As the broader ASX grapples with lockdown blues, Talga Group Ltd (ASX:TLG) defies expectations. The battery materials company is trading share price 0.79% higher…

Stay Informed About the Latest Developments in the Graphite Industry

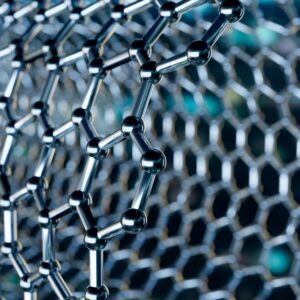

It doesn’t sound all that interesting. It’s not considered a precious metal, and its name doesn’t bounce around the market like zinc, lead or lithium does.

But it’s actually somewhat of a hidden gem in the metals sector.

Graphite is a naturally occurring form of carbon. It has an extremely high resistance to heat, which comes in handy for many industrial applications.

Renascor Resources Share Price Up on Major Capacity Upgrade (ASX:RNU)

The Renascor Resource Ltd [ASX:RNU] announces a planned capacity upgrade for its battery anode operation on increased enquiries from anode manufactures. The RNU share price is up 4.5%…

Renascor Resources Share Price Is Up after Offtake MOU (ASX:RNU)

The Renascor Resource Ltd [ASX:RNU] share price is up 13% at time of writing after offtake memorandum of understanding (MOU) to supply purified graphite to Japanese-based global trading company…

EcoGraf Share Price Up, Receives Major Project Status (ASX:EGR)

Today, EcoGraf Ltd [ASX:EGR] announced the Australian government has approved Major Project Status for its battery anode material facility. EcoGraf share price shot up to 64 cents in early trade…

Battery Race Drives Renascor Resources Share Price Higher (ASX:RNU)

The prospective graphite miner Renascor Resource Ltd [ASX:RNU] share price is trading higher today thanks to developments at its Siviour Battery Anode Material Project in South Australia…

Renascor Resources’ Share Price Builds on Stellar January (ASX:RNU)

The share price of prospective graphite producer Renacsor Resources Ltd [ASX:RNU] isn’t showing signs of relenting this month after a strong performance in January. At time of writing the RNU share price is up 10%