In today’s Money Morning…Goldman Sachs called it, but we said it first…Tesla and BTC price rises closely linked to commodities rise…so how do we think all of this will play out?…and more…

Yesterday my colleague Ryan Dinse argued the following:

‘I see Tesla and Bitcoin, not as stand-alone bubbles, but as clues to huge changes taking place in the fields of money and energy.

‘You can’t get two more important industries to the fabric of the global economy than these two.’

You can catch the full article here.

Now, if you read Money Morning regularly, you may think Ryan and I are some sort of hivemind.

But we actually disagree on a few things (mostly political), even though he’s my investment sensei.

We examine each other’s arguments for flaws while still working towards uncovering the next exponential investment trends.

Today though, I’m going to take his ‘clues’ argument one step further.

That is, that there is something huge brewing in the commodities market which is starting to go mainstream because of factors directly related to the BTC and Tesla price rises.

And it’s being driven by huge trends that are on the cusp of a proverbial collision point.

We flagged this way back in August for subscribers of Exponential Stock Investor.

It’s our commodities ‘Supercell’ thesis, which you can learn all about right here.

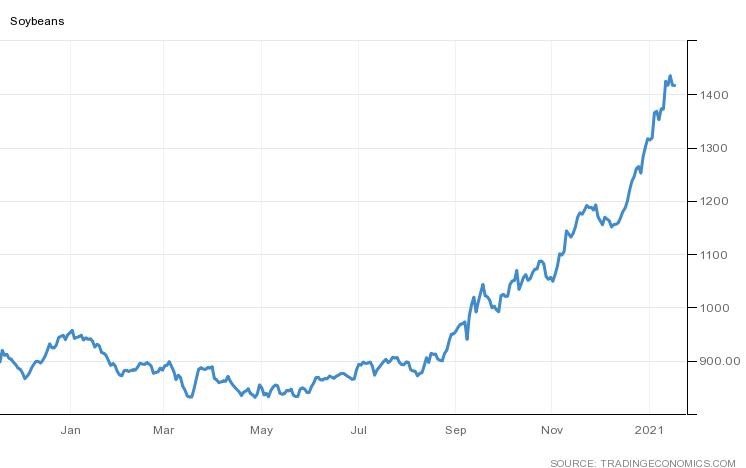

I won’t bore you anymore though, just check out this hockey stick chart that caught my eye recently:

|

|

| Source: Tradingeconomics.com |

That’s a bonkers move for the humble legume.

And it’s not alone.

Check out the chart for copper:

|

|

| Source: Tradingeconomics.com |

[conversion type=”in_post”]

Goldman Sachs called it, but we said it first

Here are the highlights from a Reuters article from earlier this month:

‘While last year’s strong rebound in many commodity prices might be viewed as a “V-shaped vaccine recovery”, the bank contends it is just “the beginning of a much longer structural bull market for commodities.’

Continuing:

‘Looking at the 2020s, we believe that similar structural forces to those which drove commodities in the 2000s could be at play.’

But here’s where it goes wrong (emphasis added):

‘The 2000s were transformative for metal prices, which experienced a tectonic demand boost from industrialisation and urbanisation in emerging nations, China in particular.

‘Copper, the bellwether of the industrial metals sector, rose from under $2,000 per tonne in 2000 to a record high of $10,190 in February 2011.

‘But the supercycle hype dissipated over the course of a four-year bear market which only troughed late in 2015, leaving many investors disillusioned with the sector.

‘No-one has talked much about a commodities supercycle since then, which makes Goldman’s call all the more remarkable.’

Except us, of course!

And we’ve been bludgeoning you with this thesis for months, so I won’t rehash it again.

What I will say though, is that exponential trends catch even us off guard sometimes.

That is part of their very nature, perhaps because human perception of time is linear (we won’t get too philosophical though).

So, let me tell you what’s surprising me at the moment.

Tesla and BTC price rises closely linked to commodities rise

These are the five things that I believe are causally linked to the exponential commodities take-off:

- Even bullish inflation estimates may be understated

- Almost 20% of USD in circulation was made in 2020

- Growth in demand for commodities used in energy tech also understated (see Tesla)

- Growing psychological fear in the market of devaluing currencies (see BTC)

- And the big one, a Biden presidency leading to stimulus/money printer/MMT shenanigans to continue unabated following the appointment of Janet Yellen to the Treasury position

Now, we certainly had our eye on a Trump loss going into November 2020.

But following the US ‘blue wave’, the things we are seeing in our stable of stocks in Exponential Stock Investor are catching even us off guard.

In a good way.

This is classic collision point market activity.

A collision point is where multiple megatrends collide to form a new exponential trend.

The five things we just listed are all interrelated, and you can’t call all of them at once months before they happen.

We were definitely onto a few of them early though.

So how do we think all of this will play out?

We think this collision point will flow directly towards certain small-cap players in the commodities sector, particularly ASX-listed resources companies.

It’s risky to be sure, but this could be where you find your next Fortescue Metals Group Ltd [ASX:FMG] type of share price chart for the next 4–5 years.

I think Ryan’s ‘clues’ argument is spot on.

The whacky monetary policy that is setting off the BTC price, and the technological explosion that the Tesla share price tells you about, point to these following two conclusions…

Namely, central bankers are going to behave in predictable ways while technological advances will always surprise.

Again, you can read all about the ‘Supercell’ thesis here and you can also read all about our ‘Clean Energy Second Order’ thesis right here as well.

The two theses are starting to combine in remarkable ways.

As a final bonus, you can catch my thoughts on retail and e-commerce stocks in the video below:

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Invest in the Renewable Energy Boom — Discover three ways you can invest to capitalise on the $95 trillion switchover from fossil fuels to renewables. Click here to learn more.

Comments