I want to discuss two things with you today.

First, I want to cover the key assumptions underpinning the bull case for commodities associated with the green energy transition.

And second, I want to talk about the competence (or otherwise) of governments to execute the transition.

Let’s get straight to it.

Is the push for net zero losing support?

What if the thesis driving the bull case for green energy commodities rests on assumptions that won’t hold?

Like assumptions that governments — and voters — will keep pushing ahead with decarbonisation no matter the cost.

British economist Diane Coyle once wrote that our decisions are not static:

‘Things always change. This is another way of saying that economies are made up of millions of people who, peskily, react to the environment in which they find themselves.

‘Human initiative is bad news for policymakers because it means a policy drawn up on the basis that people behave in a certain way can be undermined if they change the way they behave in response to the policy.

‘Unsustainable trends always lead to changes in people’s behaviour precisely because they are unsustainable.’

Net zero policies drawn up on the basis that people will diligently forge ahead with the transition are susceptible to error if people change their response to these policies.

My colleague Nick Hubble wrote about this last week for The Daily Reckoning Australia. Nick noted:

‘Almost all media coverage in Europe and the US is already highly critical of net zero. Even the politicians have woken up.

‘In Europe, French President Emmanuel Macron has called for a halt on new green legislation coming out of the EU.

‘Germany successfully torpedoed the EU’s attempt to ban combustion engine cars.

‘In the UK, some councils are refusing to cooperate with the Government’s demands to impose net zero policies.

‘Net zero is so unpopular in the UK that politicians are using it as a punching bag for all sorts of barely related shortcomings. For example, one minister is blaming her inability to carry out Brexit reforms on the constraints imposed by the emissions commitment.

‘Financial markets cottoned on to this shift first. Green energy stocks plunged in 2022 and clean energy tech companies’ favourite bank in California went bust in 2023…

‘Just when an energy crisis was supposed to prove renewable energy’s credentials and capabilities, the world concluded the precise opposite. It turned to coal instead.’

Here we must ask.

What is the more unsustainable trend: our carbon-intensive daily habits or the ambitious phasing out of fossil fuels?

What is the average voter more likely to bristle against? Slow progress towards net zero or rising energy prices and supply shortages?

If support for net zero wanes or gets scaled back, we may see a boom in fossil fuels — an outcome Nick Hubble canvassed in a recent editorial meeting.

Governments know the stakes…but can they execute?

Here I want to give governments and their faceless technocrats some credit.

The need for more materials to fit out the green energy transition isn’t a secret.

Do we really think governments don’t realise their net zero ambitions hinge on expanding the supply of critical materials?

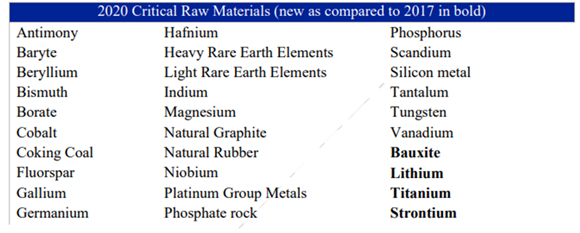

Take the European Union’s (EU) latest update to its critical raw materials list, amended in 2020 and set for another review later this year.

The list contains ‘those raw materials that are most important economically and have a high supply risk.’

The 2020 update admitted the ‘underlying problem of rapidly increasing global resources demand’.

Hence the EU’s push to reduce ‘external dependencies’ and encourage recycling.

|

|

| Source: EU |

The EU’s latest list contains 30 materials, double the amount in 2011. Lithium was one of four new materials to make the cut in 2020.

Battery materials feature heavily with cobalt, rare earths, graphite, and lithium on the list.

Note, however, the absence of copper.

The US’ most recent list of critical minerals — which now tops 50 — didn’t include copper, either.

Regular readers of this newsletter will know that our commodities expert James Cooper thinks copper is set for a protracted supply deficit.

James has argued strongly the ‘looming copper shortage is an opportunity you should be paying attention to.’

Regarding copper, the EU doesn’t seem too worried, writing in a dispatch a few years ago that it is ‘well-endowed with aggregates and industrial minerals as well as certain base metals such as copper and zinc.’

We’ll see how that plays out.

But in any case, the EU seems aware of the task ahead. Take, for instance, its admission of what it will take to electrify its car fleet:

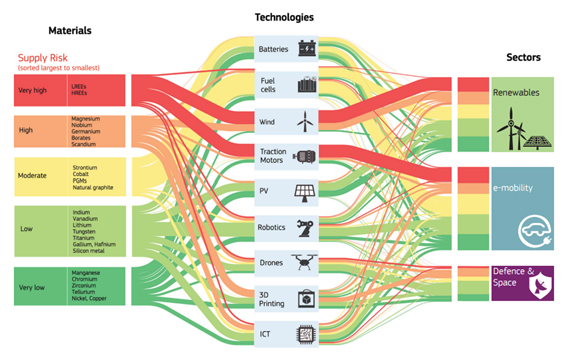

‘For electric vehicle batteries and energy storage, the EU would need up to 18 times more lithium and 5 times more cobalt in 2030, and almost 60 times more lithium and 15 times more cobalt in 2050, compared to the current supply to the whole EU economy. If not addressed, this increase in demand may lead to supply issues.’

|

|

| Source: EU |

The crux of the issue lies in how the world plans to address the demand surge everyone sees coming.

I’ll delve into that issue next week!

Regards,

|

Kiryll Prakapenka,

Editor, Fat Tail Commodities

Comments