Following in the wake of the other big four banks, Commonwealth Bank of Australia [ASX:CBA] was the last major Australian bank to post its most recent financial report.

Commonwealth Bank’s results came to the total of $2.6 billion for Q3. Though a strong result in isolation, this was majorly flat on the same time last year — 1% up Q3 FY2022.

CBA’s share price was falling by 1% not long after their announcement, trading for $96.34 a share.

Year-to-date, CBA has dropped more than 6% in share price, nearly 3% in the month and 4% in the last week alone:

Source: TradingView

Commonwealth Bank shares Q3 profit results

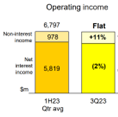

Within its Q3 trading update, CBA’s operating performance was reported as mostly flat on the 1H23 quarterly average (up by 2% on a day-weighted basis), and up by 18% on the prior comparative quarter.

This was a result driven by volume growth and higher non-interest income, with low net interest margins applying pressure via a highly competitive market.

Aside from its earnings and activities in the last reporting period, the bank echoed sentiments offered by the other three big banks. This is of rising competition in mortgage rates and some challenging times ahead, as stated by Westpac [ASX:WBC] only yesterday.

CBA said that its customers appear to be moving towards higher yielding deposits as rising interest rates force households to find resourceful ways to protect and manage funds.

Loan impairment expenses totalled $223 million, with collective and individual provisions slightly higher.

Portfolio credit quality was described as ‘sound, with credit provisions increasing slightly to further strengthen our balance sheet position as financial conditions continue to tighten’.

Source: CBA

Outlook for CBA, banks and economy

Rising interest rates have been forcing customers to look for more creative ways to protect their funds.

This behaviour has not only been applying pressure to mortgage and loan lending here in Australia but has also been hurting US regional banks.

In fact, the financial pressure and competition ultimately caused the US regional banking index to fall overnight.

In the US, the federal reserve has now released its financial stability report, flagging risks for tightening credit in the markets with banks less eager to lend.

This is expected to further unsettle the US economy.

Loan officers and US banks have completed a survey for the federal reserve to shed light on the financial situation at present. Banks across the US are tightening their lending to households and businesses, further slowing down the US economy.

With things this tight in the US, what will it mean for the Australian economy?

Jim Rickards’ Sold Out book offer — grab your copy now

Banks are permanently closing more and more branches across towns.

Used car prices are rising, and sourcing new ones for speedy delivery is getting harder by the day.

Prices in general are skyrocketing while packaging is shrinking.

Is it all just inflation, COVID ramifications and market volatility, or is there more to the story?

These are just some of the seemingly unrelated signs pointing to something bigger.

Mere ‘inconveniences’ are just the start…

Geopolitical expert Jim Rickards has been making very apt, on-point predictions for decades.

And now he’s predicting ensuing financial chaos — yes, more so than there is right now.

He explains it all, offering a unique perspective that should not be ignored, in his book, SOLD OUT: How Broken Supply Chains, Surging Inflation, and Political Instability Will Sink the Global Economy.

You can grab a free copy when you sign up for The Daily Reckoning Australia, also free, right here.

Regards,

Mahlia Stewart

For The Daily Reckoning Australia