Omega-3 acidic and lipid products business-to-business retailer Clover Corporation [ASX:CLV] announced a record half year.

Net sales revenue ballooned 49.5% to $44.4 million, and profit after tax increased a whopping 81.1%, earning the company $3.6 million for the half year.

CLV was relatively flat in the wake of is financial announcement, trading around the same price as its close the prior day, around $1.32.

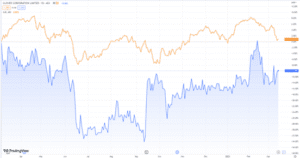

Clover’s stock has moved only marginally upwards in the past year (by 1.5%), and despite shooting up more than 4% in the last week, it’s down 7% in the past month:

www.TradingView.com

Clover’s advancing sales, profits, customers, and products

For the half-year ending 31 January 2023, Clover Corporation has said it has achieved record results, claiming growth in revenue, new customers, and products all at once.

For a start, net sales revenue for the half year came to the total of $44.4 million, up on last year’s $29.7 million, which represents an increase of 49.5%.

Net profit after tax came to the total of $3.6 million, a significant increase of 81.1% on the prior year’s $2 million.

The group also reported an increase in volume and improved trading conditions for the past six months, which helped to deliver the period’s elevated net profit.

Clover reported it had grown its revenue across Europe and the Middle East by 76%, with Asia having increased 36%, and Australia and New Zealand by 76%.

These results were helped along by new customers in infant formula and food applications, which has further diversified the group’s customer base.

Clover also said that it has now been able to stabilise its gross margin by managing supply chain input and pricing positions, even under increasing inflation across its workforce, costs of raw materials, and freight expenses.

The group also said its first-half revenue was strengthened by not only the new and existing customer base, but also building inventory in preparation for the new China BG standard, which will require infant formula manufacturers to hold a certain licence to sell to Chinse retail stores. These new regulations already launched in China last month.

As the Chinese standard UPS required to 15mgDHA/100Kcal product specifications, with most manufacturers using 5mg to 10mg of DHA, Clover has been supporting its manufacturers in qualifying formulations and submitting licence applications.

Post-COVID, navigation of new channels of the market has improved overall demand for Clover, yet as customers continue working through their inventory and await their own GB licencing, the group says to expect some continuing volatility in demand.

Nevertheless, Clover’s new products have been launched and already achieved high sales in the half year.

For example, Clover’s Gelphorm, a mixture of Omega 3 capable of strengthening UHT products has now undertaken the first successful sales in the US, whilst other potential customers have the product on trial.

Based on the company’s cash position, Clover’s directors have decided to declare a fully franked final dividend of 75 cents per share.

Clover expects full-year revenues for FY23 to be in the range of $80-90 million, but remains cautious in light of ongoing COVID-19 infections, geopolitical issues, and the outcome of the introduction of the Chinese infant formula GB license.

Australia, are you prepared?

Australia has a history of robust trade, but that system is breaking.

Not only that, but the global supply chain has also been twisted, you can see it on supermarket shelves and in individual company reports.

The change is all around us. The clues and signs are everywhere.

Jim Rickards, one of the world’s top financial and geopolitical analysts, has joined the dots nobody else has.

He says ‘no one is talking about how this could end the Australian economy as we know it’ — as soon as within the next 12 months.

If you can learn the patterns and prepare for change, you could run ahead of the curve.

If you want to learn more, click here.

Regards,

Mahlia Stewart

For Money Morning