Core Lithium [ASX:CXO] shares fell 5% on Tuesday morning in a red day for the ASX.

The sharp sell-off in stocks across global markets has hit lithium stocks hard.

Having rapidly risen in value, the stocks are shedding value just as fast with investors exiting risk-on assets — like pre-production lithium developers.

CXO is down 30% from its 52-week high.

Fellow lithium developer Lake Resources [ASX:LKE] is down 45% from its 52-week high.

And lithium battery tech stock Novonix [ASX:NVX] is down 65% from its 52-week high.

Source: Tradingview.com

Core’s drilling and exploration update

On Tuesday, amid all the recent market turbulence, CXO released its final 2021 lithium drilling assays.

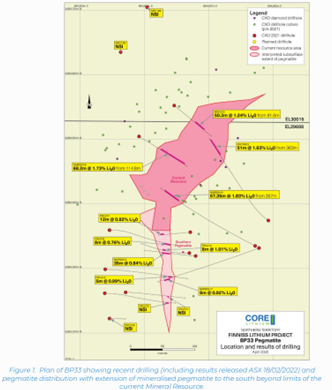

The final assays relate to drilling at Core’s Finniss Lithium Project in the Northern Territory.

Core said that mineralisation within the southern extension to pegmatite at BP33 is now confirmed, with spodumene reaching further than original estimates.

The lithium developer also noted ‘exciting’ results from the new Penfolds prospects.

CXO further reported ‘visible spodumene mineralisation’ at its Hang Gong site, with intersecting holes demonstrating satisfying ‘thickness of the targeted mineralised pegmatite’ in both the Lees and Yan Yam sites.

Source: CXO

CXO share price outlook: what next for lithium stocks?

CXO’s Managing Director Stephen Biggins said:

‘The highly prospective nature of these new lithium drilling results reflect the confidence Core has in delivering further significant resource growth from the Finniss Project that will add to our life of mine and our capacity to materially increase lithium production from northern Australia in the future to keep up with rapidly growing global demand.

‘Our prime directive is to deliver first production of high-quality lithium concentrate from the Finniss Project this year in the midst of a very high lithium price and high operating margin environment.

‘With the commencement of diamond drilling at the BP33 prospect, we are also excited to be recommencing field work and look forward to further unlocking the longer-term potential of the Finniss Project.’

Investors may have been buoyed by Core’s target to deliver first lithium spodumene from Finniss this year, given the tight lithium market right now.

Just last week, Albemarle — one of the world’s largest lithium producers — released its quarterly results.

In the update, Albemarle revised its market outlook based on ‘improved expectations of continued demand growth and tightness in the markets it serves.’

But even that wasn’t enough to subdue wider market worries. Albemarle shares fell 8% overnight on the NYSE.

Even a positive guidance revision was not enough to stave off a sell-off as investors grow more jittery about inflation and central banks’ responses.

Grave-dancer stocks in times of fear

Picking stocks in the current climate seems like folly.

But abnormal volatility can cause abnormal mispricing opportunities for the savvy bargain hunter.

Or a ‘grave dancer’.

A what?

In 1976, famed American investor Sam Zell wrote an article when the US had seen a massive property boom and bust.

For him, the collapse was a chance to go shopping. And he called it ‘grave dancing’.

Well, nearly five decades later, our small-cap expert Callum Newman thinks it’s time to go grave dancing again.

Callum’s identified three grave-dancer stocks he thinks are mispriced by a fearful market right now.

To hear more about them, read on here.

Regards,

Kiryll Prakapenka,

For Money Morning