The Core Lithium Ltd [ASX:CXO] share price is trading slightly down today despite lithium exploration drilling recommencing.

At the time of writing, Core Lithium’s shares were down 1%.

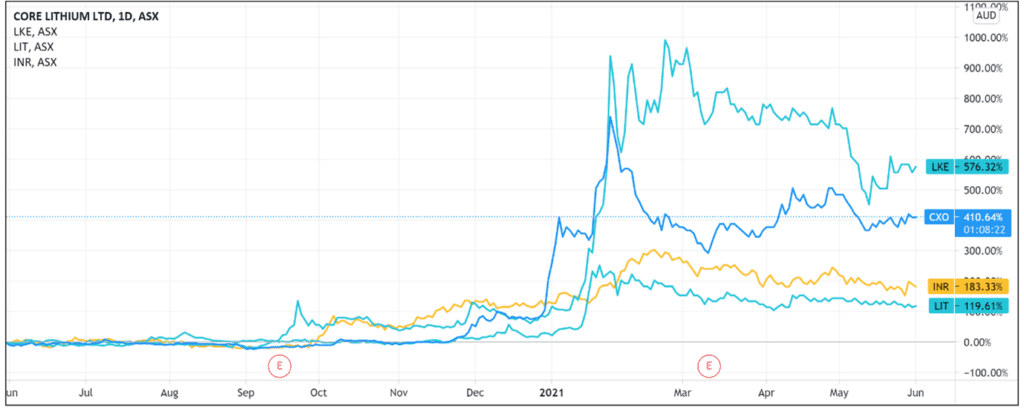

Zooming out further, CXO shares have dipped 13% this month. However, the lithium explorer is up a mammoth 450% over the last 12 months, reflecting the strong interest in the ASX lithium sector. Source: Tradingview.com

Source: Tradingview.com

CXO’s lithium exploration drilling recommences

Core Lithium today notified the market that drilling has restarted at its 100% owned Finniss project in Darwin.

Managing Director Stephen Biggins described the recommenced work as the ‘most extensive exploration and drilling campaign we have ever conducted at our flagship asset.’

Diamond core drilling started this week and will be followed by an RC rig and RAB rig later in May.

The resource expansion drilling aims to convert ‘a high proportion’ of newly acquired prospective ground at Finniss.

CXO also reported that it resumed gold exploration at its Bynoe Gold project.

Biggins was excited by fieldwork restarting at Finniss:

‘We are confident that, through this program, we will be able to significantly upscale the lithium resources and mine life at Finniss, making Australia’s next lithium mine an even more attractive investment opportunity.’

CXO Share Price ASX outlook

The resumed lithium exploration program at Finniss is expected to bring ‘lithium rich pegmatites into spodumene resources in coming months.’

The vague nature of the timeline could partly explain the market’s muted reaction to today’s update.

Additionally, the recommencement of lithium exploration may have already been anticipated by the market following CXO’s 20 May update.

Last month, Core Lithium established a new lithium exploration target at Finniss of 9.8 to 16.2 million tonnes at a grade of between 0.8 to 1.4% lithium oxide.

That ASX update flagged that resource expansion drilling would start ‘in the coming weeks.’

So today’s news may have represented nothing investors didn’t already expect, explaining why CXO shares are trading sideways today.

Lithium stocks are on a lot of investors’ minds. But with so many news items coming out almost daily, it’s hard to keep up and know where to look for lithium investment ideas.

I think this free report on ASX lithium stocks is a great place for anyone who wants further information and ideas.

Additionally, governments and private interests alike are converging on electric vehicles and renewable energy.

But if you’re wondering exactly what this trend means for savvy private investors, I recommend reading our free report on the renewables revolution.

There, our energy expert Selva Freigedo reveals three ways you can capitalise on the $95 trillion renewable energy boom.

Regards,

Lachlann Tierney,

For Money Morning

PS: In this new report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2021. Get the FREE Report