my wheelhouse.

To discuss the subject I’ve spent an entire decade analysing, watching, and talking about…

See, the majority of Aussies don’t understand gold.

And that’s exactly what I’ve set out to change…

Cryptic feedback

A few weeks ago, I received a rather cryptic bit of mail from a reader.

There was no sender address. No letter or note as to why it was being sent.

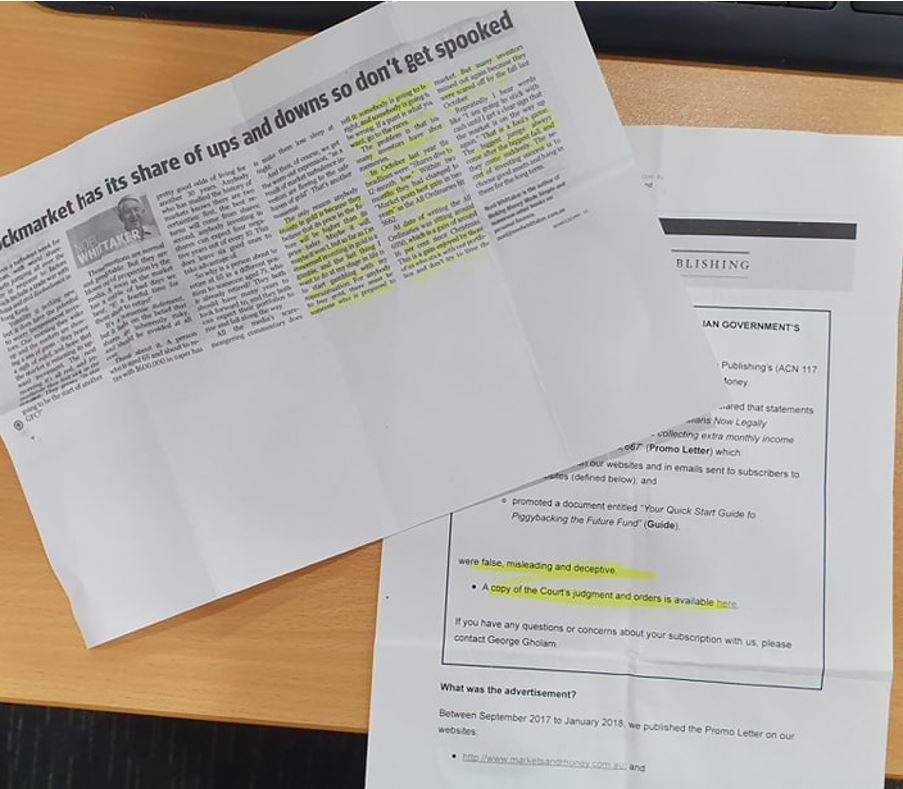

Just two bits of paper neatly folded into an envelope.

One, was a print out of an email our sister company Port Phillip Publishing sent around addressing a ruling from ASIC.

The other was a photocopy of a newspaper article.

Take a look:

|

|

| Source: Shae’s smartphone |

The highlight on the printed email points to ‘false, misleading and deceptive’ information as claimed by ASIC.

The second paper, highlighted a chunk about gold.

Or rather a negative thing about gold. With the author of the article writing:

‘The only reason anybody invests in gold is because they believe that its price in the future will be higher than its price today. Maybe it will, maybe it won’t, but as far as I’m concerned investing in gold is a gamble, and the last thing I want to do at my stage in life is to start gambling with my superannuation. For anybody to buy gold, there must be someone who is prepared to sell it: somebody is going to be right, and somebody is going to be wrong. If a punt is what you want, go to the races.’

Now, this is interesting to put together.

Is the mysterious mailer trying to tell me that they are wary of people pushing gold?

That perhaps I am making false and misleading claims about encouraging gold ownership…

Here’s the thing. I talk my own book. I’m heavy with physical gold and silver.

That’s how I choose to store my wealth. And this decision has been made on my decades-long understanding that gold is money.

I don’t see it as an investment. I understand that while I can’t use gold to buy groceries, it is an alternative to fiat dollars.

To boot, I advocate people only sinking money into precious metals if they are comfortable having it tied up for a decade.

In fact, this has been the better part of my 20-year career in finance. I’ve literally staked my career on the benefits of bullion ownership.

Why?

Simply put, gold has routinely proven that it maintains purchasing power.

No matter what short-term government decisions have on the value of money, gold is a long-term form of wealth protection of your money.

It can’t be devalued by central banks. It’s a finite resource.

Unlike most mainstream information that’s designed to encourage you to think about short-term benefits, gold and silver is about maintaining and growing your wealth over decades.

It’s not a flash in the pan. Physical bullion ownership is about wealth preservation.

And in a world of low interest rates, and a weakening currency, it’s one of the few tools that will ensure your wealth at least keeps pace with a changing economy. Cash simply won’t do that.

And here’s the rub. If you stick with mainstream information, then you’re stuck with mainstream profits…or in this week’s case, losses.

Let’s take the past week as an example.

The coronavirus has been ‘news’ since the middle of January this year.

That’s roughly 45 days.

Yet for almost that entire time, stocks here and in the US remained at all-time highs.

Why? Investors were late to really assess the information.

As a result markets are taking a beating, and are likely to for the rest of the week.

But if you’d been watching gold…you would’ve known that the broader market had called the virus wrong.

This really began back in January

Gold is called the fear metal.

That is, when things look shaky, people turn to investments they can trust.

The sell-off we’ve seen this week suggests people are dumping shares and moving into cash and gold.

Yet this really began back in the middle of January.

Gold in US dollars

|

|

| Source: Trading View |

Since 13 January gold is up 4.9%.

And eagle-eyed investors watching the price movements of gold would have realised this was a leading indicator that some investors weren’t buying the ‘virus is contained’ story.

And gold is doing exactly what it should be as the coronavirus reveals itself.

It’s reflecting market uncertainty. The heavier the sell-offs, the more likely we are to see investors move into gold.

In saying that, some investors still struggle with the idea of swapping fiat dollars for a shiny rock.

And this is exactly why I created Rock Stock Insider.

To help people see past mainstream rhetoric that demonises the metal. To ensure people understand that gold has enduring purchasing power over cash at the bank.

To teach people that fiat currencies come and go. And that they rely on the government of the day to prop them up.

And that gold is a way to ensure your hard-earned coin is removed from wealth-destroying policies.

The best part is, you don’t even need to take just my word for it.

Over at Rock Stock Insider, we take my decades-long experience with gold and then speak to experts around the world on the metal. Already subscribers have been given exclusive interviews to the thoughts from some of the biggest names in the gold market, like Rick Rule, Grant Williams, and of course, Jim Rickards.

In five short months they’ve had access to about 15 chats.

There’s at least that many more I’m in the process of getting ready to share.

I’m in the process of arranging at least four new interviews right now. And I still have a pipeline of about 40 people…

My point? You don’t need to just take my word for it…

‘Cause I’ve found the world’s experts on gold, and brought them to you.

| Until next time, |

| Shae Russell, PS: Discover how some investors are preserving their wealth and even making a profit, as the economy tanks. Download your FREE report by clicking here. |