Pity the men and women running Qantas right now.

They’ve been through the ringer in the last two years. Now, Omicron is kicking them in the guts again.

The Australian Financial Review says that Qantas is cutting nearly a third of flights. Travellers suddenly don’t like the odds of risking that getaway to wherever. International flying is at 20% of the pre-COVID level.

It could get even worse for the flying kangaroo team.

There’s one fund manager suggesting that oil could go to US$200 a barrel in the next few years. That would clobber Qantas’ earnings potential again.

Of course, a suggestion isn’t reality or a guaranteed eventuality. But it does show how a natural resource bull market can give a massive headache to the poor souls who have to use the stuff.

A nickel boom is wonderful for nickel miners. Elon Musk would tear his hair out because it does nothing but drive up the cost of his batteries.

What’s good for the Aussie mining sector is problematic for other industries.

We can see it in the gas market right now. International gas prices are so high that they are effectively paying a US$200 oil price in Europe.

I can say that with some confidence. My mother-in-law wants to wash her clothes at 2:00am in the morning to save her pension in Spain.

This has the potential to drive Europe into a recession. It also has the potential to drive the earnings of Australian gas producers sky-high if they can export it and get the world price.

Point being, a recession in Europe may appear to be a ‘bad’ headline and make you nervous about holding stocks.

But if those stocks happen to be making a fortune, then that’s exactly what you should be doing!

This is one reason I’m wildly positive about Australia over the next few years. High commodity prices generate staggering wealth.

We already alluded to this earlier in the week when we saw that Rio Tinto Ltd [ASX:RIO] and BHP Group Ltd [ASX:BHP] are both expected to declare $8 billion in dividends for the last six months.

That’s bigger than most stocks on the ASX!

And that’s after they’ve paid out enormous sums in wages and capital spending.

Is it any wonder that Perth property is booming?

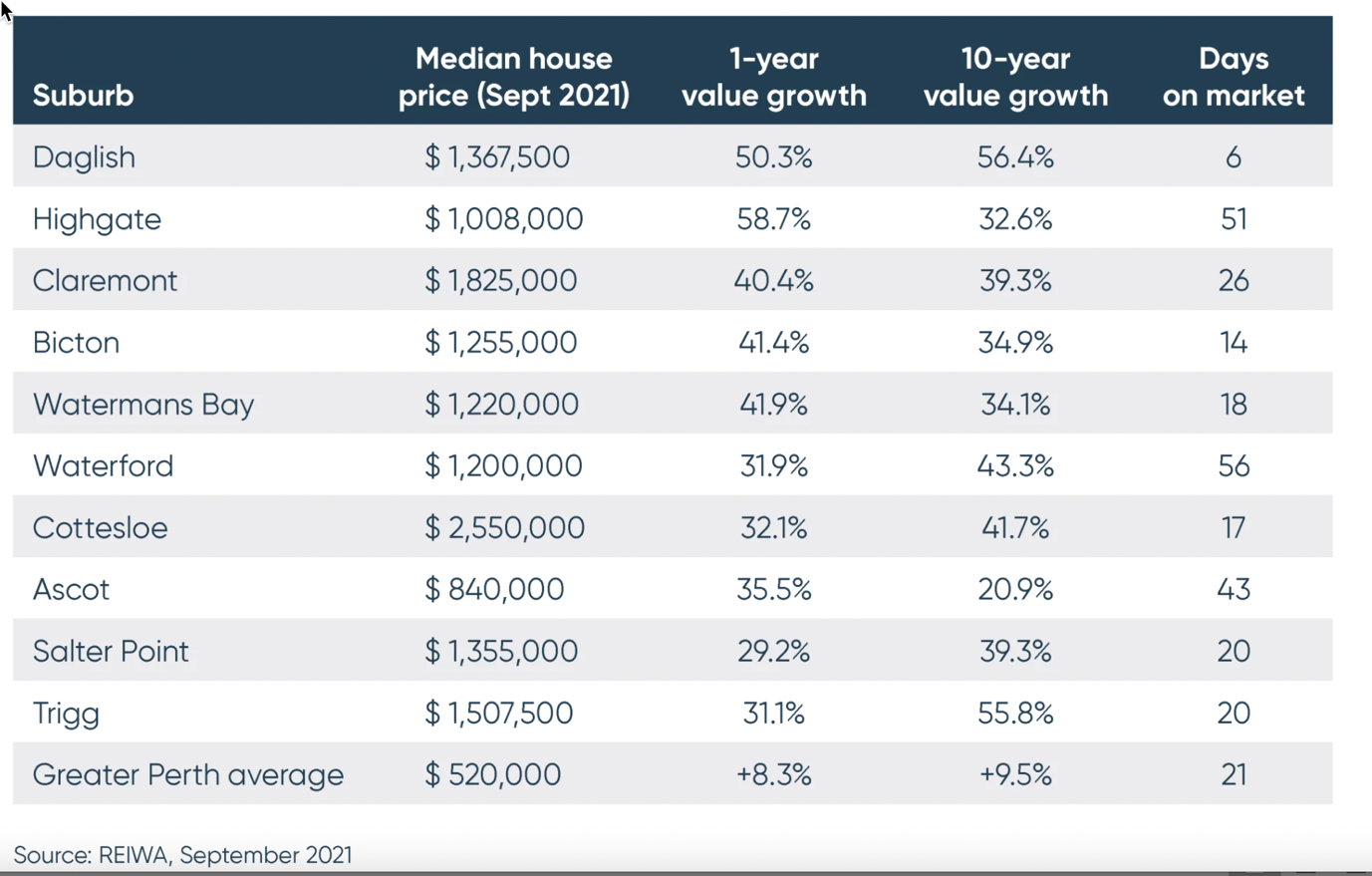

Here’s a table that my mate Catherine Cashmore shared with our readers at Cycles, Trends & Forecasts earlier in the week:

|

|

| Source: REIWA |

This is unlikely to slow down anytime soon.

My take is that it’s highly likely we are now in a resource bull market that will last years.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

The dismal capital expenditure on new production over the last 10 years almost guarantees it.

And it only takes one mishap in the supply chain to send prices soaring. Iron ore is an example of that right now. Flooding in Brazil is shutting down their mines and sending the price well over US$100 a tonne again.

Australia benefits at their expense (again).

That’s why BHP, Rio, and FMG have risen so strongly in the last few weeks of trading. But this can happen across any of the other commodity sectors at any time.

Copper is an interesting case here. Because so much of the production of world copper comes out of Chile, the political situation there is always of interest.

There’s a new man in power and he has big plans for the country. Naturally, this involves paying for everything and everyone that could win a vote.

It’s only natural that he’ll look to the stream of potential royalties from Chile’s mining wealth to help make it happen.

There may be a social justice argument for that. But the world copper market won’t like the look of it if it deters further investment into the industry. Copper would rise as the prospect of a tightening market strengthened.

That’s a potential scenario, nothing more.

But it shows why Australia could boom in the years ahead.

We have the natural resource wealth and the security to deliver it to world markets. Capital comes to where it’s treated well.

The flow-on effects of this could be prodigious.

We should see high wages as the miners bid for staff to live on — or fly to — remote mining projects. Rents in mining towns will rise, as spending and business caters to the new workers.

And profits and dividends will keep flowing back to shareholders all over the country.

With a commodity boom, comes a real estate boom. They practically go hand in hand. You’ve already seen a taste of this above. What will that table look like in five years?

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.