What’s the biggest event that’s shaped commodity markets this decade?

Was it the lithium boom? This commodity surged in 2022 and then collapsed. It gifted a fortune for some but mental scars for many others.

Or was it the rapid uranium spike?

A market that finally exited a decade-long depression in 2023.

Those that held names like Boss Energy [ASX: BOE] were gifted 2,000%+ returns from the company’s lows to the eventual peak in early 2024.

Across the board, there have been sparks of optimism in the resource market this decade.

That includes rare earths and several other lesser-known critical minerals.

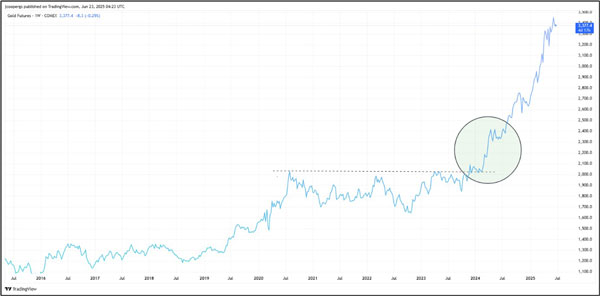

But in terms of what really matters, I believe it’s the melt-up in gold.

Gold was as low as US$1,600 per ounce in 2022…This year it touched US$3,400.

But it’s not so much the PRICE that matters, but rather the price ACTION.

You see, gold is the ONLY commodity that has broken into new all-time highs in this cycle.

Yes, we’ve had price spikes in things like uranium, silver, platinum and rare earths.

But what matters here is the historical breakout event, exclusively limited to gold.

Gold has now pushed well past its major resistance set in 2011, the peak of the last commodity cycle.

So, why does that matter?

If you believe and understand my theory, you’ll know that gold leads these big commodity-cycle events, with other metals following higher, eventually.

And importantly, gold confirmed this signal in 2024.

We’re now one year on from that milestone event.

So that means we should be seeing other commodities starting to press higher and threaten ‘their own’ all-time highs.

And that’s precisely what’s happening!

Copper: on the precipice of a historical breakout

Remarkably, copper is again just a smidgen away from becoming the next major commodity to break past its all-time high from 2011:

| |

| Source: Trading View |

First gold, now copper.

The last time copper did this was EXACTLY 20 years ago, back in 2005.

I’ve circled that event on the chart above.

But another interesting aspect here is that these key resistance levels have the potential to unleash powerful price moves in commodity markets.

Copper surged 140% in less than 18 months when it last broke its multi-year resistance level in 2005.

I doubt anyone considers this remotely possible for today’s copper market.

But that’s what these powerful ‘technical’ levels can unleash.

In 2005, the copper ‘breakout’ generated a surge of excitement across the resource market, especially among junior mining stocks.

It was the crystallising event that kick-started that last commodity cycle.

And the catalyst that finally drove speculation back into junior mining stocks.

And that’s what I’ve been preparing my paid readership group for this year: a potential repeat of what occurred in 2005.

I issued a special report to my Diggers & Drillers group in March detailing the set-up:

| |

Since then, we’ve remained patient, watching copper’s price action carefully.

And as a bonus, watching one of those copper plays surge 70% since March.

A major turning point in this cycle

Despite logic telling you otherwise, the world’s bellwether commodity continues to display extremely positive price action.

And if copper does break into new all-time highs soon, that puts resource investors on a very bullish path for the remainder of 2025.

As you might know, copper has made several ‘false breaks’ over the last couple of years, but each time, it’s made a ‘higher low,’ reaffirming its long-term bullish trend.

I maintain that if (or when) copper resoundingly breaks through its 2011 resistance level, the breakout will be fierce.

Just like it was for gold last year, see below:

| |

| Source: Trading View |

For now, I’ve primed my paid readership group for this set-up.

Remember, if copper breaks through this key resistance level, this will be bullish across the resource market.

Our portfolio holds exposure to silver, titanium, REEs, zinc, uranium, gold AND copper. Several of these stocks remain a buy.

Plus, mining service stocks leveraged to rising activity in the sector.

There’s still time to get into these key positions, but as I pointed out, our recommendations are already moving.

You can get all the details here.

Until next time.

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments