This week’s video was recorded at the IMARC mining conference in Sydney.

I sat down with Fat Tail’s publisher Woody to share my insights about what I’ve seen and heard at this year’s event.

As an added bonus, I’ve also shared a snippet (below) from my latest report, which was sent to our paid readership group at Diggers and Drillers earlier this month.

It discusses the commodity cycle and why mining service companies could be the key stocks to own as the cycle turns more bullish.

In fact, one of our service plays, RPM Global [ASX:RUL], has already doubled in price since we recommended it in November 2023.

However, that’s not to say you should be buying it now, at these elevated levels.

But we have two other service plays currently listed as a BUY in Diggers and Drillers.

As outlined below, both stocks could be positioned for a strong move in 2025 if the commodity cycle turns more bullish.

The emerging cycle

It’s important to understand that the upward leg of a commodity cycle (boom phase) doesn’t kick off overnight.

If you’re a long-term Diggers & Drillers reader, I’m sure you’ll understand!

We’ve followed this theme since we kicked off D&D in late 2022.

While there have been some green shoots…record gold prices, and copper (briefly) spiking into new all-time highs in 2024, we’re still not what I’d consider in ‘boom conditions.’

Especially among junior mining stocks, many of which still trade close to all-time lows!

So, how does the recent China stimulus fit in with our overall outlook on the emerging commodity cycle?

As you know, my view on this unfolding cycle hasn’t been fleeting.

And not built on sudden bullish turns like China’s stimulus.

While important, numerous factors must be in play to help stage stronger prices in the commodity market.

I see China’s latest announcement as just another cog in the wheel, so to speak.

So, how close are we to something representing a more bullish market in the commodity sector?

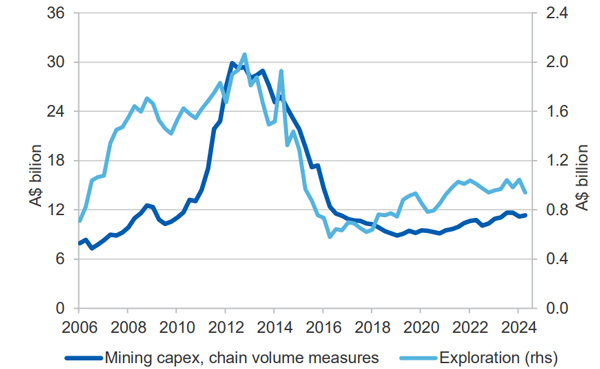

One metric that can help us understand our position in the overall commodity cycle is to look at spending on exploration and new mine development.

As you’ll find out later in this report, it plays into our latest recommendation.

Not surprisingly, capex tends to rise alongside higher commodity prices.

As much as it would make sense to develop projects during a downturn when capital is cheap and labour is easy to access, this rarely happens in the mining industry.

Capex investment follows the boom and bust commodity price cycle.

Higher prices are the catalysts that spark growth ambitions for the miners.

The promise of future rewards is a powerful driver in the industry… From companies to investors to lenders.

And today, investment remains subdued.

To illustrate what I mean, let’s examine a graph from the Australian government’s latest quarterly resource and energy outlook:

| |

| Source: Department of Industry, Science and Resources |

As you can see, exploration (light blue) and mining capex (dark blue) are well below their cyclical highs in inflation-adjusted terms.

Looking at the surging activity from the peak of the last boom (2011) should give you some context on what’s been playing out over the last few years.

Activity in the sector remains muted and far from a cycle high.

Yet green shoots are forming…

Note that investment activity has been trending higher since the cyclical low in 2016.

While conditions might not be described as bullish, they are strengthening.

Capex clues

To understand why investment in new development is important for understanding our position in this commodity cycle, we need to revisit how these cycles operate:

Underinvestment in new supply offers a floor for commodity prices.

A level from which prices can’t move lower due to the constraints of limited supply.

In the graph above, this ‘underinvestment phase’ has existed from 2016 to 2024.

Muted activity has been a long-lasting response to the hyperbolic investment phase that culminated in 2011/2012.

From boom to bust… That’s how the cycle turns!

Since the lows of 2016, the sector has been recovering.

But until meaningful demand returns, the cycle will be stuck in limbo, somewhere between bullish and bearish.

That gives mixed messages, offering no clear direction for investors.

But the key point is this…

The stage is set.

Underinvestment over the last decade has offered a floor (structural support) for commodity prices.

The foundation has been laid.

So, what will drive the sector towards its next, more bullish phase?

Well, before we answer that, let’s examine another clue that points to the upward turning of the cycle!

