Today, Novonix revealed that US Department of Energy (DoE) is willing to fund their development of this graphite anode material. News that has sent the NVX share price soaring by 16.83%…

Stay Informed About the Latest Developments in the Graphite Industry

It doesn’t sound all that interesting. It’s not considered a precious metal, and its name doesn’t bounce around the market like zinc, lead or lithium does.

But it’s actually somewhat of a hidden gem in the metals sector.

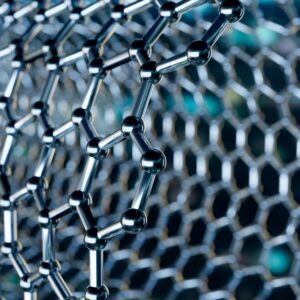

Graphite is a naturally occurring form of carbon. It has an extremely high resistance to heat, which comes in handy for many industrial applications.

Taiwan, China, the US, and the Rare Earth Conundrum

In today’s Money Morning…China’s last-minute curveballs…common ground for rare earths…the Australian alternative…and more… It looks like the political clash between the US and China is back!

Renascor Resources Share Price Up on China Deal (ASX:RNU)

The share price of small-cap graphite explorer/developer Renascor Resources Ltd [ASX:RNU] has risen today, on the prospect of a deal with one of China’s largest battery companies. At the time of writing, The RNU share price has climbed 18.18%…

China + US + Climate Change = ASX Resource Stocks

It’s an equation for forward-thinking investors. China and the US sparring over climate goals could be the beginning of a huge uptick in demand for certain Aussie resources. It’s all part of the equation…