Mining Memo has been a relatively new idea for our Fat Tail publication, and I hope it has given you plenty to think about in terms of investing in the resource space.

As I’ve pointed out throughout 2025, the sector is moving.

We’ve highlighted key evidence like the rapid rise of precious metals prices, what I’d describe as ‘early-cycle’ movers.

Year-to-date, gold has risen 52%, outpaced by platinum and silver, which have surged over 70% in 2025.

Again, further signs that this market is moving towards its next phase.

So, what happens next?

To try to figure that out, we need to understand the mechanics of a commodity cycle… It’s essentially an investment cycle.

At its peak, overinvestment swamps global markets with supply gluts, driving down prices.

However, as investment stagnates and capital flees, eventual shortages emerge.

And so, the cycle turns. It’s relatively simple.

So, why don’t more investors capitalise on the explicit cyclical nature of resource markets?

Well, as the recent global market rout has shown, investors tend to be short-term thinkers.

Following a multi-year cycle amid daily market gyrations is far too challenging for most.

So, that’s a big part of what I do at Mining Memo: helping readers stay the course by delivering evidence of where I think we are in this cycle.

That means recognising the news events that actually matter and separating them from the noise.

Over the past several years, we’ve examined key evidence, including the rising risks of nationalisation in commodity export regions, major mine accidents at ageing operations, and governments vying to build railways and transport links to access resources in foreign lands.

These are the subtle events that point to the turning of the cycle.

So, are we moving up or down?

Well, let’s reveal some specific evidence.

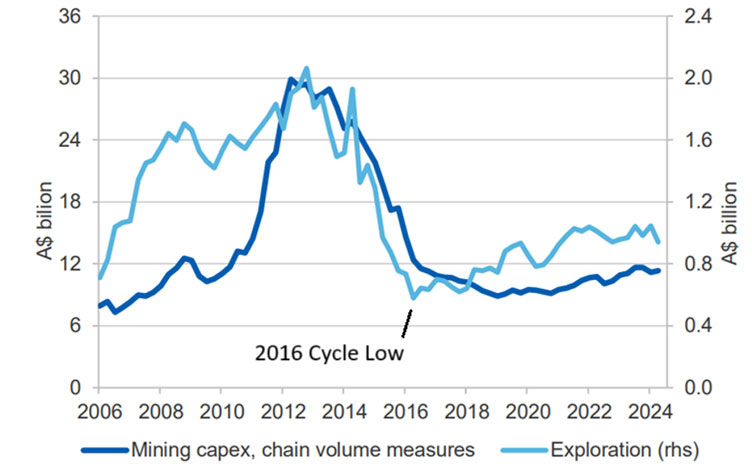

For your first clue, here’s a graph demonstrating the amount of money funnelling into new mine development (dark blue) and exploration (light blue) within Australia over the last decade:

Source: ABS

Note the significant investment low in 2016. This is important for several reasons….

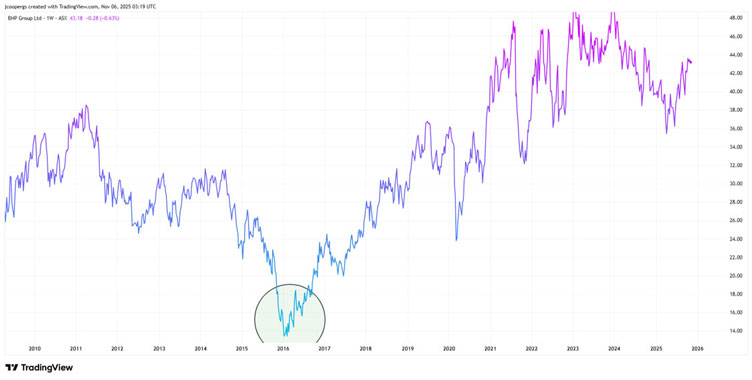

It just happens to be the year that major miners like BHP and Rio Tinto both made their cyclical share price lows, as you can see on the BHP chart below:

Source: TradingView

[Click to open in a new window]

That also aligns with the market’s bellwether commodity, copper, which also made a cyclical low in 2016:

Source: TradingView

[Click to open in a new window]

2016 was an important year for resource investors.

What I would call the beginning of this current commodity cycle.

A year where investment was at its lowest point. Pessimism was at its peak.

Most mining stocks and industrial commodities, such as copper, aluminium, and zinc, had reached their lowest price levels in decades and were forming important lows.

But given that the resource market has turned decisively bullish in 2025, are we now approaching a major cycle peak?

And is now the time to start taking decisive action within your portfolio?

That’s what we try to answer in our latest presentation.

The key question that every investor wants to know… What happens next?

You can get all the details here.

Until next time.

Regards,

James Cooper,

Mining: Phase One and Diggers and Drillers

Comments