Copper… A Commodity Leader

Minerals tend to ebb and flow throughout the upward leg of a cycle.

As one metal hits a major high, others could be hitting major lows… The performance of gold versus iron ore in 2024 is a good example.

But in terms of specific commodities, as long as the long-term trend remains, there’s no need to pay too much attention to short-term pressures.

Here, we can use copper as an example.

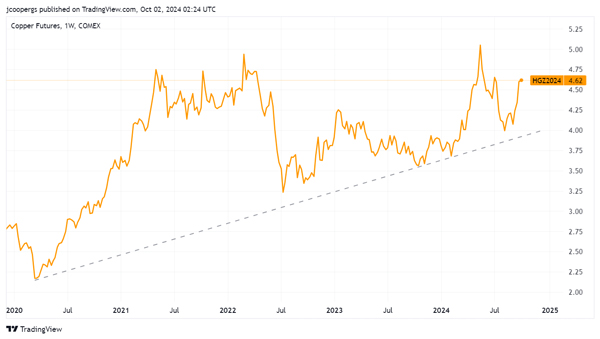

On the chart below, you can clearly see copper prices trending higher over the last 5-years:

| |

| Source: Trading View |

And that’s despite numerous setbacks to global growth over that time.

Pandemic, rapid interest rate rises, a surging US Dollar, wars, real estate and stock market collapse in China and global recession fears.

Copper, a commodity with its fortunes pegged to global growth, has climbed an impossible wall of worry!

China stimulus: will it ignite the cycle?

Markets have a short memory and tend to overreact to economic developments, either up or down.

Recall that in August 2024, authorities in China revised GDP growth below their long-term target of 5% per annum.

That drove a wave of panic across markets, especially those tied to commodities.

To make matters worse, steel producers in China responded with production cuts.

As a major buyer of Australia’s most important export, iron ore prices dived below the key support level of $US100 per tonne.

By September, several of Australia’s largest mining firms had hit multi-year lows.

Any thoughts of a looming commodity supercycle vanished!

The imminent collapse of China’s economy took over, and markets fell into a tailspin of worry.

If you bought into that panic, you would likely have sold out close to a major low.

But as I explained here, this was not a time to sell.

I reminded readers that the key metric to watch was still intact… China’s imports of raw materials.

A data point that’s difficult for Chinese authorities to manipulate.

Despite deep pessimism over August and September and a wave of selling in commodity markets, imports of key commodities like iron ore remained robust.

In fact, the latest data has confirmed iron ore imports jumping 6.7% in H1 2024 compared to the same period in 2023!

That’s according to the Chinese Steel Association (CISA).

As the majority panicked, we held firm.

We didn’t sell a single position in the mid-year panic.

Meanwhile, at our more active resource trading service, Mining Phase One, we capitalised on the panic by adding two new copper stocks to the portfolio.

So, what happens next?

From here on, it’s pure speculation on what could happen next in the resource market.

As I’ve shown you, Dr copper continues to trend higher.

Capex and exploration spending is also building despite years of underinvestment.

The market is ripe for higher prices, and China’s latest move should give you every reason to be optimistic.

It aligns precisely with the progression of a typical commodity cycle: a period of underinvestment, consolidation, rising optimism, and then boom!

The inevitable turning of the cycle is underway.

And right on cue, the US Federal Reserve has kicked off a new rate-cutting cycle.

This will send more liquidity into markets and help stimulate the US economy while weakening the US Dollar.

Each of these elements offers bullish tailwinds for commodities.

But it’s not just the US; from East to West, a new wave of liquidity is set to swamp global markets as central banks embark on a new era of rate cuts.

And mining service stocks could be an excellent way to leverage into a broad rally across commodities.

Hedging your commodity bets

with Mining Services

Mining services are an excellent way to capitalise on the upward turning of the mining cycle.

That’s because it ties into the well-known ‘picks-and-shovels’ strategy.

During the 19th-century gold rush, the best way to get rich was to sell equipment to the miners, not to hunt for gold.

Except those picks and shovel businesses are now far more advanced…

Precision engineering, AI-backed software, hyperspectral analysis to log drill core, and advanced geophysics—tech and mining are increasingly intertwined.

I saw this first-hand at the IMARC conference in Sydney this week; AI integration is spreading through the resource sector.

And since mining plays a critical role in Australia’s economy, ASX service stocks are among the global leaders in this niche market.

Many have leveraged their local knowledge, branched out and established global hubs in Canada, the US, Africa and South America.

To get the names of the two other Aussie service plays I’m backing for this cycle, you can do so here!

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments