Commodity stocks rallied on Monday on persistent rumours China will ease its strict COVID-19 policies.

But the market is likely to be disappointed.

As the Financial Times reported on Monday:

‘China’s National Health Commission reiterated the country’s commitment to eliminating Covid-19 at a press conference on Saturday and warned that the situation was set to become even “more severe and complex” as the country entered the winter flu season.

‘“Practice has proved that our pandemic prevention and control strategy . . . [is] completely correct, and such measures are proven the most economical and effective,” said Hu Xiang, an official with the NHC.

‘“With the government preparation beginning, increased pricing-in of China reopening in a forward-looking market may be warranted,” said Goldman analysts. “However, it is worth emphasising that we are still at least a few months away from the actual reopening.”

‘“The market is cherry-picking facts in search of any sign of zero-Covid relaxation,” said Feng Chucheng, a partner at the research firm Plenum, in Beijing. “The bottom line to understand China policy is, the higher prominence attached to a specific policy is, the more sophisticated manoeuvre such a policy exit would require.”’

Markets do look ahead, and they may be starting to slowly price in the eventual reopening of China, but it won’t be an immediate thing.

Today, The Wall Street Journal noted:

‘Chinese leaders are considering steps toward reopening after nearly three years of tough pandemic restrictions but are proceeding slowly and have set no timeline, according to people familiar with the discussions.

‘As a result, they are proceeding cautiously despite the deepening impact of the Covid-19 policies, the people said, pointing to a long path to anything approaching prepandemic levels of activity, with the timeline stretching to sometime near the end of next year.’

In any case, some export countries are benefiting whether China is loosening COVID restrictions or not.

Australia is one of them.

Australia’s ballooning commodity exports

In October, the Australian Department of Industry released its latest Resources and Energy Quarterly for the three months to September 2022.

Unsurprisingly, the report found global high energy prices and a strong US dollar are ‘driving a surge in export earnings’.

After a record $422 billion in 2021–22, the Department expects Australia’s commodity export earnings to rise even further in 2022–23 to $450 billion.

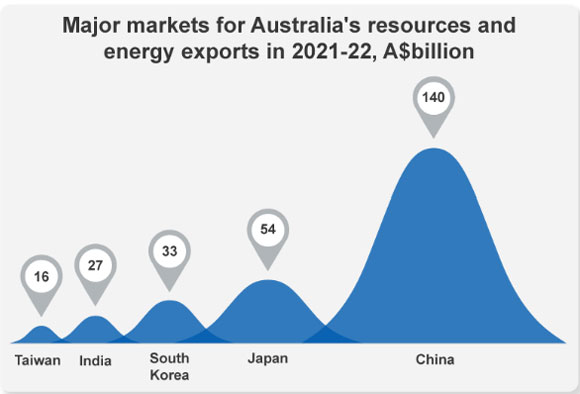

And despite its tight pandemic restrictions, China remained the dominant destination for Australian commodities in 2021–22.

You can see that in the chart below:

|

|

| Source: Department of Industry |

But the boffins in government departments don’t think the commodities boom will last.

The record export earnings of $450 billion expected in 2022–23 mark the peak, according to the Department of Industry.

The following year, 2023–24, export earnings are expected to slump to $375 billion.

But while some commodities are expected to see a drop in price on lower demand — like steel and iron ore — some commodities are on the rise.

‘Green’ metals like nickel, copper, and lithium. Metals that are essential for the world’s energy transition.

As the Department of Industry noted:

‘Metals central to the global energy transition (copper, nickel, lithium) are set to earn $33 billion in 2022–23, double what they earned in 2020–21.’

And China looms large again.

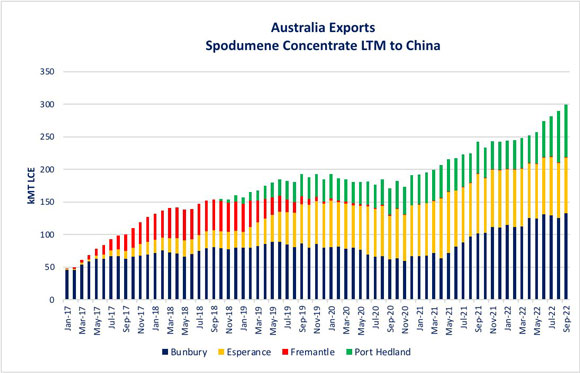

For instance, Australian lithium producers have raised their lithium carbonate exports to China sixfold since 2016 as demand for the white metal critical to EV production ramps up.

|

|

| Source: Twitter |

Miners ramp up spending on battery tech metals

Analysis from BDO shows that Australian total exploration spending in the June 2022 quarter rose 25% from the March 2022 quarter to $1.04 billion.

BDO trawls ASX commodity stocks’ quarterly reports and collects their aggregate exploration spending data.

BDO said the June quarter’s exploration spending was the first time since BDO began its analysis in June 2013 that exploration spending surpassed $1 billion.

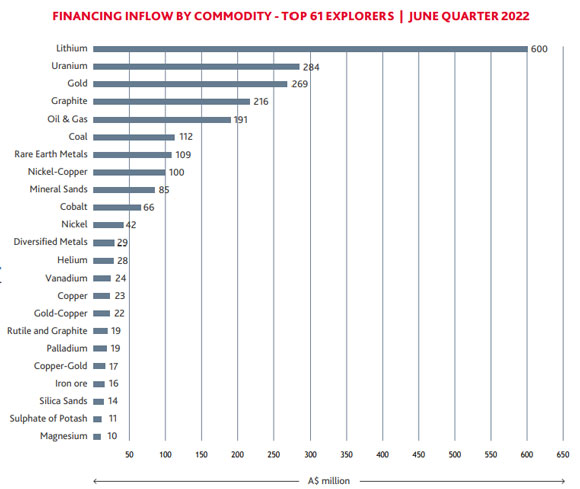

We can use BDO’s data to look at the changing exploration spending landscape:

|

|

| Source: BDO |

The chart above captures the financing inflow by commodity in the June 2022 quarter.

Lithium took the top spot with $600 million.

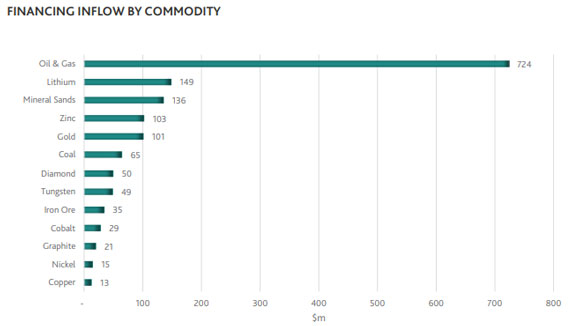

What about the June 2018 quarter?

|

|

| Source: BDO |

Oil and gas were the top with $724 million.

Lithium was a distant second with $149 million.

Since the June 2018 quarter, ASX financing inflow for:

- Lithium has gone up 300%

- Uranium has gone up at least 2,080%

- Graphite has gone up 925%

- Rare earth metals have gone up at least 2,000%

- Cobalt has gone up 125%

- Nickel has gone up 180%

- Copper has gone up 75% (without taking into account the rise in nickel-copper financing)

In the same time, ASX financing inflow for:

- Oil and gas have gone down by 73%

- Iron ore has gone down 54%

- But coal has gone up 70%

What does this brief shaking of the spending data tree yield?

Commodities are rearranging themselves into a new hierarchy.

Battery metals and ‘green’ metals like lithium, graphite, nickel, cobalt, copper, and rare earth metals are ascending.

It is also interesting to see the drop in financing for oil and gas, again corroborating the idea that a concerted effort to ‘go green’ has led to underinvestment in some key fossil fuels.

Fossil fuels that still power much of our world.

As my colleague Ryan Clarkson-Ledward pointed out last week:

‘From the mid-2000s to around 2012, mining investment was soaring. Apart from a brief blip during the GFC, mining investment was averaging around 10% growth a year and topping out at almost 25% at its peak.

