In today’s Money Morning…you can see digital camera sales start to dip in 2007…a new crossover is here…what comes next?…and more…

There’s a very famous chart in investing circles.

It’s the classic example of what happens when an industry is about to turn on its head.

Here it is:

|

|

| Source: PMA |

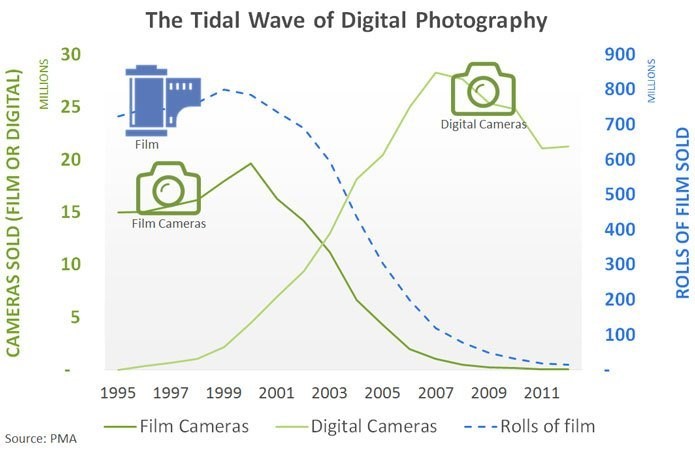

You can see the bottom line starting to rise as the top lines are starting to fall. They are the mirror opposites of each other.

And then the crossover point hits!

As you’ll have guessed, this chart shows the demise of the original film-based camera (and accompanying film!), and the rise of digital cameras from 1995 to 2007.

When such disruption hits, it creates huge winners.

But even bigger losers.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

For example, this is what happened to the share price of camera maker Kodak over that time:

|

|

| Source: Money Morning |

As you can see, the share price of Kodak actually peaked well before the crucial crossover point.

In fact, that upturn in digital camera sales in 1997 was the first early warning signal for anyone who cared to notice.

A year later film sales peaked, and the year after that we saw a sharp downturn in sales of film cameras.

But here’s the interesting thing…

While digital cameras had a few brief years in the sun, they too were disrupted by the smartphone revolution which provided quality in-built cameras as standard.

In the first chart, you can see digital camera sales start to dip in 2007.

What happened in 2007, you ask?

Well, it was the year Apple’s famous iPhone was born.

Here’s the chart of Apple’s share price since the birth of the iPhone:

|

|

| Source: Incredible Charts |

What’s interesting to me about all this is not the original point of disruption. It’s the second-order effects that came after.

While digital cameras were the obvious play for investors who had spotted the immense changes coming to the camera market, the actual winner was something completely different.

The age of the smartphone was the real investment opportunity at the end of this, not the chunky SLR digital cameras that first disrupted the space.

With that example in mind, let’s look at a very interesting chart right now…

A new crossover is near

Check out this chart:

|

|

| Source: Wood Mackenzie |

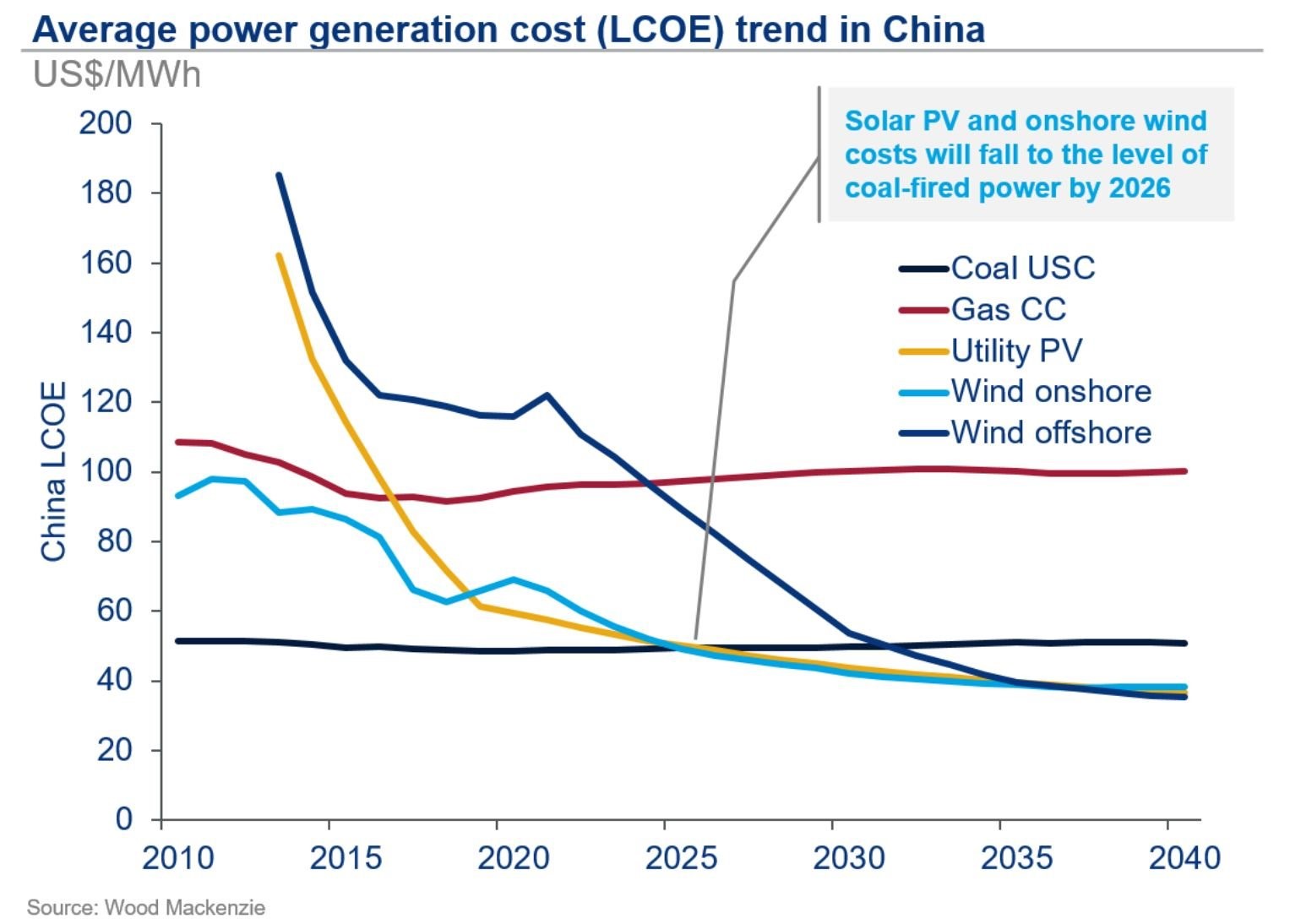

This chart shows the respective costs of coal and gas versus green options like wind and solar in China.

As you can see, we’re very close to a tipping point where renewable power is set to be cheaper than coal.

That’s pure economics speaking, not ideological musings.

Alex Whitworth, research director with Wood Mackenzie Power & Renewables, said recently:

‘Wealthier demand centers on the coast and in parts of central and northeast China will be first to see competitive renewables costs. But renewables investment in some areas of northern China, such as Xinjiang, will not be competitive with coal-fired generation, even by 2040.’

Though the timescale will vary on a case-by-case basis, the trend is clear. Renewable energy is getting cheaper and more competitive every year.

And not just in China…

Consider the fact that the Lone Star state of Texas — far from a hot bed of greenies — has seen coal-powered energy fall from 32% of total power to 20% since 2017; while at the same time wind power is up from 3% of power generated in 2007 to 20% in 2019.

Carlos Torres Diaz, head of gas market research at Rystad, said in a press release recently:

‘Renewable energy technologies are reaching a level where new installations are not driven solely by policies or subsidies, but by economics.’

It seems inevitable that renewable energy is only set to grow from here.

And while fossil fuels will continue to play some part in the energy mix for a while yet, in my opinion it’s not the place for forward-thinking investors to start parking their funds.

So where is?

What comes next?

Now the obvious answer would be to invest in solar and wind power companies.

But like the digital camera disruption we spoke about at the start, I think the real opportunities will spring from more left-field ideas.

And if you look beyond the obvious, you’ll find unbelievably cheap — though of course higher risk — investment ideas.

But bear this in mind…

Energy is such a crucial part of the world economy; the winners of this coming crossover point will be immense. Whoever they may be.

The one thing I do know is that the future tends to surprise people in ways they can’t imagine.

Which means the key will be to spot those crucial changes — those initials upticks — in certain areas, companies, and sectors as early as you can.

Later this week, I’ll be dropping a special report that lays out exactly where I think you should be looking if you’re eager to have a non-obvious speculative punt on the future of energy.

Look out for that in your inbox…

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: How to Find Promising Energy Stocks — Discover why the energy market is ripe for massive disruption and how to identify innovative energy stocks. Click here to learn more.

Comments