‘It was only once the pandemic hit that exports really went negative. That is, until the late spike in 2022.

‘Again, though, the bigger trend to consider here is that mining investment growth has never really recovered.

‘We have failed to fund new exploration and drilling despite knowing that demand is only going to increase.

‘We are making these scarce resources even more scarce by undersupplying them…’

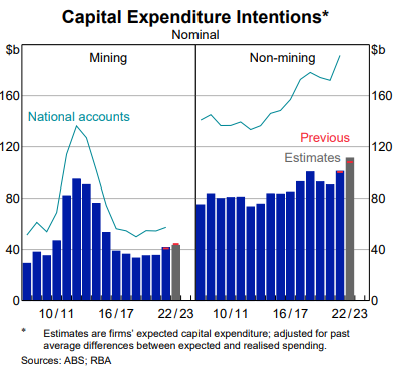

This underinvestment in commodities has been shown again by the Reserve Bank (RBA).

In its latest Statement on Monetary Policy, the RBA cited research that planned investment by the mining industry ‘will largely be to maintain production rather than to expand capacity’.

Commodity stocks are largely returning recent outsized profits to shareholders rather than reinvesting profits into the business.

|

|

| Source: RBA |

Are ASX lithium stocks priced to perfection?

One of the biggest beneficiaries of the ramping up of exploration spending on energy transition metals has been the lithium sector.

Lithium stocks were some of the best-performing stocks on the ASX in 2021 as investors bid up lithium juniors.

But have lithium stocks now been priced to perfection?

It’s likely.

Our new mining specialist James Cooper — who is a geologist by trade — thinks lithium is a ‘one-hit’ wonder because it caters almost exclusively to the EV battery theme.

Other critical metals are more versatile and possess better supply-side economics.

There’s an asymmetry of focus when investors think about businesses and their markets.

Respected investment strategist Russell Napier once said, ‘analysts spend 90% of their time thinking about and forecasting demand, and 10% of their time thinking about supply’.

James recently argued that lithium is a perfect example of a sector where most of the time has gone into pondering demand.

This occludes the true picture as paying more attention to the supply side sharpens the analysis.

As James wrote:

‘Most market commentators have stated future demand for EV batteries will continue to drive a boom in lithium prices.

‘But that’s the typical mainstream sentiment; I believe much of the excitement has already been priced in. In my opinion, I see much stronger opportunities presenting in other areas of the commodity sector.

‘You see, lithium does not have the same impending supply constraints that I see looming over other key metals.

‘Sure, demand for lithium is set to grow on the back of a large transition into renewables, but there’s a strong pipeline of projects already underway which will meet this future demand.

‘Lithium has defied the odds; its acceleration is primarily down to future optimism in the uptake of electric vehicles (EVs). But in many ways, this commodity is a “one-hit wonder” as it’s used principally in the manufacture of EV batteries.’

If lithium stocks are priced to perfection, there’s still other commodity stocks that aren’t.

How to take advantage of the new commodity stock hierarchy

James thinks investors should turn their focus away from the much-hyped lithium sector.

He thinks better opportunities lie elsewhere.

Cobalt is one such opportunity.

As James put it:

‘You might say, “Sure, but the amount of, say, cobalt needed in a single EV battery is far less than what’s needed for lithium.”

‘But what you NEED to understand is this: How abundant is this metal compared to lithium?

‘You see, virtually all the world’s cobalt resources are locked up in just ONE country, the highly volatile Democratic Republic of the Congo (DRC).

‘This, to me, makes cobalt a standout contender in the race to find alternative, stable supplies of critical metals.

‘Furthermore, DRC ore is shipped directly to China for refining, excluding Western economies from the cobalt supply chain.’

Now, James has identified other opportunities — and specific stocks to boot — in an upcoming investment report for 2023.

James is anticipating a scarcity-driven resource stock boom on the ASX, and he’s diligently picked out the ASX stocks he thinks stand the most to gain.

Money Morning will release more information about his report on Thursday.

So stay tuned!

Until next week,

|

Kiryll Prakapenka,

For Money Morning